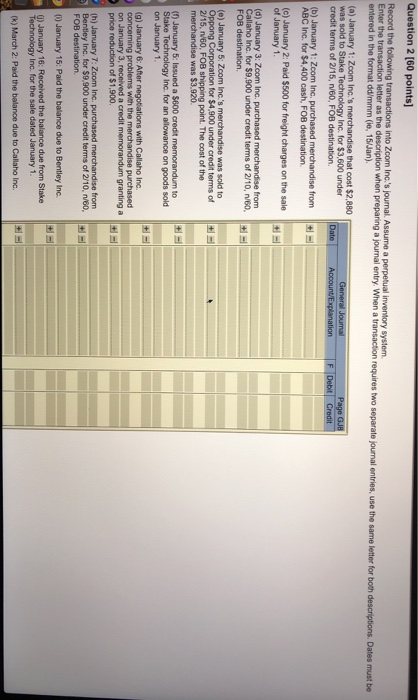

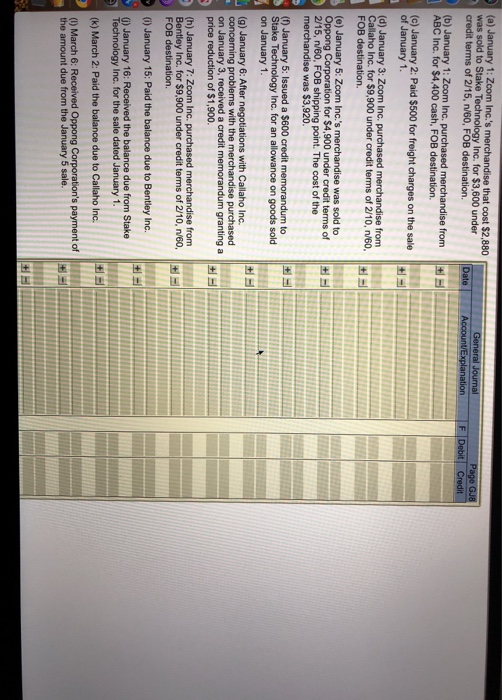

Record the following transactions into com Inc.'s joumal. Assume a perpetual inventory system Enter the transaction letter as the description when preparing a journal entry. When a transaction requires two separate journal entries, use the same letter for both descriptions Dates must be entered in the format ad mmm , 15 Jan General Journal Account Explanation F Debit Page GJE Credit (a) January 1: Zoom Inc.'s merchandise that cost $2.880 was sold to Stake Technology Inc. for $3.500 under credit forms of 2/15, V60, FOB destination (b) January 1: Zoom Inc. purchased merchandise from ABC Inc. for $4.400 cash, FOB destination (c) January 2: Paid $500 for freight charges on the sale of January 1. (d) January 3: Zoom Inc. purchased merchandise from Callaho Inc. for $9.900 under Credit terms of 2/10, 160 FOB destination. (e) January 5: Zoom Inc.'s merchandise was sold to Oppong Corporation for $4.900 under credit forms of 2/16, V60, FOB shipping point. The cost of the merchandise was $3.920 (1) January 5: Issued a $600 credit memorandum to Stake Technology Inc. for an allowance on goods sold on January 1 (9) January : Alter negotiations with Callaho Inc. concerning problems with the merchandise purchased on January 3, received a credit memorandum granting a price reduction of $1,900 th) January : Zoom Inc. purchased merchandise from Bentley Ing for $9.900 under credit forms of 2/10, 1/60, FOB destination January 15: Paid the balance due to Bentley Inc. January 16: Received the balance due from Stake Technology Inc. for the sale dated January 1. (k) March 2: Paid the balance due to Callaho Inc. (a) January 1: Zcom Inc.'s merchandise that cost $2,880 was sold to Stake Technology Inc. for $3,600 under credit terms of 2/15, 1/60, FOB destination. Date General Journal Account Explanation Page GJE F Debit Credit (b) January 1: Zcom Inc. purchased merchandise from ABC Inc. for $4,400 cash, FOB destination. (c) January 2: Paid $500 for freight charges on the sale of January 1. (d) January 3: Zcom Inc. purchased merchandise from Callaho Inc. for $9.900 under credit terms of 2/10, n/60, FOB destination. (e) January 5: Zcom Inc.'s merchandise was sold to Oppong Corporation for $4.900 under credit terms of 2/15, n/60, FOB shipping point. The cost of the merchandise was $3,920. (1) January 5: Issued a $600 credit memorandum to Stake Technology Inc. for an allowance on goods sold on January 1. (9) January 6: After negotiations with Callaho Inc. concerning problems with the merchandise purchased on January 3, received a credit memorandum granting a price reduction of $1,900. (h) January 7: Zcom Inc. purchased merchandise from Bentley Inc. for $9,900 under credit terms of 2/10, 1/60, FOB destination. (1) January 15: Paid the balance due to Bentley Inc. 6) January 16: Received the balance due from Stake Technology Inc. for the sale dated January 1. (k) March 2: Paid the balance due to Callaho Inc. (1) March 6: Received Oppong Corporation's payment of the amount due from the January 5 sale