Answered step by step

Verified Expert Solution

Question

1 Approved Answer

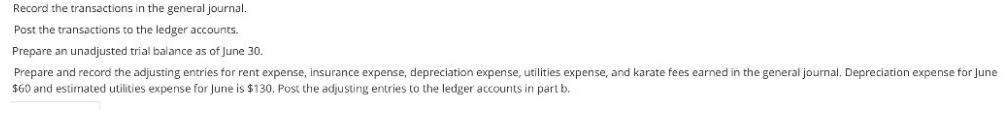

Record the transactions in the general journal. Post the transactions to the ledger accounts. Prepare an unadjusted trial balance as of June 30. Prepare

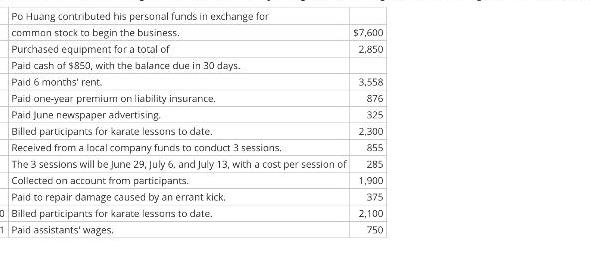

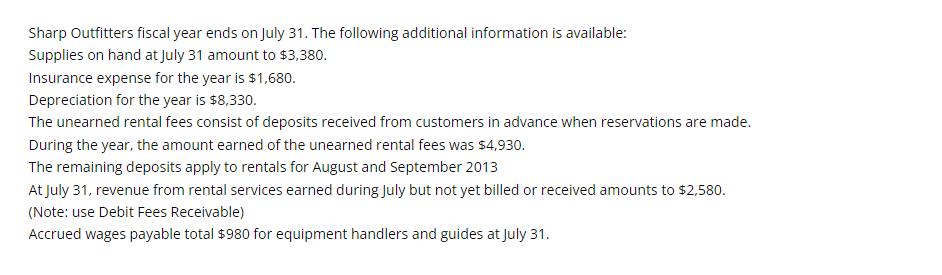

Record the transactions in the general journal. Post the transactions to the ledger accounts. Prepare an unadjusted trial balance as of June 30. Prepare and record the adjusting entries for rent expense, insurance expense, depreciation expense, utilities expense, and karate fees earned in the general journal, Depreciation expense for June $60 and estimated utilities expense for June is $130. Post the adjusting entries to the ledger accounts in part b. Po Huang contributed his personal funds in exchange for common stock to begin the business. Purchased equipment for a total of Paid cash of $850, with the balance due in 30 days. Paid 6 months' rent. Paid one-year premium on liability insurance, Paid june newspaper advertising. Billed participants for karate lessons to date. Received from a local company funds to conduct 3 sessions. The 3 sessions will be June 29, July 6. and July 13, with a cost per session of Collected on account from participants. Paid to repair damage caused by an errant kick. 0 Billed participants for karate lessons to date. Paid assistants' wages. $7,600 2,850 3.558 876 325 2,300 855 285 1,900 375 2,100 750 Sharp Outfitters fiscal year ends on July 31. The following additional information is available: Supplies on hand at July 31 amount to $3,380. Insurance expense for the year is $1,680. Depreciation for the year is $8,330. The unearned rental fees consist of deposits received from customers in advance when reservations are made. During the year, the amount earned of the unearned rental fees was $4,930. The remaining deposits apply to rentals for August and September 2013 At July 31, revenue from rental services earned during July but not yet billed or received amounts to $2,580. (Note: use Debit Fees Receivable) Accrued wages payable total $980 for equipment handlers and guides at July 31.

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

General Journal 1 Po Huang contributed his personal funds Debit Cash 7600 Credit Common Stock 7600 2 Purchased equipment Debit Equipment 2850 Credit Accounts Payable 2000 Credit Cash 850 3 Paid 6 mont...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started