Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording and Determining the Financial Statement Effect of Error Helms Company purchases a delivery truck for $21,600 on January 1 of Year 9. Helms

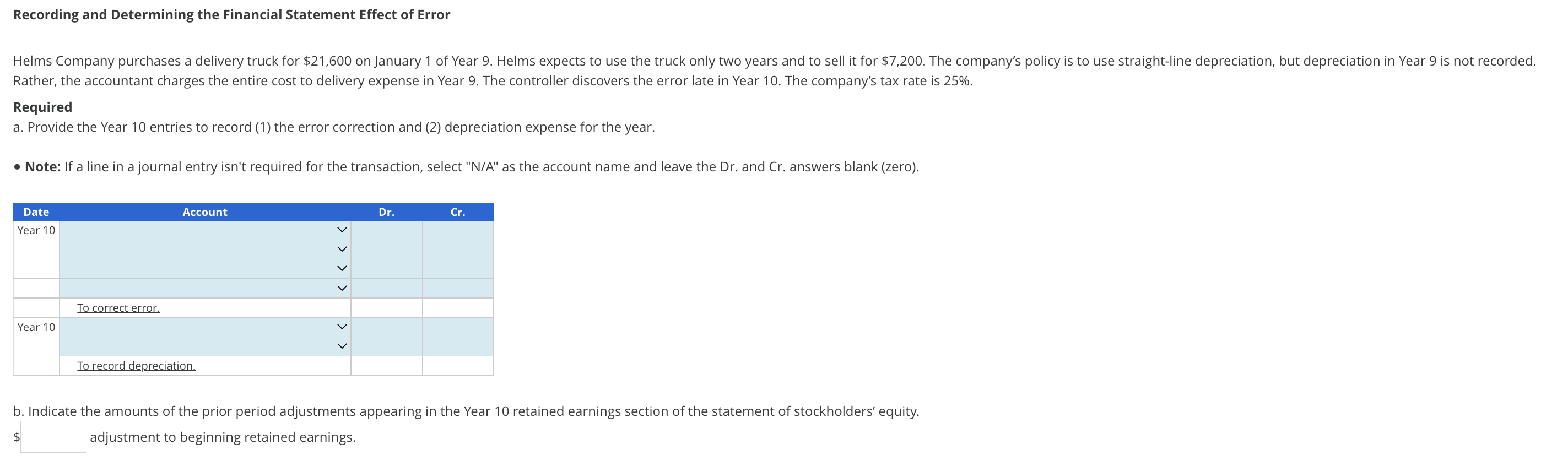

Recording and Determining the Financial Statement Effect of Error Helms Company purchases a delivery truck for $21,600 on January 1 of Year 9. Helms expects to use the truck only two years and to sell it for $7,200. The company's policy is to use straight-line depreciation, but depreciation in Year 9 is not recorded. Rather, the accountant charges the entire cost to delivery expense in Year 9. The controller discovers the error late in Year 10. The company's tax rate is 25%. Required a. Provide the Year 10 entries to record (1) the error correction and (2) depreciation expense for the year. Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero). Date Year 10 To correct error. Year 10 Account > > > > > > Dr. Cr. To record depreciation. b. Indicate the amounts of the prior period adjustments appearing in the Year 10 retained earnings section of the statement of stockholders' equity. adjustment to beginning retained earnings. $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started