Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording Income Tax Expense Nike, Inc., reports the following tax information in the notes to its 2 0 2 0 financial report. Income before income

Recording Income Tax Expense

Nike, Inc., reports the following tax information in the notes to its financial report. Income before income taxes is as follows:

Year Ended May In millions Income before income taxes: United States $ $ $ Foreign Total income before income taxes $ $ $

The provision for income taxes is as follows:

Year Ended May In millions Current: United States Federal $ $ $ State Foreign Total current Deferred: United States Federal State Foreign Total deferred Total income tax $ $ $

The effective tax rate for the fiscal year ended May was lower than the effective tax rate for the fiscal year ended May due to increased benefits from discrete items such as stockbased compensation. The foreign earnings rate impact shown above for the fiscal year ended May includes withholding taxes of and held for sale accounting items of offset by a benefit for statutory rate differences and other items of The foreign derived intangible income benefit reflects US tax benefits introduced by the Tax Act for companies serving foreign markets. This benefit became available to the Company as a result of a restructuring of its intellectual property interests. Income tax audit and contingency reserves reflect benefits associated with the modification of the treatment of certain research and development expenditures of offset by an increase related to the resolution of an audit by the US Internal Revenue Service IRS and other matters of Included in other is the deferral of income tax effects related to intraentity transfers of inventory of and other items of

Nike also states the following:

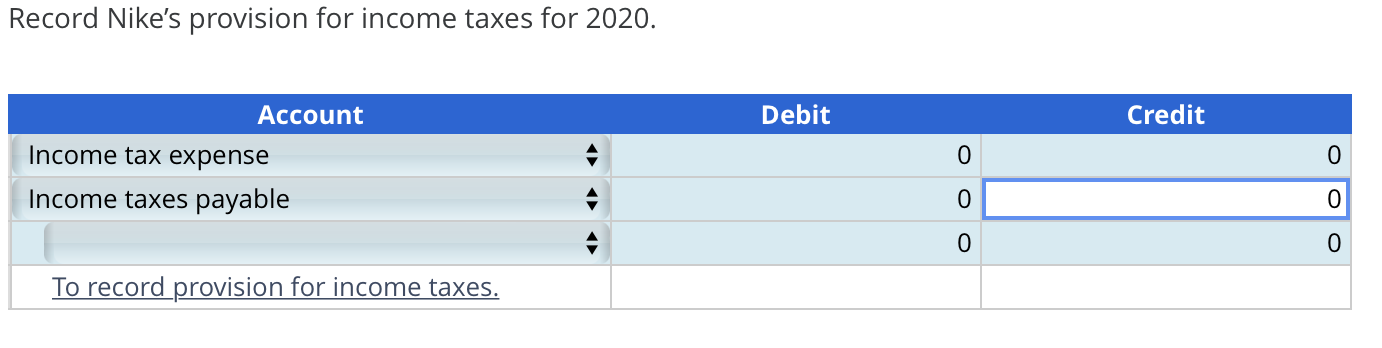

Record Nike's provision for income taxes for

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started