Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recording Transactions in Journal Entries and T-Accounts Schrand Aerobics, Inc., rents studio space (including a sound system) and specializes in offering aerobics classes. On

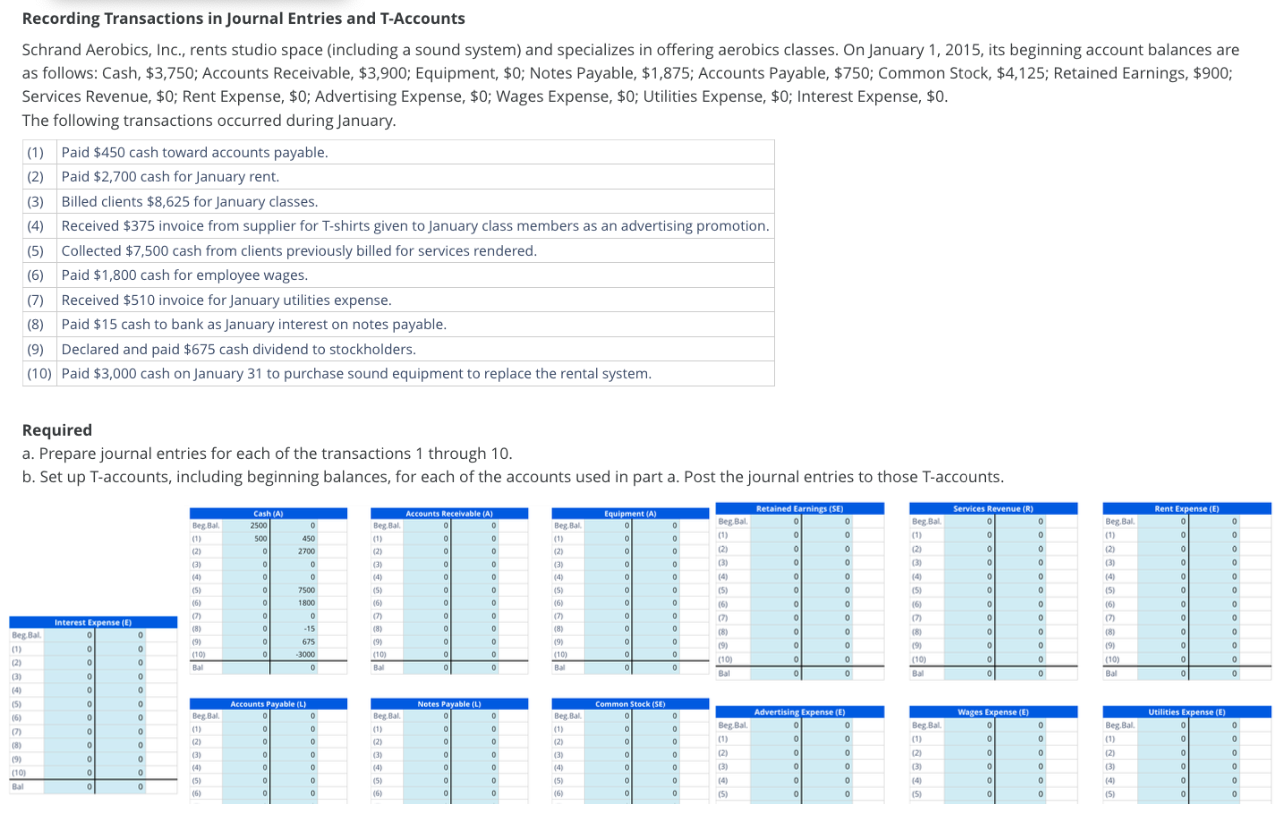

Recording Transactions in Journal Entries and T-Accounts Schrand Aerobics, Inc., rents studio space (including a sound system) and specializes in offering aerobics classes. On January 1, 2015, its beginning account balances are as follows: Cash, $3,750; Accounts Receivable, $3,900; Equipment, $0; Notes Payable, $1,875; Accounts Payable, $750; Common Stock, $4,125; Retained Earnings, $900; Services Revenue, $0; Rent Expense, $0; Advertising Expense, $0; Wages Expense, $0; Utilities Expense, $0; Interest Expense, $0. The following transactions occurred during January. (1) Paid $450 cash toward accounts payable. (2) Paid $2,700 cash for January rent. (3) Billed clients $8,625 for January classes. (4) Received $375 invoice from supplier for T-shirts given to January class members as an advertising promotion. (5) Collected $7,500 cash from clients previously billed for services rendered. (6) Paid $1,800 cash for employee wages. (7) Received $510 invoice for January utilities expense. (8) Paid $15 cash to bank as January interest on notes payable. (9) Declared and paid $675 cash dividend to stockholders. (10) Paid $3,000 cash on January 31 to purchase sound equipment to replace the rental system. Required a. Prepare journal entries for each of the transactions 1 through 10. b. Set up T-accounts, including beginning balances, for each of the accounts used in part a. Post the journal entries to those T-accounts. Retained Earnings (SE) Services Revenue (R) Cash (A) Accounts Receivable (A) Equipment (A) Rent Expense (E) Beg Bal 2500 (1) 500 450 Beg Bal (1) Beg Bal Beg Bal 0 Beg Bal 0 Beg Bal 0 0 (1) 0 (1) 0 (1) 0 (1) 0 (2) 2700 (2) 0 (2) 0 0 (2) 0 (2) 0 (3) (3) 0 (3) 0 (3) 0 (3) (3) 0 0 (4) 0 0 (4) 0 (4) 0 0 (4) (4) (4) 0 (5) 0 7500 (5) 0 0 (5) 0 (5) 0 0 (5) 0 (5) 0 0 (6) 1800 (6) (6) 0 (6) 0 (7) 0 (7) 0 (7) (7) 0 (7) 0 Interest Expense (E) (8) -15 (8) 0 0 (8) Beg Bal 0 (8) 0 (8) (9) 675 (9) (9) 0 0 0 (9) (9) 0 0 (1) 0 0 (10) -3000 (10) 0 0 (10) 0 (2) (10) (10) (10) 0 Bal Bal 0 0 Bal Bal Bal Bal 0 0 (3) 0 (4) 0 0 0 0 Accounts Payable (L) Notes Payable (L) Common Stock (SE) (6) 0 0 Beg Bal Beg Bal Beg Bal Advertising Expense (E) Wages Expense (E) Utilities Expense (E) Beg Bal 0 0 (1) 0 (1) o 0 (1) 0 Beg Bal 0 Beg Bal (8) (2) 0 (2) 0 (2) 0 (1) 0 (1) 0 (1) 0 (3) (3) 0 (3) (2) (2) 0 (2) 0 (9) 0 (4) 0 0 (3) 0 (3) 0 (10) 0 (5) (5) 0 (5) 0 (4) (4) 0 (4) 0 0 0 (6) 0 (6) 0 0 (5) 0 (5) 0 (5) 0

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for each transaction 1 Paid cash toward accounts payable Debit Accounts ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started