Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recovery Pharmaceutical Limited (RP) undertakes research for a new drug. It needs a machine of $100,000 which has 4 years' life with zero residual value.

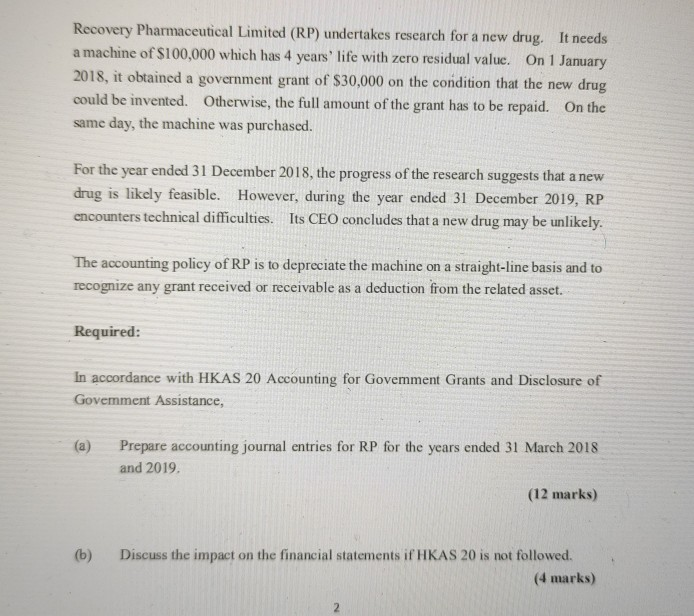

Recovery Pharmaceutical Limited (RP) undertakes research for a new drug. It needs a machine of $100,000 which has 4 years' life with zero residual value. On 1 January 2018, it obtained a government grant of $30,000 on the condition that the new drug could be invented. Otherwise, the full amount of the grant has to be repaid. On the same day, the machine was purchased. For the year ended 31 December 2018, the progress of the research suggests that a new drug is likely feasible. However, during the year ended 31 December 2019, RP encounters technical difficulties. Its CEO concludes that a new drug may be unlikely. The accounting policy of RP is to depreciate the machine on a straight-line basis and to recognize any grant received or receivable as a deduction from the related asset. Required: In accordance with HKAS 20 Accounting for Government Grants and Disclosure of Goverment Assistance, (a) Prepare accounting journal entries for RP for the years ended 31 March 2018 and 2019. (12 marks) (b) Discuss the impact on the financial statements if HKAS 20 is not followed. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started