Answered step by step

Verified Expert Solution

Question

1 Approved Answer

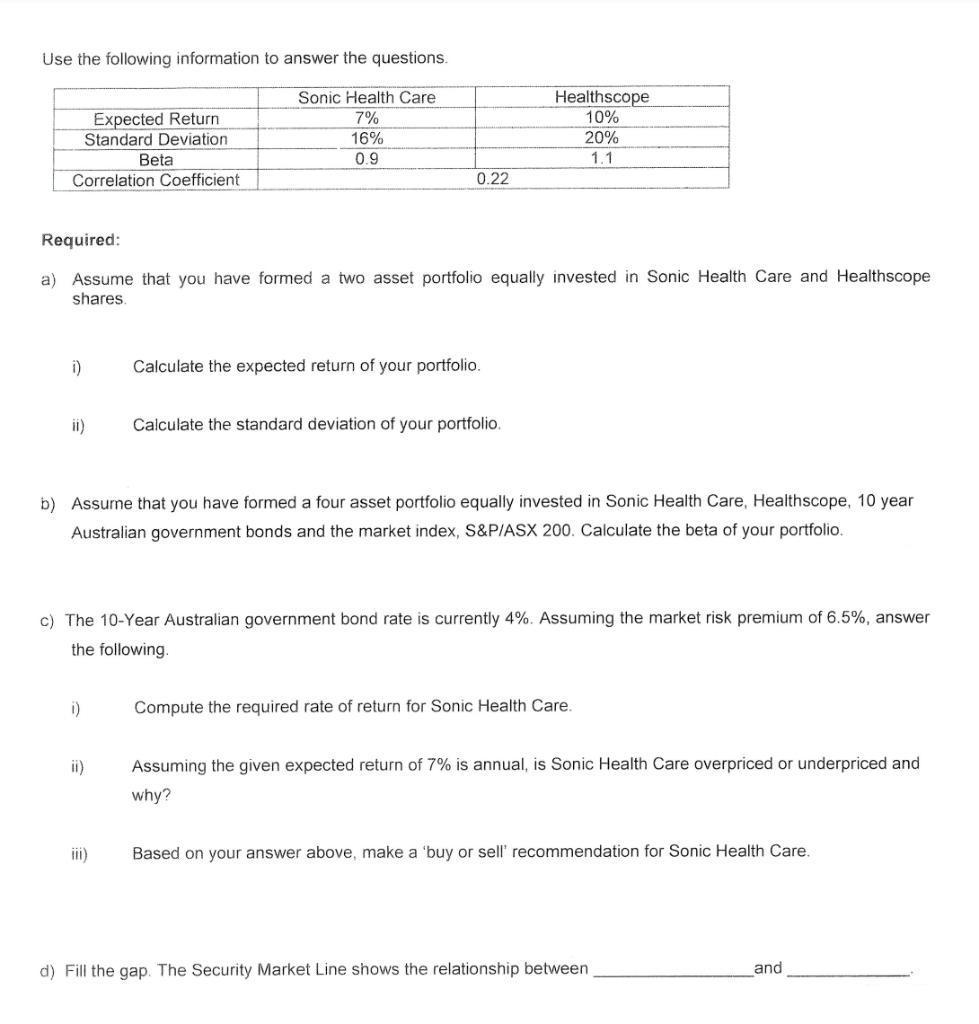

Use the following information to answer the questions. Sonic Health Care 7% 16% 0.9 Correlation Coefficient i) Expected Return Standard Deviation Beta i) Required:

Use the following information to answer the questions. Sonic Health Care 7% 16% 0.9 Correlation Coefficient i) Expected Return Standard Deviation Beta i) Required: a) Assume that you have formed a two asset portfolio equally invested in Sonic Health Care and Healthscope shares. ii) 0.22 III) Calculate the expected return of your portfolio. Healthscope 10% Calculate the standard deviation of your portfolio. b) Assume that you have formed a four asset portfolio equally invested in Sonic Health Care, Healthscope, 10 year Australian government bonds and the market index, S&P/ASX 200. Calculate the beta of your portfolio. c) The 10-Year Australian government bond rate is currently 4%. Assuming the market risk premium of 6.5%, answer the following. 20% 1.1 Compute the required rate of return for Sonic Health Care. Assuming the given expected return of 7% is annual, is Sonic Health Care overpriced or underpriced and why? Based on your answer above, make a 'buy or sell' recommendation for Sonic Health Care. d) Fill the gap. The Security Market Line shows the relationship between and

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each of the required parts one by one a i Calculate the expected return of your portfolio The expected return of a portfolio with two ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started