Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording journal entries for nonprofits Prepare journal entries to record the transactions. 1 . Donor A gave the nonprofit a cash gift of $ 5

Recording journal entries for nonprofits

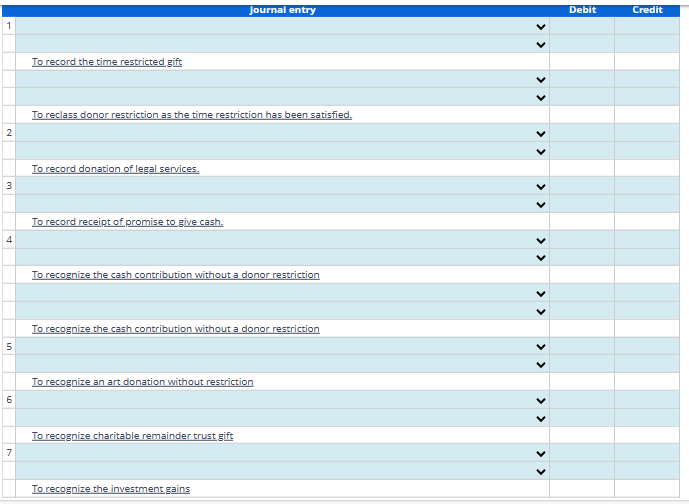

Prepare journal entries to record the transactions.

Donor A gave the nonprofit a cash gift of $ in June, telling the nonprofit the gift could not be used until the next fiscal year. Identify the

affected net asset classifications in the journal entries made both in the current fiscal year and the next fiscal year.

Attorney Howard Gorman volunteered his services to Taconic Singers, a nonprofit. He spent hours preparing contracts for the services of professional

singers and hours serving as an usher before performances. Gorman normally gets $ an hour for legal services, and Taconic normally pays $ an

hour when it hires ushers.

Donor B sent a letter to a nonprofit, saying she would donate $ in cash to the nonprofit, to be used for any purpose the nonprofits trustees desired,

provided the nonprofit raised an equal amount of cash from other donors.

Regarding the previous transaction, the nonprofit raised $ in cash from other donors and then notified Donor B of its success in meeting her condition

for the gift.

Donor C donates to a local museum a work of art having a fair value of $ with the understanding that the museum will sell it at auction and use the funds

for its general activities.

Donor D advises a university that he has established an irrevocable charitable remainder trust, administered by his attorney, whereby his wife will receive

income from the trust as long as she lives. At her death, the remaining trust assets will be distributed to the university as a permanent endowment. The

universitys actuary estimates the fair value of the universitys beneficial interest to be $

As of December the fair value of investments held in perpetuity by a nonprofit had increased by $

Note: If no journal entry is necessary, select the no entry required debit and no entry required credit for the account names and record zero for the debit and credit amounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started