Question

Red River Company acquired 100% of the voting stock of the CarStyle Group on January 1 of the current year for a total acquisition cost

Red River Company acquired 100% of the voting stock of the CarStyle Group on January 1 of the current year for a total acquisition cost of $500,000. The trial balance of CarStyle on the date of acquisition follows.

| Debit | Credit | |

| Investment in held-to-maturity securities | 60,000 | |

| Plant and equipment – net | 390,000 | |

| Intangible assets – net | 140,000 | |

| Long-term debt | 230,000 | |

| Contributed capital | 120,000 | |

| Retained earnings | 240,000 | |

| Totals | 590,000 | 590,000 |

The CarStyle Group acquired the intangible assets 4 years ago. It amortizes the assets using the straight-line method with no estimated residual value. The appraisal of the subsidiary’s net assets on the date of acquisition indicated that the following adjustments were required.

| Book Value | Fair Value | Adjustment | |

Investment in held-to-maturity securities | 60,000 | 60,000 | 0 |

Plant and equipment -- net | 390,000 | 420,000 | 30 ,000 |

| Intangible assets -- net (other than customer list) | 140,000 | 140,000 | 0 |

| Customer list | 0 | 100,000 | 100,000 |

| Long-term debt | (230,000) | (240,000) | (10,000) |

| Total net assets | 360,000 | 480,000 | 120,000 |

On December 31 (1 year after the acquisition of CarStyle), Red River’s management conducted its annual impairment test for goodwill. Management has also assessed recent events and determined that it should review its plant and equipment and finite-life intangible assets for possible impairment. Management determines CarStyle to be the reporting unit, which is also the cash-generating unit. Management estimated that the fair value of the unit (CarStyle) with goodwill 1 year after the acquisition was $600,000; its value in use was $620,000; and the costs to sell were $40,000. The net assets of the unit, excluding goodwill, were appraised at $588,000. Assume that annual depreciation is $10,000, annual amortization for the customer list is $2,000, and the annual amortization for the other intangible assets is $7,000. Red River uses separate accounts for accumulated depreciation and accumulated amortization. Treat the customer list as a finite-life intangible asset. Management is unable to determine fair values for the reporting unit’s assets, but it estimates the following future cash flows for each of the unit’s assets with the exception of goodwill. Assume that Red River’s cost of capital is 5%.

Future Period | Plant and Equipment | Finite-Life Intangible Assets | Customer List |

| Year 1 | 103,000 | 22,000 | 33,600 |

| Year 2 | 80,000 | 20,000 | 28,400 |

| Year 3 | 41,000 | 17,800 | 21,200 |

| Year 4 | 28,000 | 15,400 | 19,000 |

| Year 5 | 0 | 13,000 | 17,600 |

| Year 6 | 0 | 12,000 | 10,200 |

| Year 7 | 0 | 7,800 | 6,000 |

Required:

*****PLEASE USE ATTACHED SPREADSHEET*******

Conduct the impairment test for goodwill at the end of the year, 1 year after the acquisition of CarStyle. Assume no changes in the reporting unit’s assets and liabilities except for depreciation and amortization.

*****PLEASE USE THIS SPREADSHEET*******

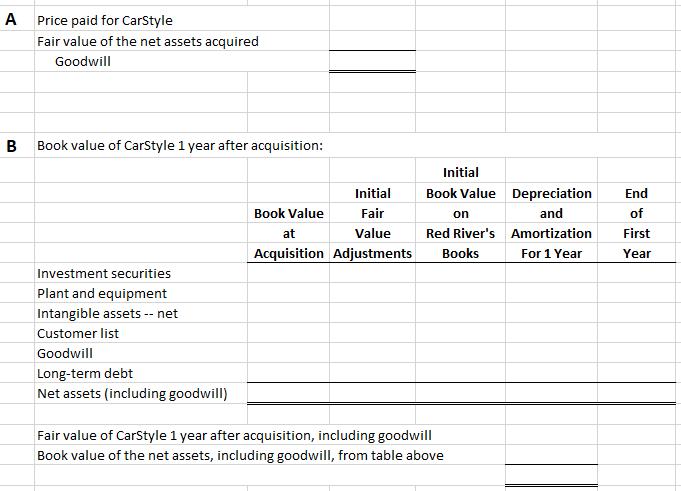

A Price paid for CarStyle Fair value of the net assets acquired Goodwill B Book value of CarStyle 1 year after acquisition: Initial Initial Book Value Depreciation End Book Value Fair on and of at Value Red River's Amortization First Acquisition Adjustments Books For 1 Year Year Investment securities Plant and equipment Intangible assets - net Customer list Goodwill Long-term debt Net assets (including goodwill) Fair value of CarStyle 1 year after acquisition, including goodwill Book value of the net assets, including goodwill, from table above

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Amount of Goodwill to Recorded ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started