Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Red plc, a retailer, reported a profit before tax of 1,750,000 for the year ended 31 March 2021. At that date, an impairment loss

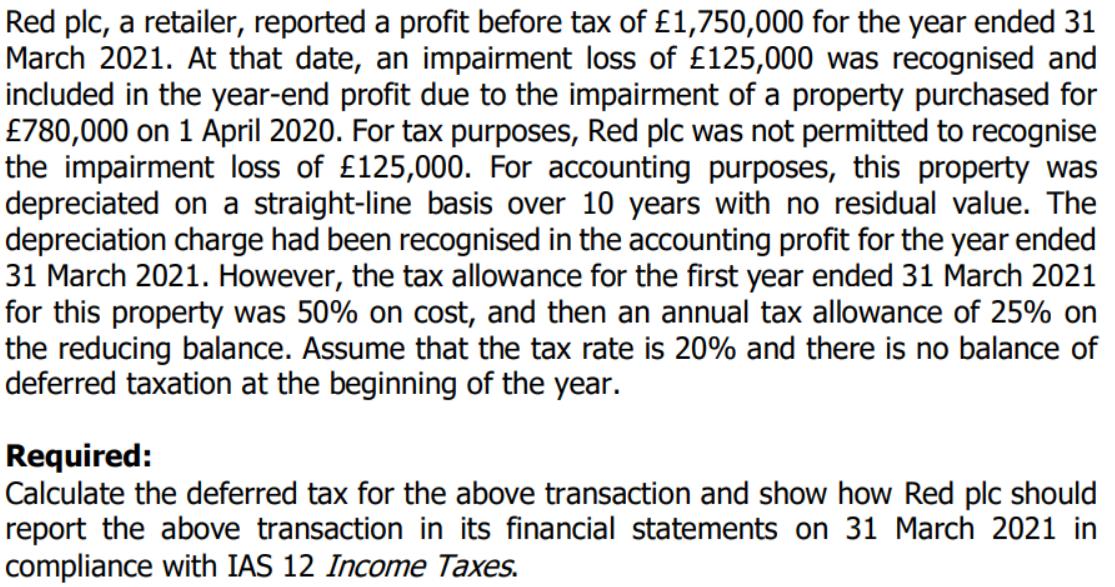

Red plc, a retailer, reported a profit before tax of 1,750,000 for the year ended 31 March 2021. At that date, an impairment loss of 125,000 was recognised and included in the year-end profit due to the impairment of a property purchased for 780,000 on 1 April 2020. For tax purposes, Red plc was not permitted to recognise the impairment loss of 125,000. For accounting purposes, this property was depreciated on a straight-line basis over 10 years with no residual value. The depreciation charge had been recognised in the accounting profit for the year ended 31 March 2021. However, the tax allowance for the first year ended 31 March 2021 for this property was 50% on cost, and then an annual tax allowance of 25% on the reducing balance. Assume that the tax rate is 20% and there is no balance of deferred taxation at the beginning of the year. Required: Calculate the deferred tax for the above transaction and show how Red plc should report the above transaction in its financial statements on 31 March 2021 in compliance with IAS 12 Income Taxes.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Deferred tax calculation Depreciation for accounting purposes in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started