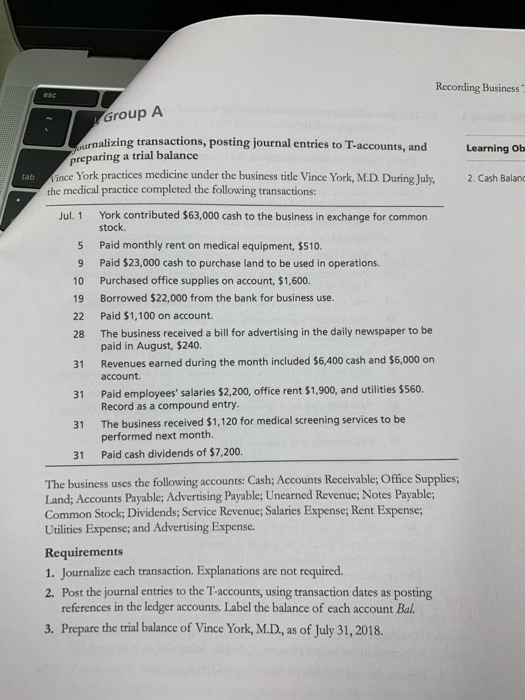

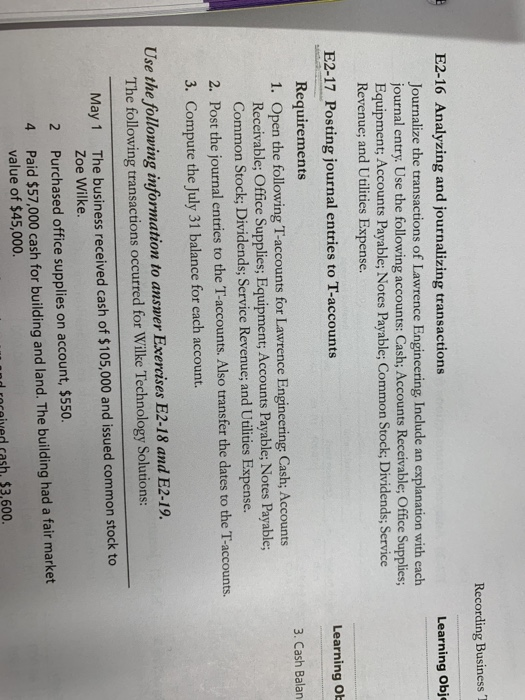

Recording Business Group A urnalizing transactions, posting journal entries to T-accounts, and preparing a trial balance Learning ob ince York practices medicine under the business title Vince York, M.D. During July, the medical practice completed the following transactions tab 2. Cash Balan York contributed $63,000 cash to the business in exchange for common stock. Paid monthly rent on medical equipment, $510. Paid $23,000 cash to purchase land to be used in operations. Purchased office supplies on account, $1,600. Borrowed $22,000 from the bank for business use. Paid $1,100 on account. The business received a bill for advertising in the daily newspaper to be paid in August, $240. Jul. 1 5 9 10 19 22 28 31 Revenues earned during the month included $6,400 cash and $6,000 on 31 Paid employees' salaries $2,200, office rent $1,900, and utilities $560. 31 The business received $1,120 for medical screening services to be 31 Paid cash dividends of $7,200 account. Record as a compound entry performed next month. The business uses the following accounts: Cash; Accounts Receivable, Office Supplies; Land; Accounts Payable; Advertising Payable; Unearned Revenue; Notes Payable; Common Stock; Dividends; Service Revenue, Salaries Expense; Rent Expense; Utilities Expense; and Advertising Expense. Requirements 1. Journalize each transaction. Explanations are not required. 2. Post the journal entries to the T-accounts, using transaction dates as posting references in the ledger accounts. Label the balance of each account Bal 3. Prepare the trial balance of Vince York, M.D, as of July 31, 2018. Recording Business E2-16 Analyzing and journalizing transactions Learning Obje Journalize the transactions of Lawrence Engineering Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Equipment; Accounts Payable; Notes Payable; Common Stock; Dividends; Service Revenue; and Utilities Expense. E2-17 Posting journal entries to T-accounts Learning ob Requirements 3. Cash Balan Open the following T-accounts for Lawrence Engineering Cash; Accounts Receivable; Office Supplies; Equipment; Accounts Payable; Notes Payable Common Stock; Dividends; Service Revenue, and Utilities Expense. 2. Post the journal entries to the T-accounts. Also transfer the dates to the T-accounts. 3. Compute the July 31 balance for each account. Use the following information to answer Exercises E2-18 and E2-19. The following transactions occurred for Wilke Technology Solutions: The business received cash of $105,000 and issued common stock to Zoe Wilke. May 1 2 Purchased office supplies on account, $550. 4 Paid $57,000 cash for building and land. The building had a fair market value of $45,000. d rocaived cash. $3,600