Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording Asset Impairment and Subsequent Depreciation Gates Inc., a calendar-year firm, currently uses a plant asset in operations that originally cost $990,000 and has

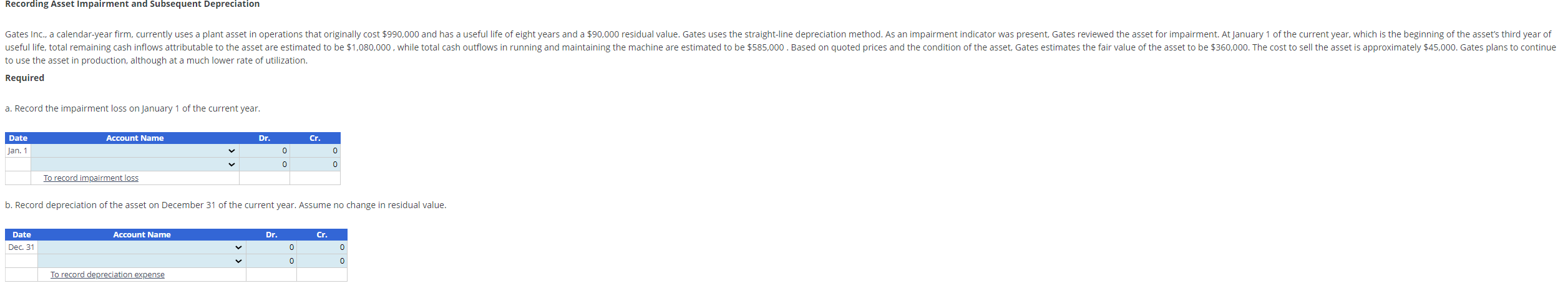

Recording Asset Impairment and Subsequent Depreciation Gates Inc., a calendar-year firm, currently uses a plant asset in operations that originally cost $990,000 and has a useful life of eight years and a $90,000 residual value. Gates uses the straight-line depreciation method. As an impairment indicator was present, Gates reviewed the asset for impairment. At January 1 of the current year, which is the beginning of the asset's third year of useful life, total remaining cash inflows attributable to the asset are estimated to be $1,080,000, while total cash outflows in running and maintaining the machine are estimated to be $585,000. Based on quoted prices and the condition of the asset, Gates estimates the fair value of the asset to be $360,000. The cost to sell the asset is approximately $45,000. Gates plans to continue to use the asset in production, although at a much lower rate of utilization. Required a. Record the impairment loss on January 1 of the current year. Date Jan. 1 Account Name Dr. Cr. 0 0 0 0 To record impairment loss b. Record depreciation of the asset on December 31 of the current year. Assume no change in residual value. Date Dec. 31 Account Name To record depreciation expense Dr. Cr. 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started