Question

Using T-accounts, indicate what happens when Bank A receives a deposit for $10,000, maintains the reserve requirements of 10% and loans out the rest

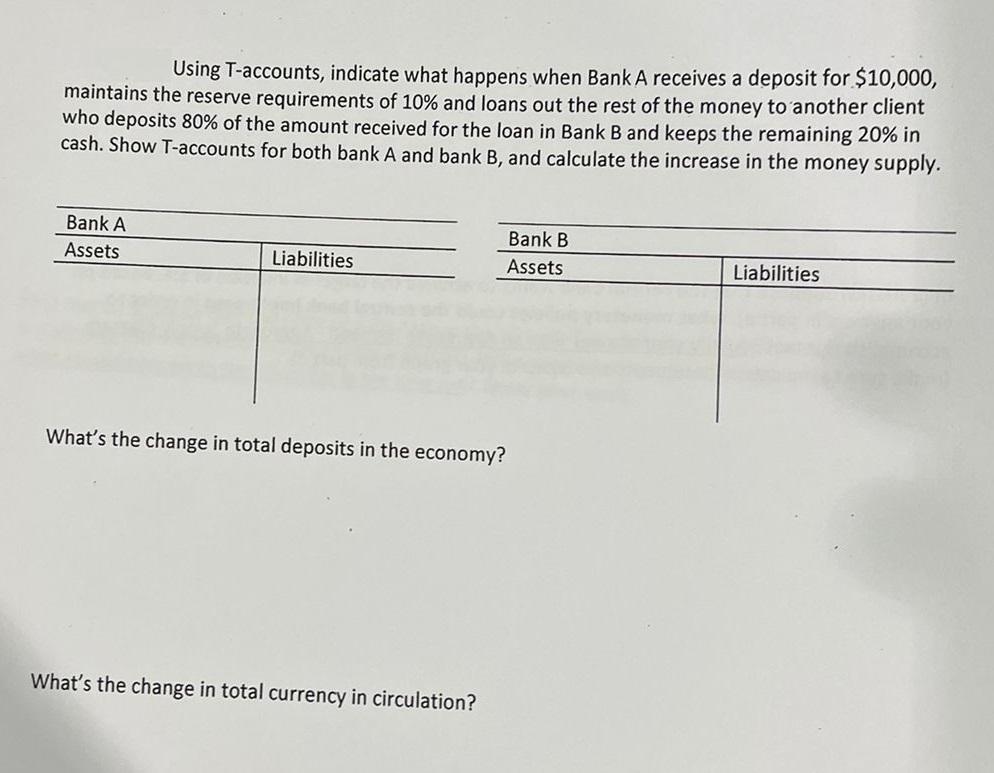

Using T-accounts, indicate what happens when Bank A receives a deposit for $10,000, maintains the reserve requirements of 10% and loans out the rest of the money to another client who deposits 80% of the amount received for the loan in Bank B and keeps the remaining 20% in cash. Show T-accounts for both bank A and bank B, and calculate the increase in the money supply. Bank A Assets Liabilities What's the change in total deposits in the economy? What's the change in total currency in circulation? Bank B Assets Liabilities

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Bank A Assets Deposits 10000 Loans 9000 Reserve Assets 1000 Liabilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Governmental and Nonprofit Accounting

Authors: Robert Freeman, Craig Shoulders, Gregory Allison, Robert Smi

10th edition

132751267, 978-0132751261

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App