record transactions. journal entries

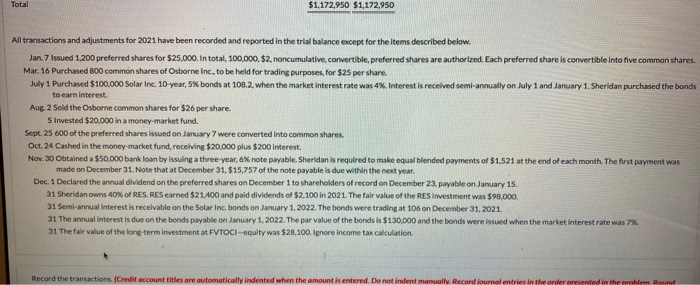

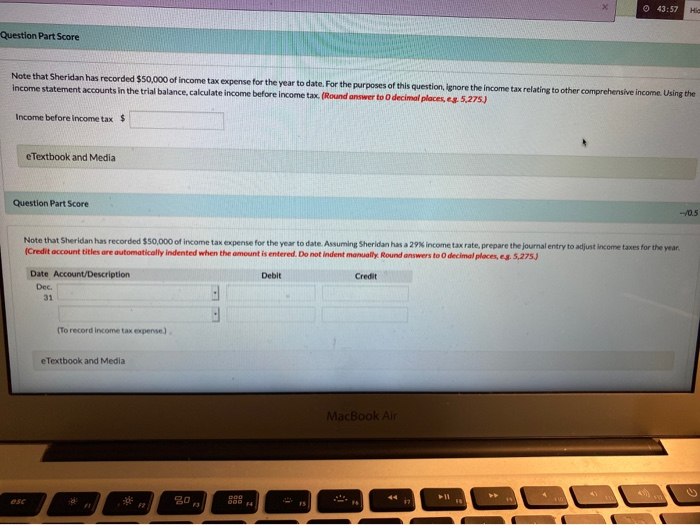

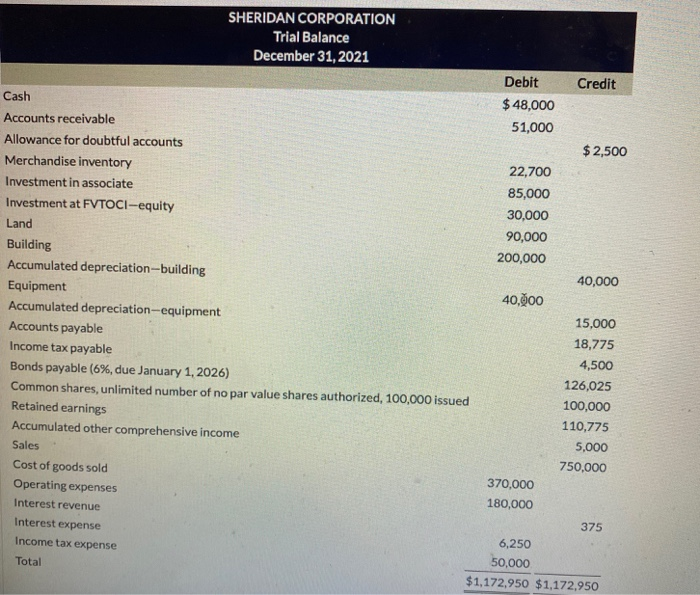

Total $1,172,950 $1,172,950 All transactions and adjustments for 2021 have been recorded and reported in the trial balance except for the items described below. Jan. 7 Issued 1,200 preferred shares for $25,000. In total, 100,000, $2, noncumulative, convertible, preferred shares are authorized. Each preferred share is convertible into five common shares. Mar. 16 Purchased 800 common shares of Osborne Inc, to be held for trading purposes, for $25 per share. July 1Purchased $100,000 Solar Inc. 10-year, 5% bonds at 108.2, when the market interest rate was 4%. Interest is received semi-annually on July 1 and January 1. Sheridan purchased the bonds to earn interest Aug. 2 Sold the Osborne common shares for $26 per share. Sinvested $20,000 in a money-market fund. Sept. 25 600 of the preferred shares Issued on January 7 were converted into common shares. Oct 24 Cashed in the money-market fund, receiving $20,000 plus $ 200 interest. Nov. 30 Obtained a $50,000 bank loan by issuing a three-year, 6% note payable, Sheridan is required to make equal blended payments of $1,521 at the end of each month. The first payment was made on December 31. Note that at December 31, $15,757 of the note payable is due within the next year. Dec. 1 Declared the annual dividend on the preferred shares on December 1 to shareholders of record on December 23, payable on January 15. 31 Sheridan owns 40% of RES, RESearned $21.400 and paid dividends of $2,100 in 2021. The fair value of the RES Investment was $98,000. 31 Semi-annual interest is receivable on the Solar Inc. bonds on January 1, 2022. The bonds were trading at 106 on December 31, 2021 31 The annual interest is due on the bonds payable on January 1, 2022. The par value of the bonds is $130,000 and the bonds were issued when the market interest rate was 7%. 31 The fair value of the long-term investment at FVTOCI-equity was $28,100. Ignore Income tax calculation Record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order resented in the emblem Bin 43:57 Hid Question Part Score Note that Sheridan has recorded $50,000 of income tax expense for the year to date. For the purposes of this question, ignore the income tax relating to other comprehensive income. Using the income statement accounts in the trial balance calculate income before Income tax (Round answer to decimal places, s. 5.275.) Income before income tax $ e Textbook and Media Question Part Score -0.5 Note that Sheridan has recorded $50,000 of income tax expense for the year to date. Assuming Sheridan has a 29% income tax rate, prepare the journal entry to adjust income taxes for the year. (Credit account titles are automatically indented when the amount is entered. Do not indent manually Round answers to decimal places, s. 5,275) Debit Credit Date Account/Description Dec. 31 (To record income tax expense.) e Textbook and Media MacBook Air 80 4 11 DOO 000 54 17 58 SHERIDAN CORPORATION Income Statement $ . . . $ e Textbook and Media MacBook Air esc SHERIDAN CORPORATION Trial Balance December 31, 2021 Debit Credit Cash $ 48,000 Accounts receivable 51,000 Allowance for doubtful accounts $2,500 Merchandise inventory 22,700 Investment in associate 85,000 Investment at FVTOCI-equity 30,000 Land 90,000 Building 200,000 Accumulated depreciation--building 40,000 Equipment 40,000 Accumulated depreciation-equipment 15,000 Accounts payable 18,775 Income tax payable 4,500 Bonds payable (6%, due January 1, 2026) 126,025 Common shares, unlimited number of no par value shares authorized, 100,000 issued 100,000 Retained earnings 110,775 Accumulated other comprehensive income 5,000 Sales 750,000 Cost of goods sold 370,000 Operating expenses 180,000 Interest revenue 375 Interest expense 6,250 Income tax expense 50,000 Total $1,172,950 $1,172,950