Answered step by step

Verified Expert Solution

Question

1 Approved Answer

-Record the lease payment for June 30, 2016. -Record the lease payment for December 31, 2016. -Record cash received. (june 30th) -Record cash received.(dec. 31)

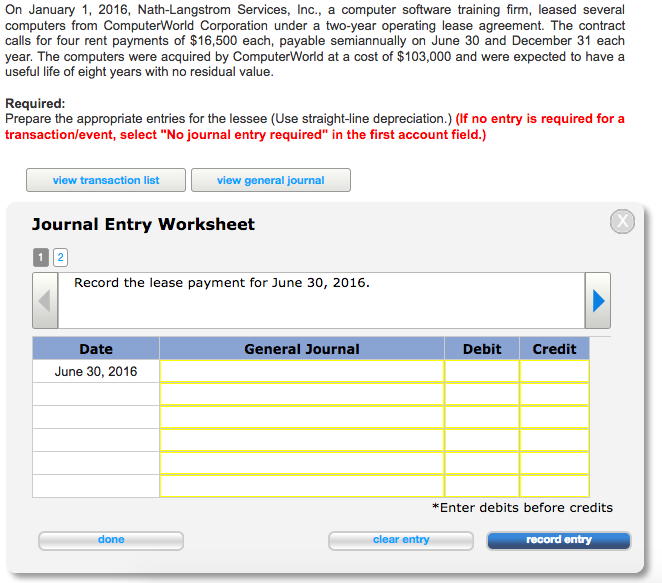

-Record the lease payment for June 30, 2016.

-Record the lease payment for December 31, 2016.

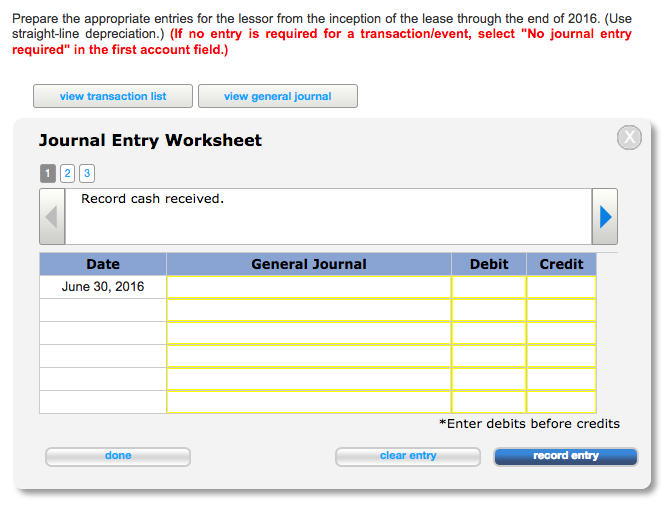

-Record cash received. (june 30th)

-Record cash received.(dec. 31)

-Record depreciation expense. (dec 31)

On January 1, 2016, Nath-Langstrom Services, Inc., a computer software training firm leased several computers from ComputerWorld Corporation under a two-year operating lease agreement. The contract calls for four rent payments of $16,500 each, payable semiannually on June 30 and December 31 each year. The computers were acquired by ComputerWorld at a cost of $103,000 and were expected to have a useful life of eight years with no residual value Required: Prepare the appropriate entries for the lessee (Use straight-line depreciation.) (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) view transaction list view general journal Journal Entry Worksheet 1 2 Record the lease payment for June 30, 2016 Debit credit Date General Journal June 30, 2016 Enter debits before credits done clear entry record entryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started