Question

Records from Dan Vce Ltd for the year ended December 31, 2020 revealed these extract: GH Sales 2,600,000 Direct materials 800,000 Direct labour 600,000

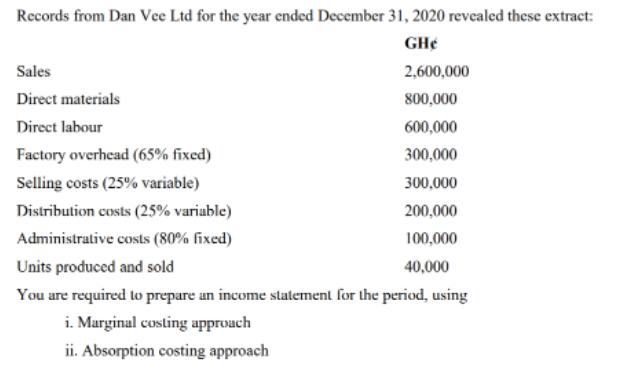

Records from Dan Vce Ltd for the year ended December 31, 2020 revealed these extract: GH Sales 2,600,000 Direct materials 800,000 Direct labour 600,000 Factory overhead (65% fixed) 300,000 Selling costs (25% variable) 300,000 Distribution costs (25% variable) 200,000 Administrative costs (80% fixed) 100,000 Units produced and sold 40,000 You are required to prepare un income statement for the period, using i. Marginal costing approach ii. Absorption costing approach

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Dan vee Ltd Absorption costing Sales 2600000 Less COGS ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting: A Business Process Approach

Authors: Jane L. Reimers

3rd edition

978-013611539, 136115276, 013611539X, 978-0136115274

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App