Question

Recording Entries under the Periodic and Perpetual Inventory Systems The records for Upland Inc. at December 31, 2020, show the following. Units Unit Price Sales

Recording Entries under the Periodic and Perpetual Inventory Systems

The records for Upland Inc. at December 31, 2020, show the following.

| Units | Unit Price | |

|---|---|---|

| Sales during period (for cash) | 10,000 | $20 (sales price) |

| Inventory at beginning of period | 2,000 | $12 (cost) |

| Merchandise purchased during period (for cash) | 16,000 | $12 (cost) |

| Purchase returns during period (cash refund) | 100 | $12 (cost) |

| Inventory at end of period (physically counted) | 7,900 | $12 (cost) |

Total expenses (excluding cost of goods sold), $60,000

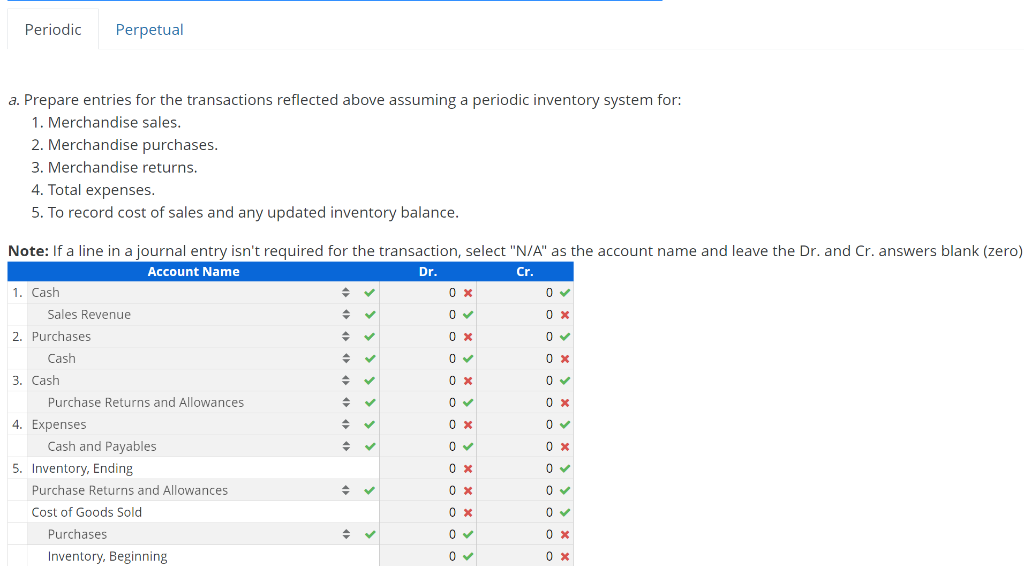

a. Prepare entries for the transactions reflected above assuming a periodic inventory system.

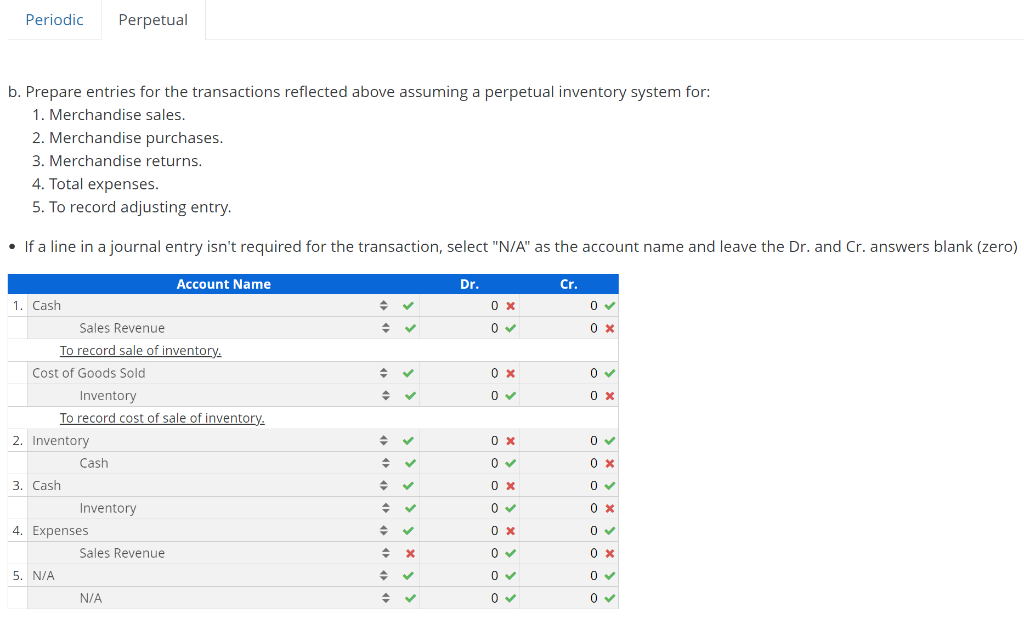

b. Prepare entries for the transaction reflected above assuming a perpetual inventory system.

-------------------------------------------------------------------------------------------------------------------------------------------------------

______________________________________________________________________________________________________________________________________________

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started