Answered step by step

Verified Expert Solution

Question

1 Approved Answer

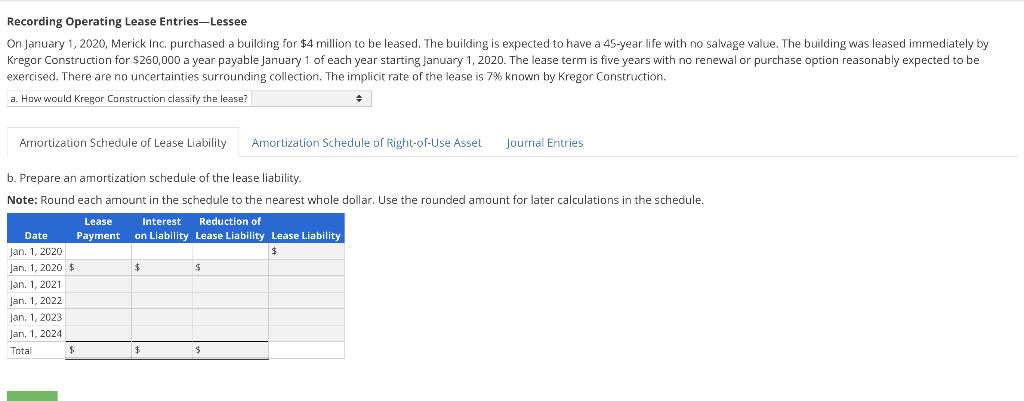

Recording Operating Lease Entries-Lessee On January 1, 2020, Merick Inc. purchased a building for $4 million to be leased. The building is expected to

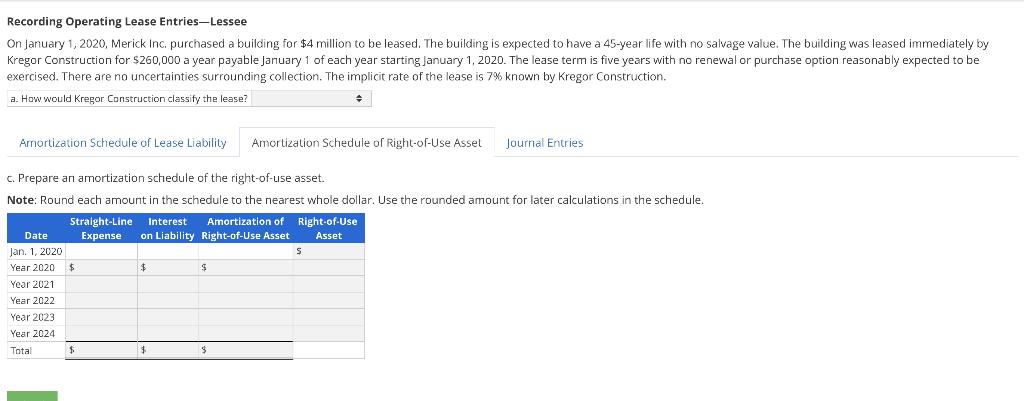

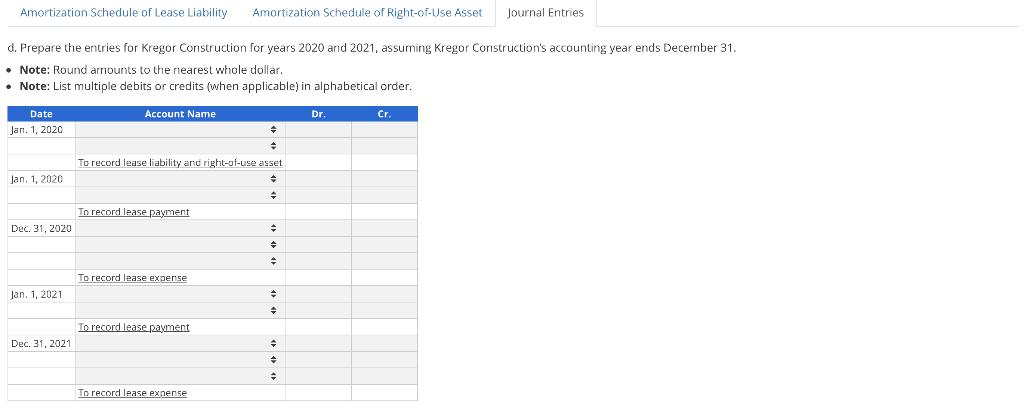

Recording Operating Lease Entries-Lessee On January 1, 2020, Merick Inc. purchased a building for $4 million to be leased. The building is expected to have a 45-year life with no salvage value. The building was leased immediately by Kregor Construction for $260,000 a year payable January 1 of each year starting January 1, 2020. The lease term is five years with no renewal or purchase option reasonably expected to be exercised. There are no uncertainties surrounding collection. The implicit rate of the lease is 7% known by Kregor Construction. a. How would Kregor Construction classify the lease? Arnortization Schedule of Lease Liability Amortization Schedule of Right-of-Use Asset Journal Entries b. Prepare an amortization schedule of the lease liability. Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Lease Interest Reduction of Date Payment on Liability Lease Liability Lease Liability Jan. 1, 2020 Jan. 1, 2020 $ Jan. 1, 2021 Jan. 1, 2022 Jan, 1, 2023 Jan. 1, 2024 Total Recording Operating Lease Entries-Lessee On January 1, 2020, Merick Inc. purchased a building for $4 million to be leased. The building is expected to have a 45-year life with no salvage value. The building was leased immediately by Kregor Construction for $260,000 a year payable January 1 of each year starting January 1, 2020. The lease term is five years with no renewal or purchase option reasonably expected to be exercised. There are no uncertainties surrounding collection. The implicit rate of the lease is 7% known by Kregor Construction. a. How would Kregor Construction classify the lease? Arnortization Schedule of Lease Liability Amortization Schedule of Right-of-Use Asset Journal Entries C. Prepare an amortization schedule of the right-of-use asset. Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Straight-Line Interest Amortization of Right-of-Use Date Expense on Liability Right-of-Use Asset Asset Jan. 1, 2020 Year 2020 24 Year 2021 Year 2022 Year 2023 Year 2024 Total Amortization Schedule of Lease Liability Amortization Schedule of Right-of-Use Asset Journal Entries d. Prepare the entries for Kregor Construction for years 2020 and 2021, assuming Kregor Construction's accounting year ends Decermber 31. Note: Round arnounts to the nearest whole dollar. Note: List multiple debits or credits (when applicable) in alphabetical order. Date Account Name Dr. Cr. Jan. 1, 2020 To record lease liability and right-of-use asset Jan. 1, 2020 To record lease payment Dec. 31, 2020 To record lease expense Jan. 1, 2021 To record lease payment Dec. 31, 2021 To record lease exnense

Step by Step Solution

★★★★★

3.27 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer to the Question is based on IFRS 16 Leases 1 How Lease transaction to be recognized in book o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started