Question

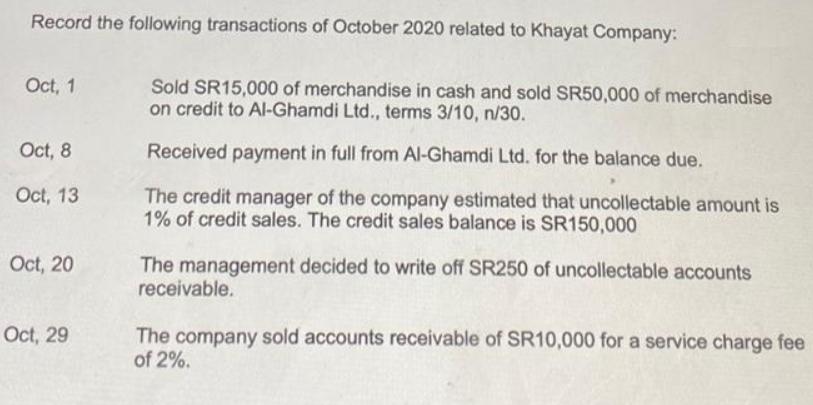

Record the following transactions of October 2020 related to Khayat Company: Oct, 1 Sold SR15,000 of merchandise in cash and sold SR50,000 of merchandise

Record the following transactions of October 2020 related to Khayat Company: Oct, 1 Sold SR15,000 of merchandise in cash and sold SR50,000 of merchandise on credit to Al-Ghamdi Ltd., terms 3/10, n/30. Oct, 8 Received payment in full from Al-Ghamdi Ltd. for the balance due. Oct, 13 The credit manager of the company estimated that uncollectable amount is 1% of credit sales. The credit sales balance is SR150,000 Oct, 20 The management decided to write off SR250 of uncollectable accounts receivable. Oct, 29 The company sold accounts receivable of SR10,000 for a service charge fee of 2%.

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Date Account Title and Explaination Post Debit Cred...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav

13th Edition

8120335643, 136126634, 978-0136126638

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App