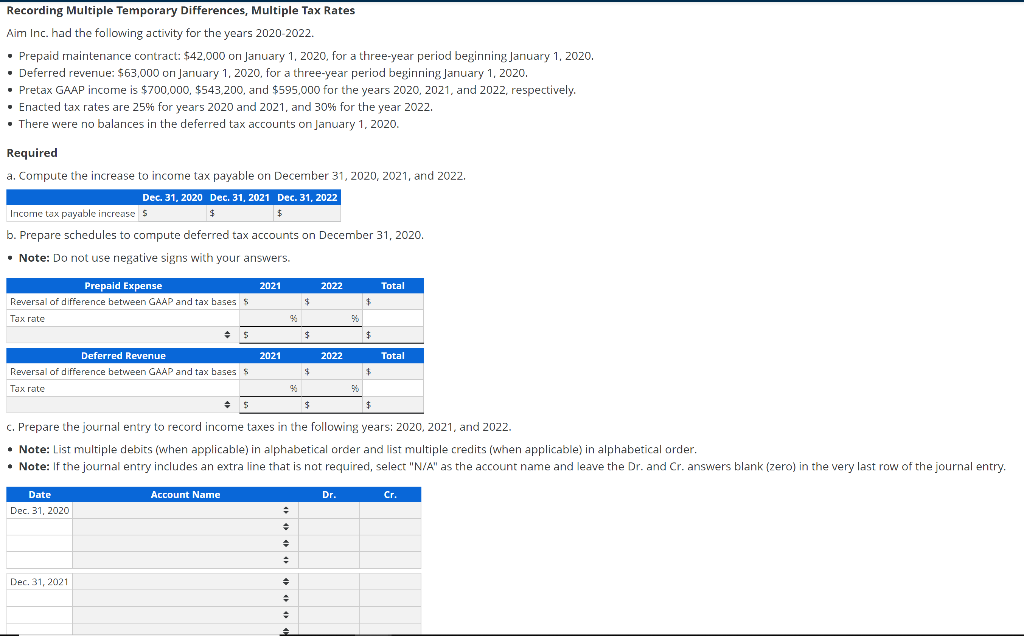

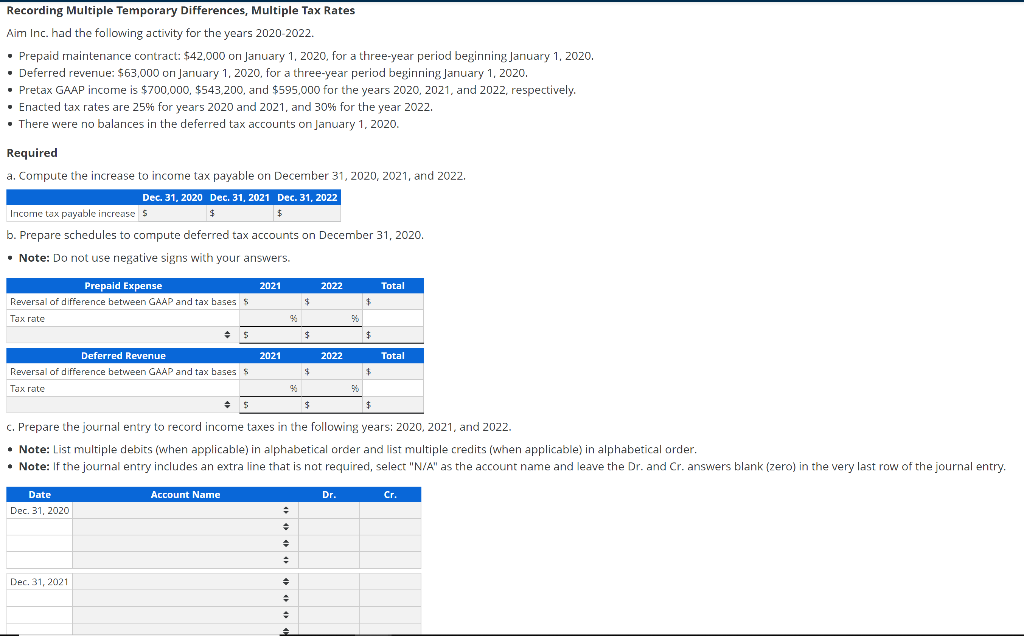

Recording Multiple Temporary Differences, Multiple Tax Rates Aim Inc. had the following activity for the years 2020-2022. Prepaid maintenance contract: $42,000 on January 1, 2020, for a three-year period beginning January 1, 2020. Deferred revenue: $63,000 on January 1, 2020, for a three-year period beginning January 1, 2020. Pretax GAAP income is $700,000, $543,200, and $595,000 for the years 2020, 2021, and 2022, respectively. Enacted tax rates are 25% for years 2020 and 2021, and 30% for the year 2022. There were no balances in the deferred tax accounts on January 1, 2020. Required a. Compute the increase to income tax payable on December 31, 2020, 2021, and 2022. Dec 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Income tax payable increases $ b. Prepare schedules to compute deferred tax accounts on December 31, 2020. . Note: Do not use negative signs with your answers. 2021 2022 Total Prepaid Expense Reversal of difference between GAAP and tax bases Tax rate S $ 2021 2022 Total Deferred Revenue Reversal of difference between GAAP and tax bases S Tax rate $ $ C. Prepare the journal entry to record income taxes in the following years: 2020, 2021, and 2022. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: If the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. Account Name Dr. Cr. Date Dec 31, 2020 . Dec 31, 2021 Recording Multiple Temporary Differences, Multiple Tax Rates Aim Inc. had the following activity for the years 2020-2022. Prepaid maintenance contract: $42,000 on January 1, 2020, for a three-year period beginning January 1, 2020. Deferred revenue: $63,000 on January 1, 2020, for a three-year period beginning January 1, 2020. Pretax GAAP income is $700,000, $543,200, and $595,000 for the years 2020, 2021, and 2022, respectively. Enacted tax rates are 25% for years 2020 and 2021, and 30% for the year 2022. There were no balances in the deferred tax accounts on January 1, 2020. Required a. Compute the increase to income tax payable on December 31, 2020, 2021, and 2022. Dec 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Income tax payable increases $ b. Prepare schedules to compute deferred tax accounts on December 31, 2020. . Note: Do not use negative signs with your answers. 2021 2022 Total Prepaid Expense Reversal of difference between GAAP and tax bases Tax rate S $ 2021 2022 Total Deferred Revenue Reversal of difference between GAAP and tax bases S Tax rate $ $ C. Prepare the journal entry to record income taxes in the following years: 2020, 2021, and 2022. Note: List multiple debits (when applicable) in alphabetical order and list multiple credits (when applicable) in alphabetical order. Note: If the journal entry includes an extra line that is not required, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) in the very last row of the journal entry. Account Name Dr. Cr. Date Dec 31, 2020 . Dec 31, 2021