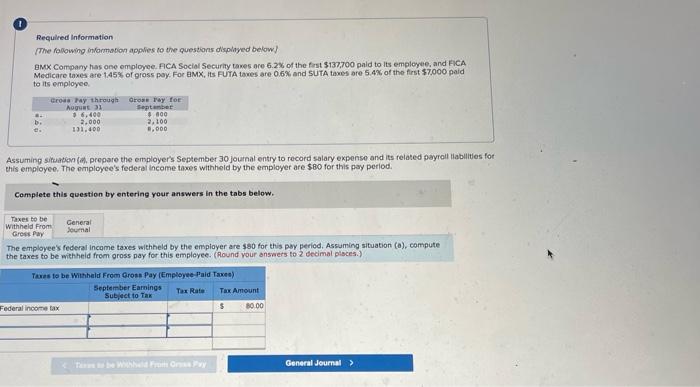

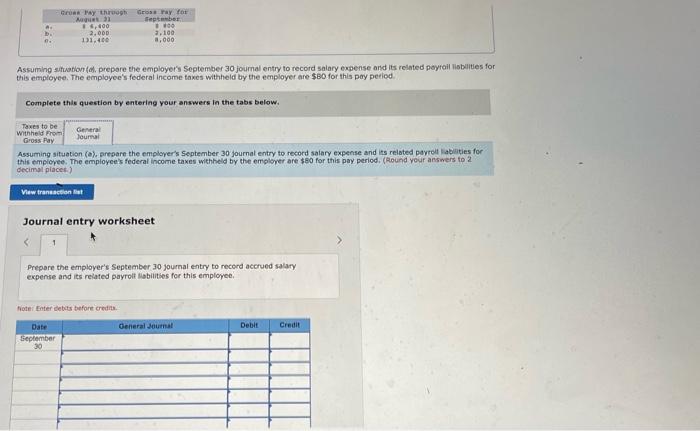

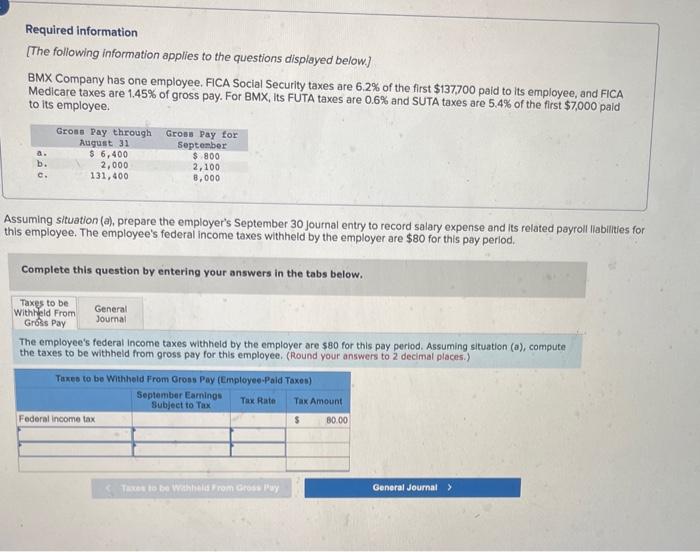

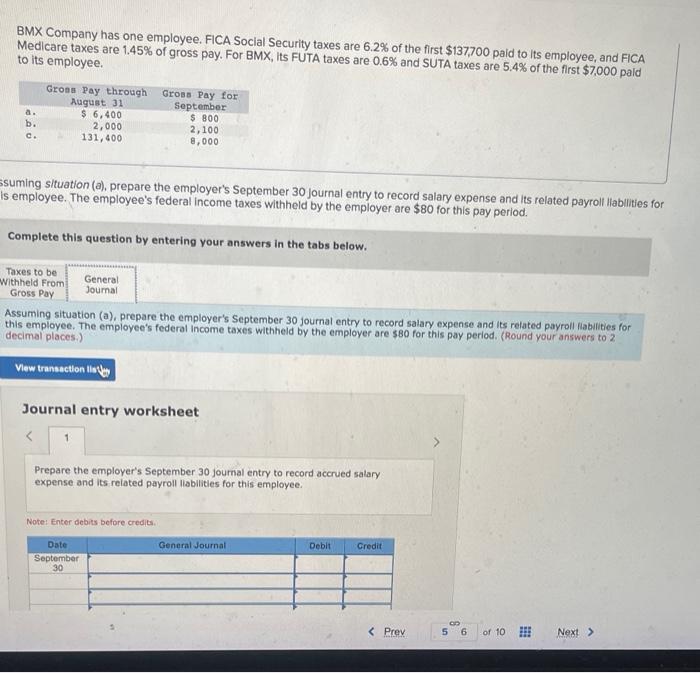

Reculred Information The folowing ontormation appwes to the questions displiyed belowf BMx Company has one employee. fICA Social Security taves are 6.2 of the frit $137,700 pald to lts employe and ElCA Medicare taxes are 1.45% of gross pay. Foe BMX, its FUTA tawes are. 0.6% and 5 UTA taxes are 5.49 of the first $7.000 paid to its employee. Assuminn situation (aw. prepare the employer's September 30 journal entry to record salary expense and its felated payrall liabilities fot this employee. The omployee's federai income tawes withheid by the employer are $ Bo for this pay period. Complete this question by entering your answers in the tabs below. The employee's federal incame taxes withheld by the eniplayer are $80 for this pay perigd. Assuming situation (a). compute the taxes to be with heid from gross pay for this empleyee. (Round your answers to 2 tecimal plsces.) Assuming stituation(a), prepore the employer's September 30 joumal entry to record salary expense and its related poytail listelities for tis employee. The employee's federal income taxes withineld by the employer are $B0 for thls pay peetied. Complete this question by entering your answers in the tabs below. Assuming situation. (o). arepare the employer's September 30 journat entry to record salary expense and its related payrof labilities for this emplopee. The employee's federal income taxes withheld by the emoloyer are \$80 for this pay period, (found your answers to 2 decimal placet.) Journal entry worksheet Prepare the employer's September 30 journal entry to record accrued salary expense and its related payrolt lisbilities for this employee. fiotei Enter detuts before credats. Required information [The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, Its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Assuming situation (a), prepare the employer's September 30 journal entry to record salary expense and its related payroll liabilities for his employee. The employee's federal income taxes withheld by the employer are $80 for this pay period. Complete this question by entering your answers in the tabs below. The employee's federal income taxes withheld by the employer are 580 for this pay period. Assuming situation (a), compute the taxes to be withheld from gross pay for this employee. (Round your answers to 2 decimal places.) BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medlcare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. isuming situation (a), prepare the employer's September 30 Journal entry to record salary expense and its related payroll llabilities for s employee. The employee's federal income taxes withheld by the employer are $80 for this pay period. Complete this question by entering your answers in the tabs below. Assuming situation (a), prepare the employer's September 30 journal entry to record salary expense and its related payroll liabilities for this employee. The employee's federal income taxes withheld by the employer are $80 for this pay period. (Round your answers to 2 ) decimal places.) Journal entry worksheet Prepare the employer's September 30 joumal entry to record accrued salary expense and its related payroll liabilities for this employee. Note: Enter debits before credita