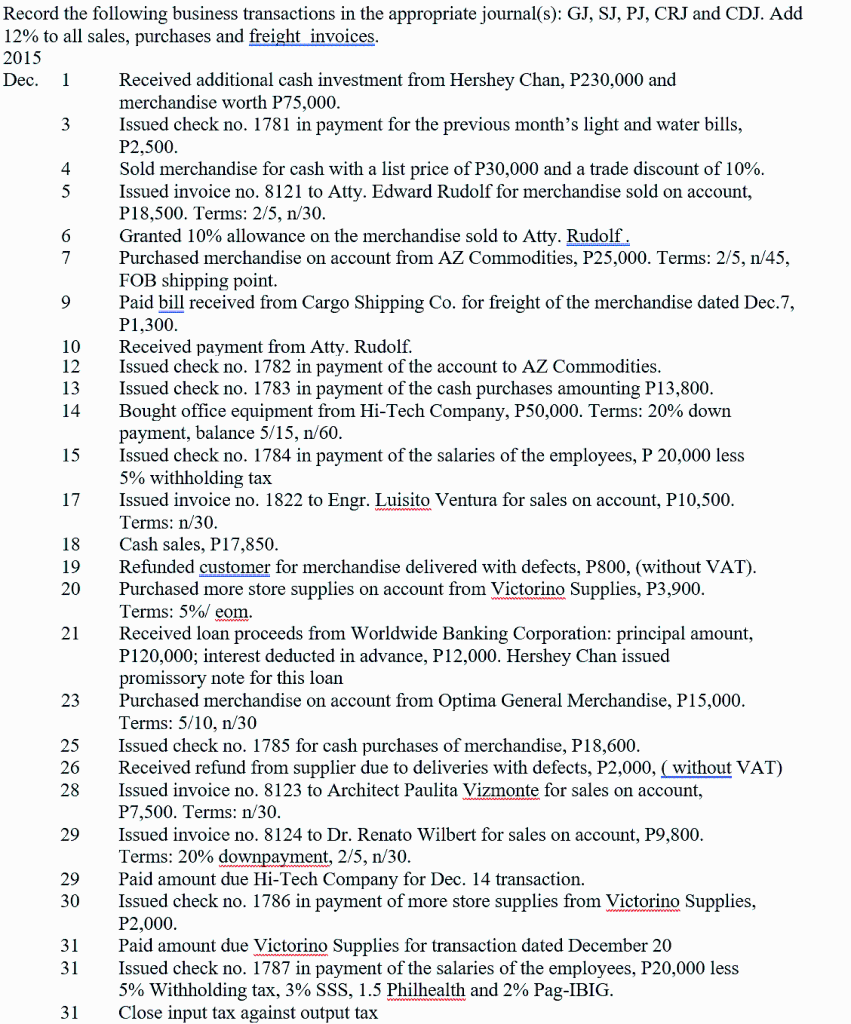

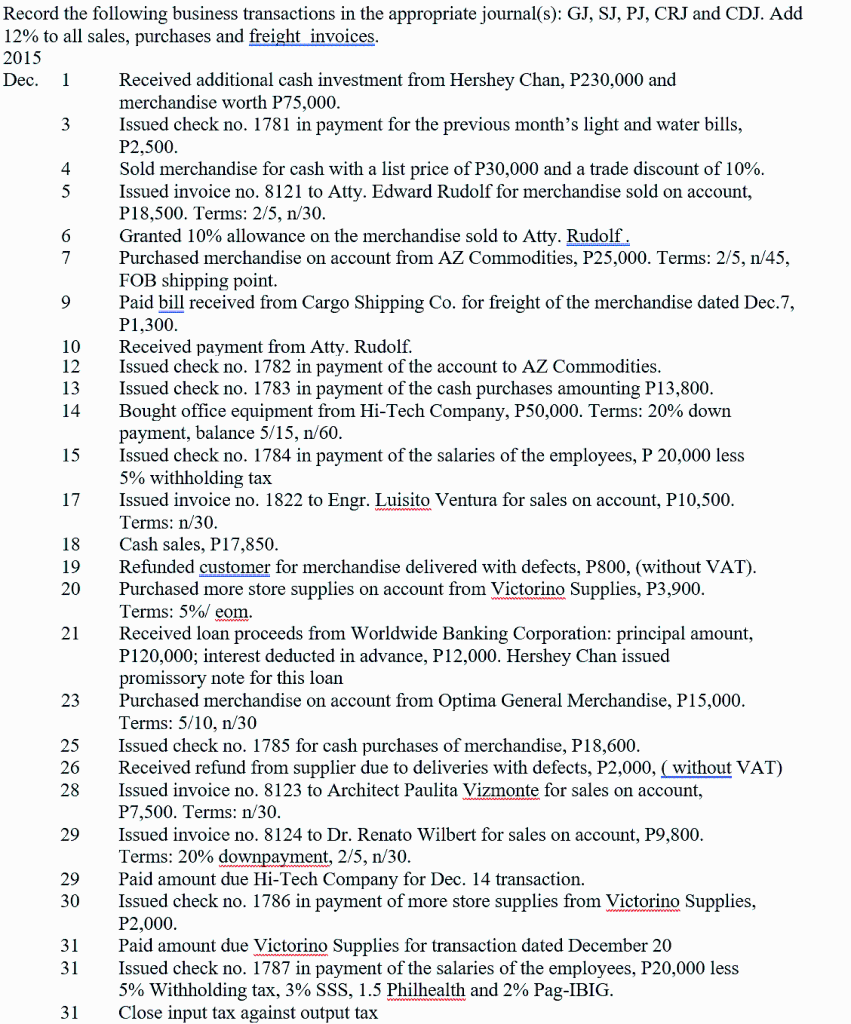

Record the following business transactions in the appropriate journal(s): GJ, SJ, PJ, CRJ and CDJ. Add 12% to all sales, purchases and freight invoices. 2015 Dec. 1 Received additional cash investment from Hershey Chan, P230,000 and merchandise worth P75,000. 3 Issued check no. 1781 in payment for the previous month's light and water bills, P2,500. 4 Sold merchandise for cash with a list price of P30,000 and a trade discount of 10%. 5 Issued invoice no. 8121 to Atty. Edward Rudolf for merchandise sold on account, P18,500. Terms: 2/5, n/30. 6 Granted 10% allowance on the merchandise sold to Atty. Rudolf . 7 Purchased merchandise on account from AZ Commodities, P25,000. Terms: 2/5, n 45, FOB shipping point. 9 Paid bill received from Cargo Shipping Co. for freight of the merchandise dated Dec. 7, P1,300. 10 Received payment from Atty. Rudolf. 12 Issued check no. 1782 in payment of the account to AZ Commodities. 13 Issued check no. 1783 in payment of the cash purchases amounting P13,800. 14 Bought office equipment from Hi-Tech Company, P50,000. Terms: 20% down payment, balance 5/15, n/60. 15 Issued check no. 1784 in payment of the salaries of the employees, P 20,000 less 5% withholding tax 17 Issued invoice no. 1822 to Engr. Luisito Ventura for sales on account, P10,500. Terms: n/30. 18 Cash sales, P17,850. 19 Refunded customer for merchandise delivered with defects, P800, (without VAT). 20 Purchased more store supplies on account from Victorino Supplies, P3,900. Terms: 5%/ eom. 21 Received loan proceeds from Worldwide Banking Corporation: principal amount, P120,000; interest deducted in advance, P12,000. Hershey Chan issued promissory note for this loan 23 Purchased merchandise on account from Optima General Merchandise, P15,000. Terms: 5/10, n/30 25 Issued check no. 1785 for cash purchases of merchandise, P18,600. 26 Received refund from supplier due to deliveries with defects, P2,000, (without VAT) 28 Issued invoice no. 8123 to Architect Paulita Vizmonte for sales on account, P7,500. Terms: n/30. 29 Issued invoice no. 8124 to Dr. Renato Wilbert for sales on account, P9,800. Terms: 20% downpayment, 2/5, n/30. 29 Paid amount due Hi-Tech Company for Dec. 14 transaction. 30 Issued check no. 1786 in payment of more store supplies from Victorino Supplies, P2,000. 31 Paid amount due Victorino Supplies for transaction dated December 20 31 Issued check no. 1787 in payment of the salaries of the employees, P20,000 less 5% Withholding tax, 3% SSS, 1.5 Philhealth and 2% Pag-IBIG. 31 Close input tax against output tax Record the following business transactions in the appropriate journal(s): GJ, SJ, PJ, CRJ and CDJ. Add 12% to all sales, purchases and freight invoices. 2015 Dec. 1 Received additional cash investment from Hershey Chan, P230,000 and merchandise worth P75,000. 3 Issued check no. 1781 in payment for the previous month's light and water bills, P2,500. 4 Sold merchandise for cash with a list price of P30,000 and a trade discount of 10%. 5 Issued invoice no. 8121 to Atty. Edward Rudolf for merchandise sold on account, P18,500. Terms: 2/5, n/30. 6 Granted 10% allowance on the merchandise sold to Atty. Rudolf . 7 Purchased merchandise on account from AZ Commodities, P25,000. Terms: 2/5, n 45, FOB shipping point. 9 Paid bill received from Cargo Shipping Co. for freight of the merchandise dated Dec. 7, P1,300. 10 Received payment from Atty. Rudolf. 12 Issued check no. 1782 in payment of the account to AZ Commodities. 13 Issued check no. 1783 in payment of the cash purchases amounting P13,800. 14 Bought office equipment from Hi-Tech Company, P50,000. Terms: 20% down payment, balance 5/15, n/60. 15 Issued check no. 1784 in payment of the salaries of the employees, P 20,000 less 5% withholding tax 17 Issued invoice no. 1822 to Engr. Luisito Ventura for sales on account, P10,500. Terms: n/30. 18 Cash sales, P17,850. 19 Refunded customer for merchandise delivered with defects, P800, (without VAT). 20 Purchased more store supplies on account from Victorino Supplies, P3,900. Terms: 5%/ eom. 21 Received loan proceeds from Worldwide Banking Corporation: principal amount, P120,000; interest deducted in advance, P12,000. Hershey Chan issued promissory note for this loan 23 Purchased merchandise on account from Optima General Merchandise, P15,000. Terms: 5/10, n/30 25 Issued check no. 1785 for cash purchases of merchandise, P18,600. 26 Received refund from supplier due to deliveries with defects, P2,000, (without VAT) 28 Issued invoice no. 8123 to Architect Paulita Vizmonte for sales on account, P7,500. Terms: n/30. 29 Issued invoice no. 8124 to Dr. Renato Wilbert for sales on account, P9,800. Terms: 20% downpayment, 2/5, n/30. 29 Paid amount due Hi-Tech Company for Dec. 14 transaction. 30 Issued check no. 1786 in payment of more store supplies from Victorino Supplies, P2,000. 31 Paid amount due Victorino Supplies for transaction dated December 20 31 Issued check no. 1787 in payment of the salaries of the employees, P20,000 less 5% Withholding tax, 3% SSS, 1.5 Philhealth and 2% Pag-IBIG. 31 Close input tax against output tax