Question

NeverLate Ltd. completed the following transactions involving delivery trucks: Mar. 26, 2020. Paid cash for a new delivery truck, $105,325 plus $7,775 of freight costs.

NeverLate Ltd. completed the following transactions involving delivery trucks:

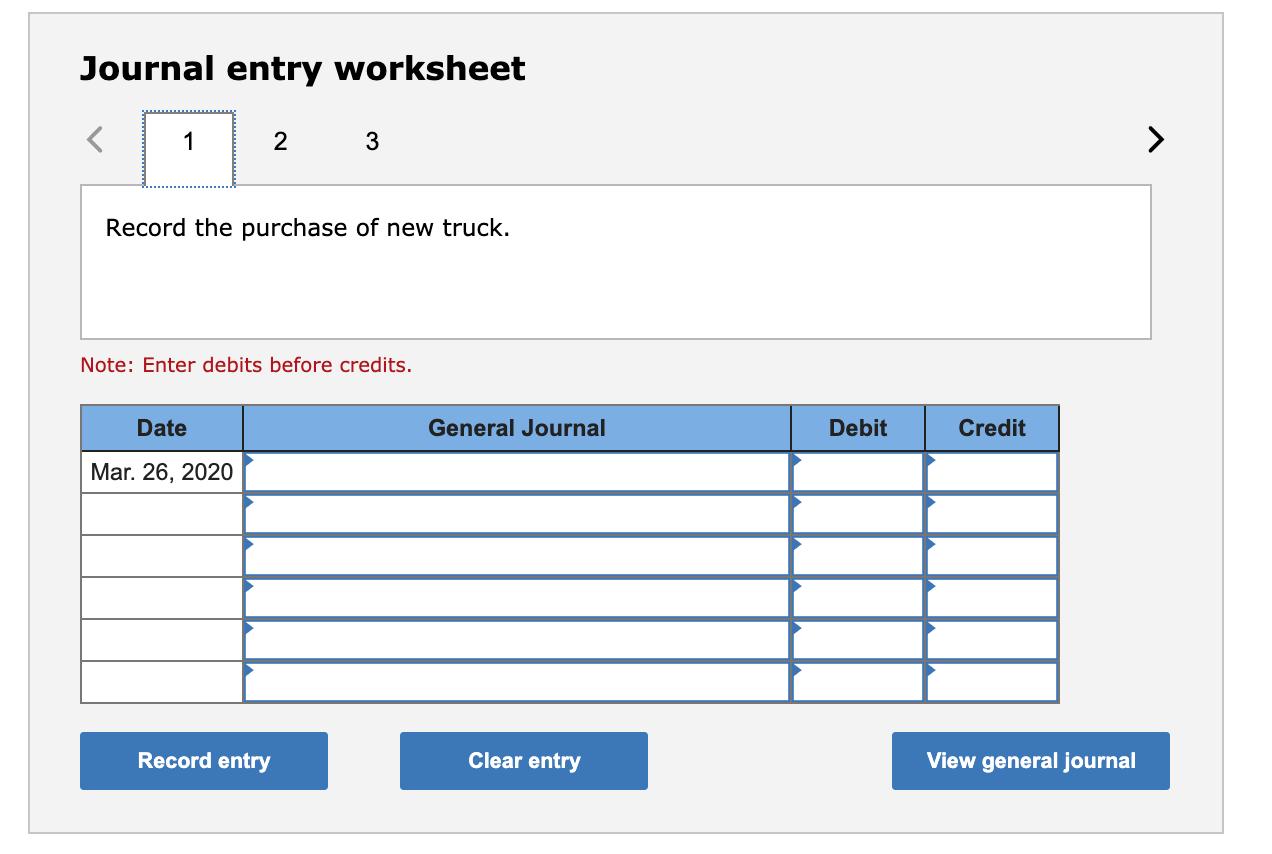

Mar. 26, 2020. Paid cash for a new delivery truck, $105,325 plus $7,775 of freight costs. The truck was estimated to have a five-year life and a $10,000 trade-in value.

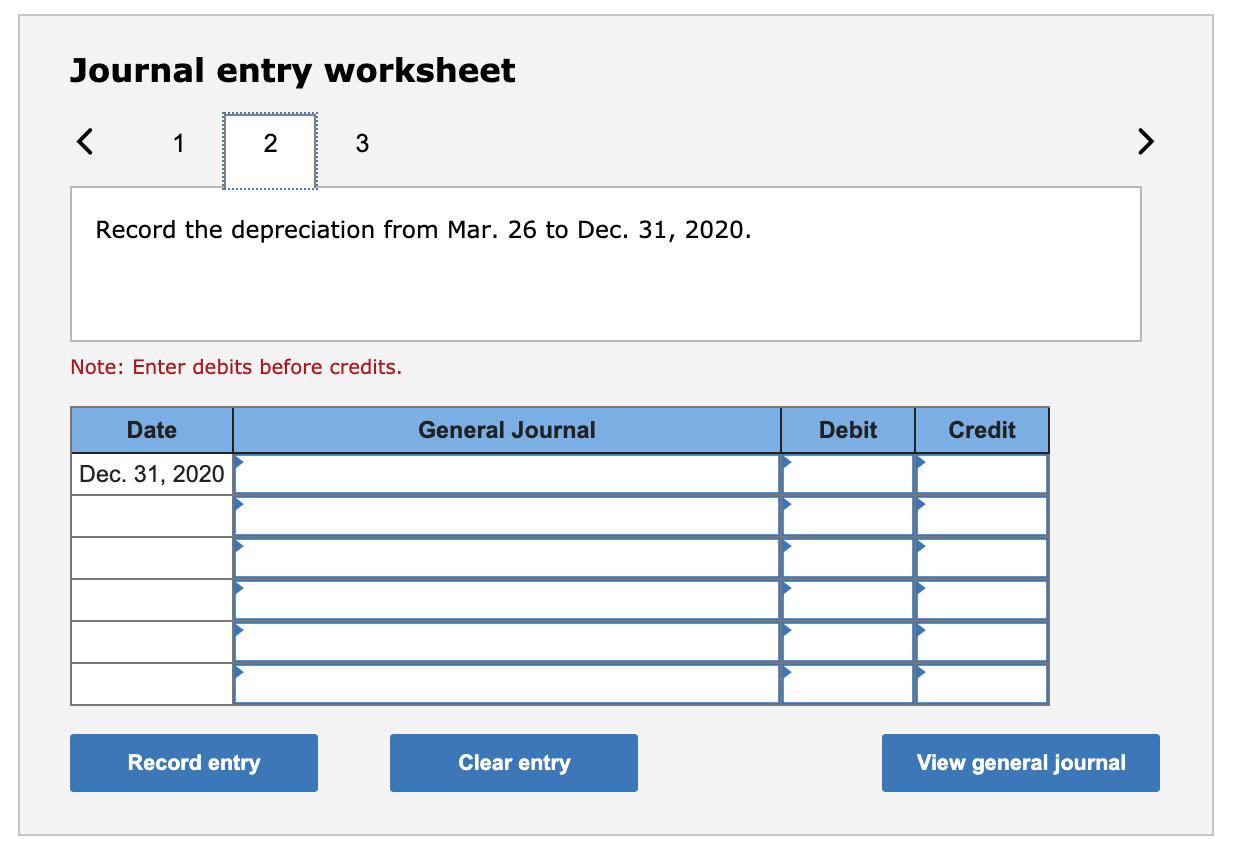

Dec. 31 Recorded straight-line depreciation on the truck to the nearest whole month.

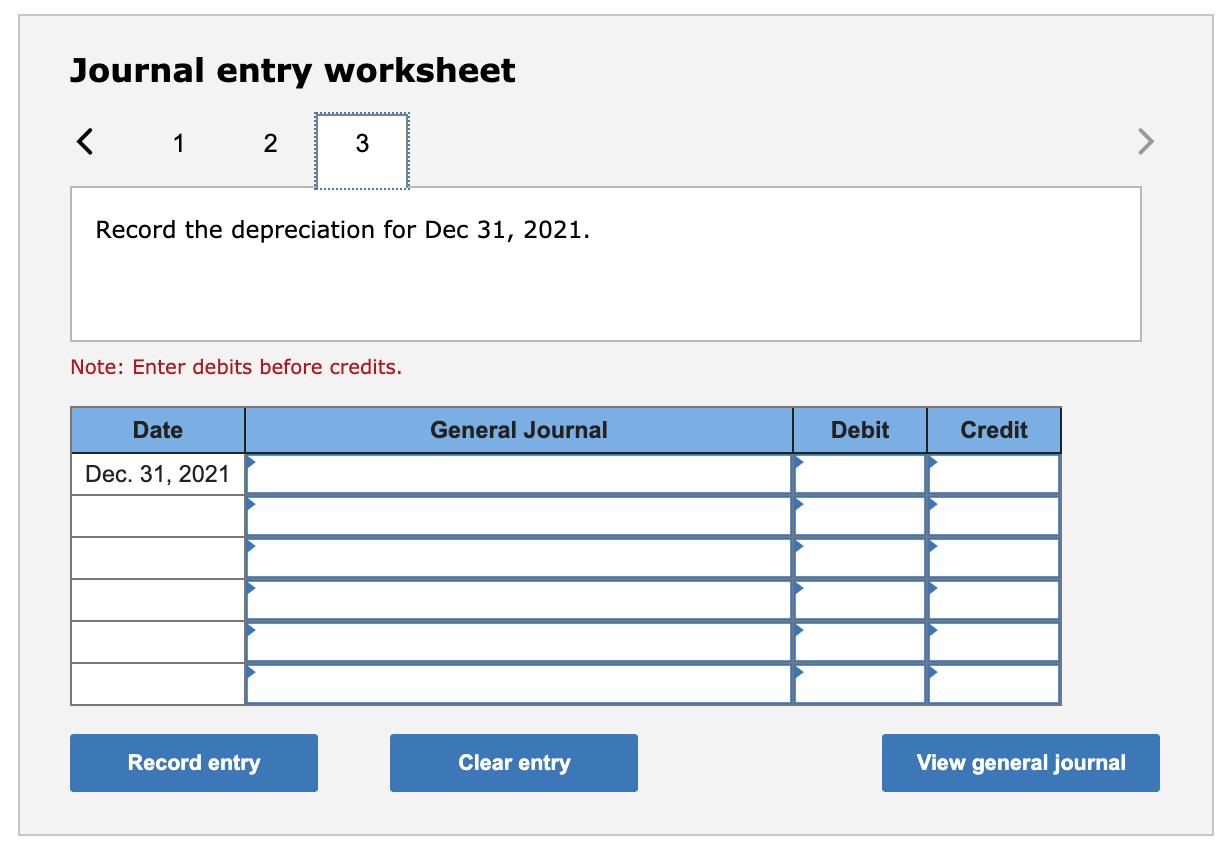

Dec. 31, 2021. Recorded straight-line depreciation on the truck to the nearest whole month. However, due to new information obtained early in January, the original estimated useful life of the truck was changed from five years to four years, and the original estimated trade-in value was increased to $17,500.

Required:

Prepare journal entries to record the transactions.

Journal entry worksheet 1 2 3 > Record the purchase of new truck. Note: Enter debits before credits. Date General Journal Debit Credit Mar. 26, 2020 Record entry Clear entry View general journal

Step by Step Solution

3.58 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries Date General Journal Debit Credit Mar 26 2020 Deliv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started