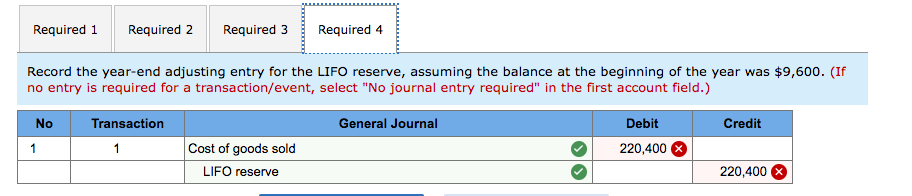

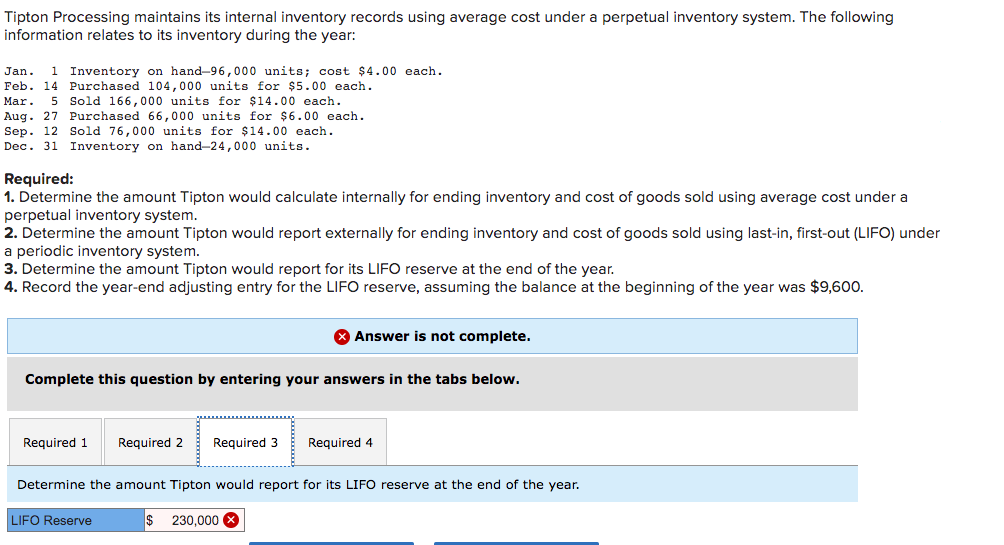

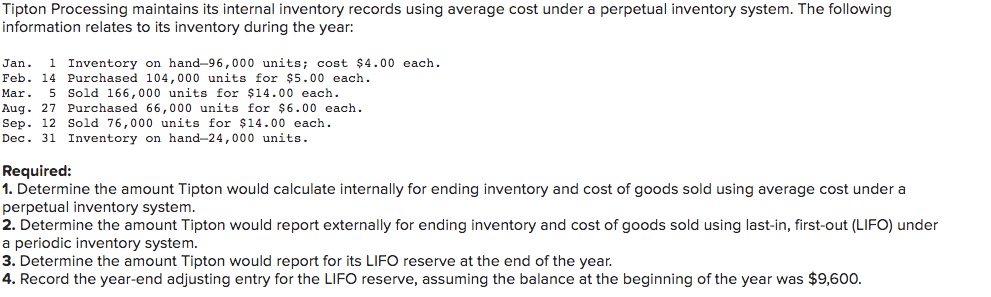

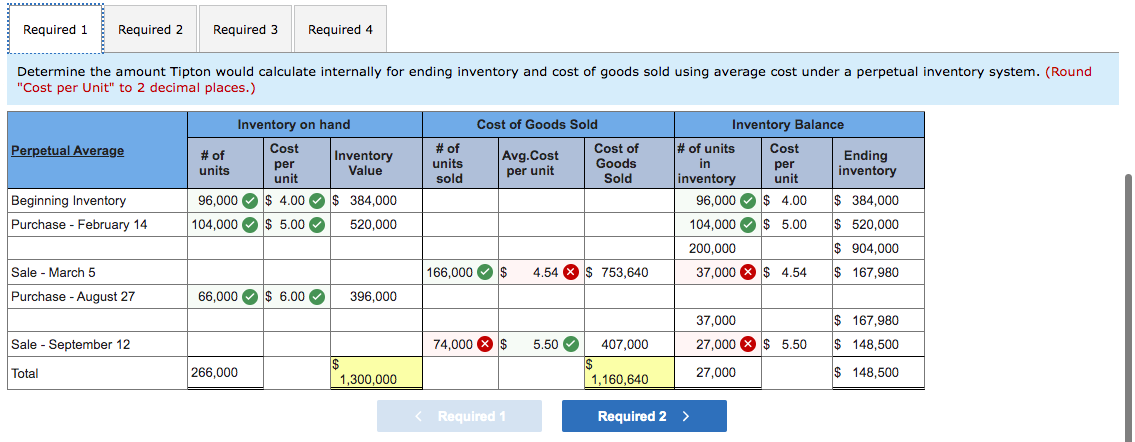

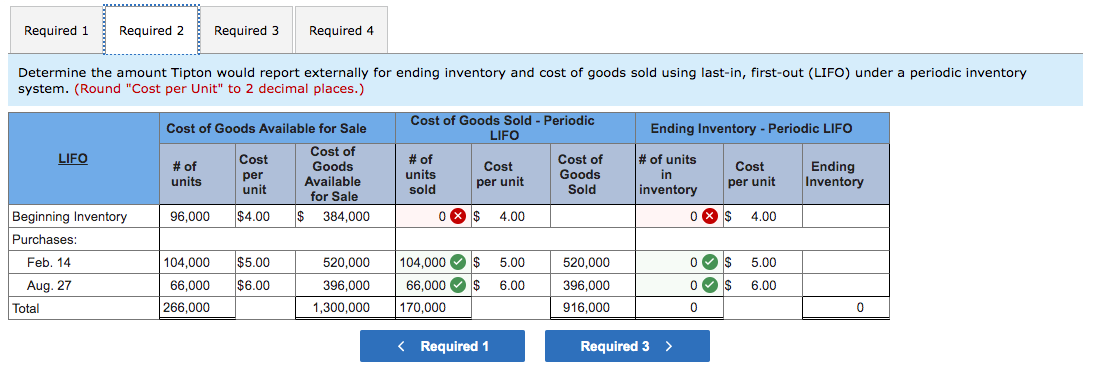

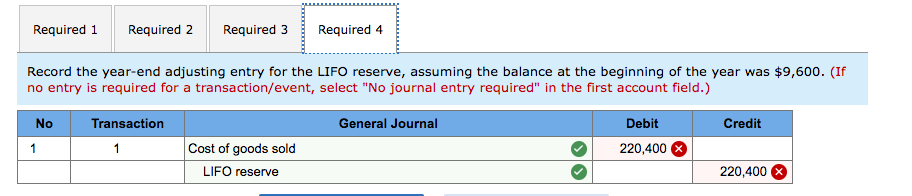

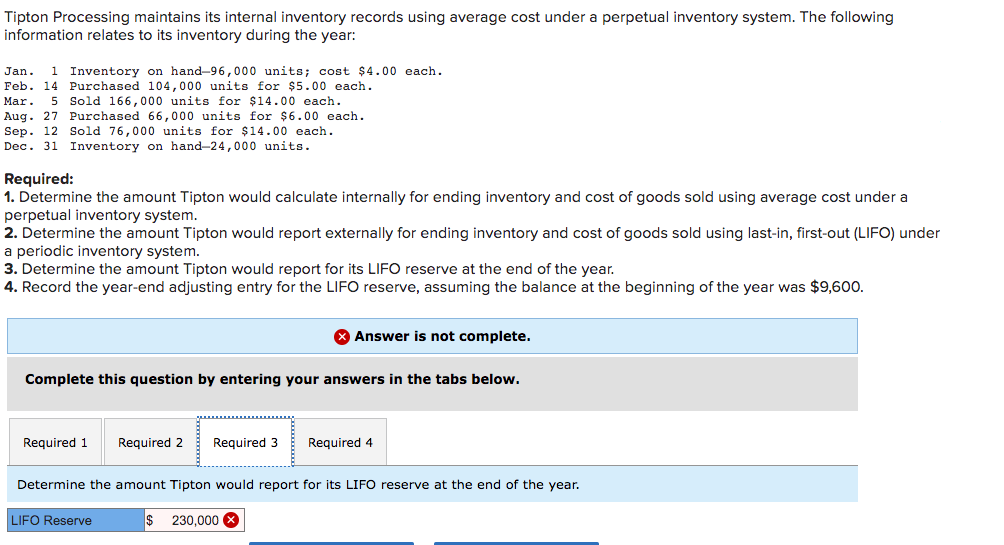

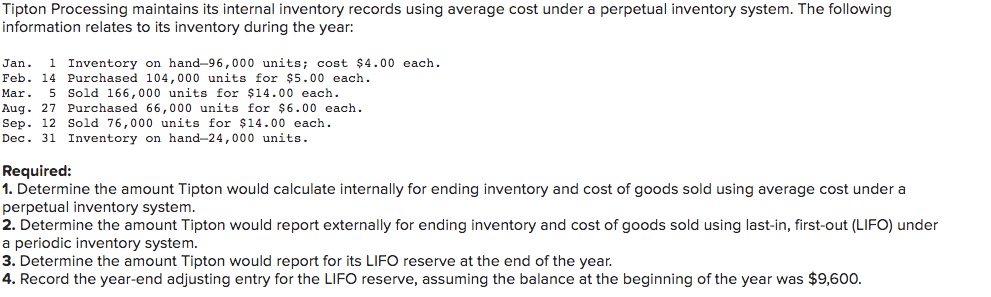

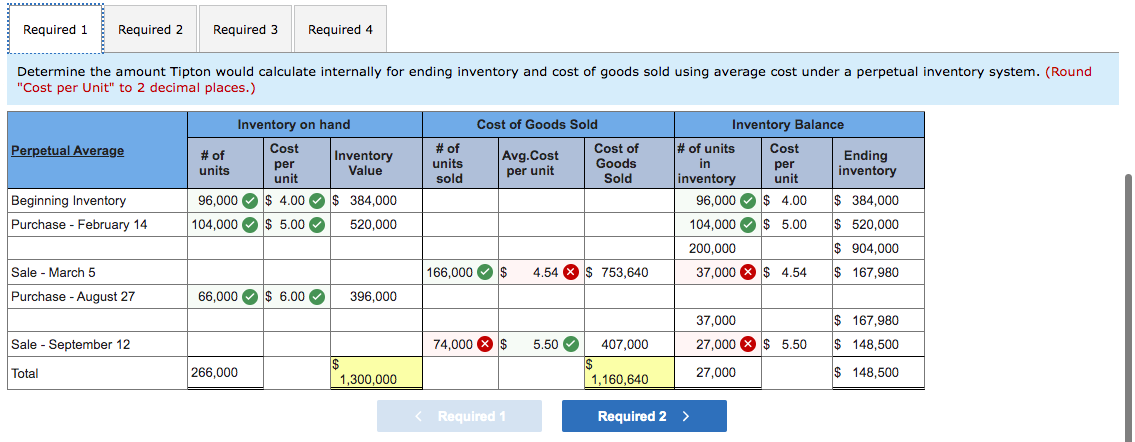

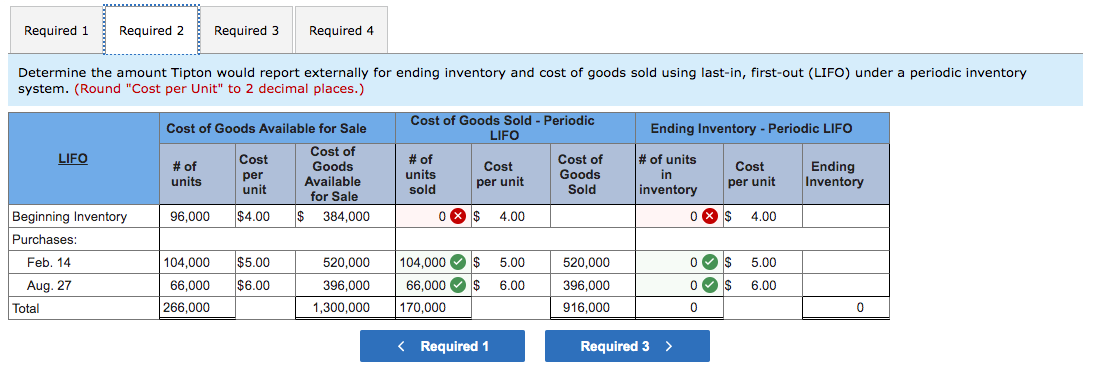

Record the year-end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the year was $9,600 no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Tipton Processing maintains its internal inventory records using average cost under a perpetual inventory system. The following information relates to its inventory during the year: Jan. 1 Inventory on hand-96,000 units; cost $4.00 each. Feb. 14 Purchased 104,000 units for $5.00 each. Mar. 5 Sold 166,000 units for $14.00 each. Aug. 27 Purchased 66,000 units for $6.00 each. Sep. 12 Sold 76,000 units for $14.00 each. Dec. 31 Inventory on hand-24,000 units. Required: 1. Determine the amount Tipton would calculate internally for ending inventory and cost of goods sold using average cost under a perpetual inventory system. 2. Determine the amount Tipton would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. 3. Determine the amount Tipton would report for its LIFO reserve at the end of the year. 4. Record the year-end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the year was $9,600. x Answer is not complete. Complete this question by entering your answers in the tabs below. Determine the amount Tipton would report for its LIFO reserve at the end of the year. Tipton Processing maintains its internal inventory records using average cost under a perpetual inventory system. The following information relates to its inventory during the year: Jan. 1 Inventory on hand-96,000 units; cost $4.00 each. Feb. 14 Purchased 104,000 units for $5.00 each. Mar. 5 Sold 166,000 units for $14.00 each. Aug. 27 Purchased 66,000 units for $6.00 each. Sep. 12 Sold 76,000 units for $14.00 each. Dec. 31 Inventory on hand-24,000 units. Required: 1. Determine the amount Tipton would calculate internally for ending inventory and cost of goods sold using average cost under a perpetual inventory system. 2. Determine the amount Tipton would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. 3. Determine the amount Tipton would report for its LIFO reserve at the end of the year. 4. Record the year-end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the year was $9,600. etermine the amount Tipton would calculate internally for ending inventory and cost of goods sold using average cost under a perpetual inventory system. (Round Cost per Unit" to 2 decimal places.) Setermine the amount Tipton would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. (Round "Cost per Unit" to 2 decimal places.)