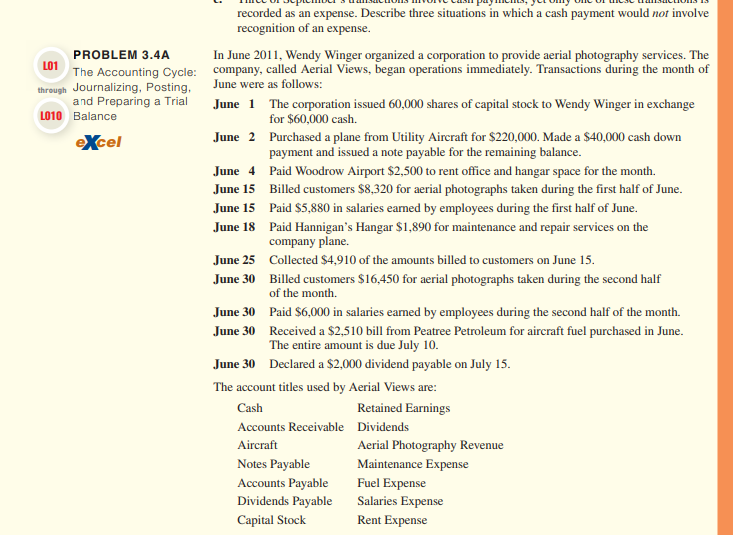

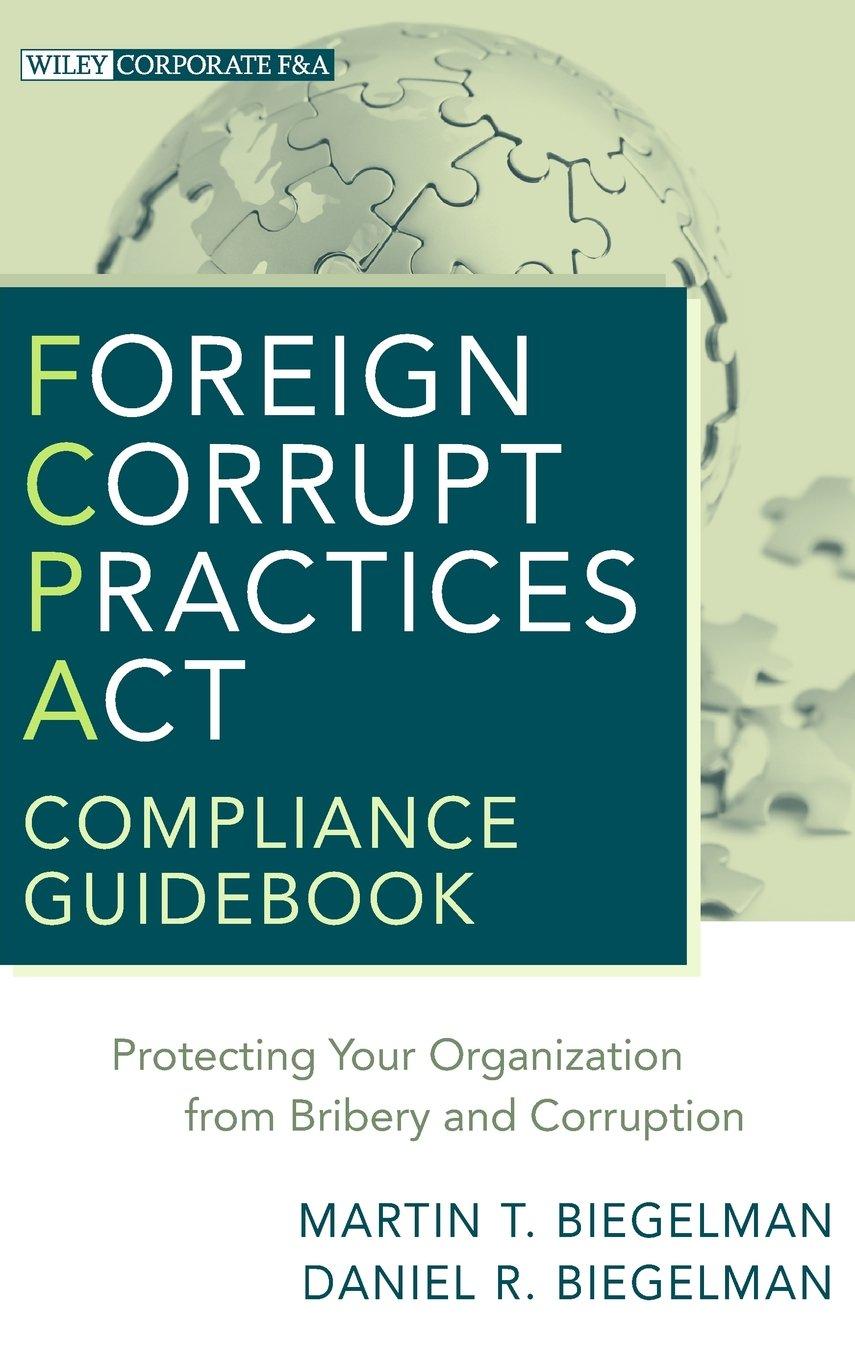

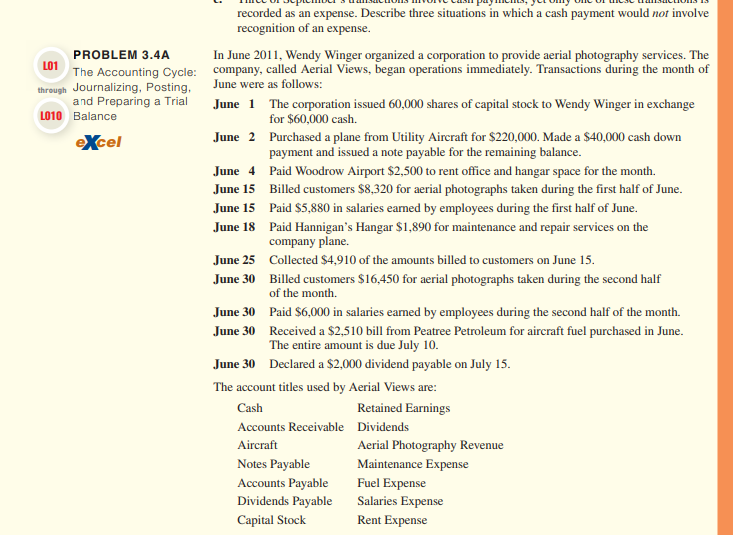

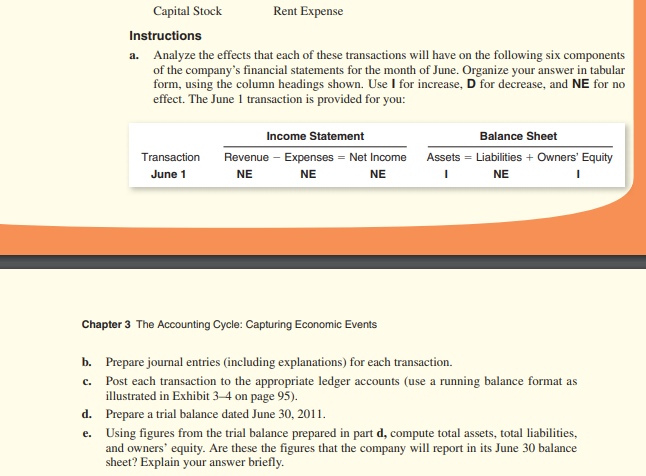

recorded as an expense. Describe three situations in which a cash payment would not involve recognition of an expense. PROBLEM 3.4A In June 2011, Wendy Winger organized a corporation to provide aerial photography services. The L01 The Accounting Cycle: company, called Aerial Views, began operations immediately. Transactions during the month of through Journalizing, Posting. June were as follows: and Preparing a Trial June 1 The corporation issued 60,000 shares of capital stock to Wendy Winger in exchange L010 Balance for $60,000 cash. excel June 2 Purchased a plane from Utility Aircraft for $220,000. Made a $40,000 cash down payment and issued a note payable for the remaining balance. June 4 Paid Woodrow Airport $2,500 to rent office and hangar space for the month. June 15 Billed customers $8,320 for aerial photographs taken during the first half of June. June 15 Paid $5,880 in salaries eamed by employees during the first half of June. June 18 Paid Hannigan's Hangar $1,890 for maintenance and repair services on the company plane. June 25 Collected $4,910 of the amounts billed to customers on June 15. June 30 Billed customers $16,450 for aerial photographs taken during the second half of the month. June 30 Paid $6,000 in salaries eamed by employees during the second half of the month. June 30 Received a $2,510 bill from Peatree Petroleum for aircraft fuel purchased in June. The entire amount is due July 10. June 30 Declared a $2,000 dividend payable on July 15. The account titles used by Aerial Views are: Cash Retained Earnings Accounts Receivable Dividends Aircraft Aerial Photography Revenue Notes Payable Maintenance Expense Accounts Payable Fuel Expense Dividends Payable Salaries Expense Capital Stock Rent Expense Capital Stock Rent Expense Instructions a. Analyze the effects that each of these transactions will have on the following six components of the company's financial statements for the month of June. Organize your answer in tabular form, using the column headings shown. Use I for increase, D for decrease, and NE for no effect. The June 1 transaction is provided for you: Transaction June 1 Income Statement Revenue - Expenses = Net Income NE NE NE Balance Sheet Assets = Liabilities + Owners' Equity NE Chapter 3 The Accounting Cycle: Capturing Economic Events b. Prepare journal entries (including explanations) for each transaction. c. Post each transaction to the appropriate ledger accounts (use a running balance format as illustrated in Exhibit 3-4 on page 95). d. Prepare a trial balance dated June 30, 2011. e. Using figures from the trial balance prepared in part d, compute total assets, total liabilities, and owners' equity. Are these the figures that the company will report in its June 30 balance sheet? Explain your answer briefly