Answered step by step

Verified Expert Solution

Question

1 Approved Answer

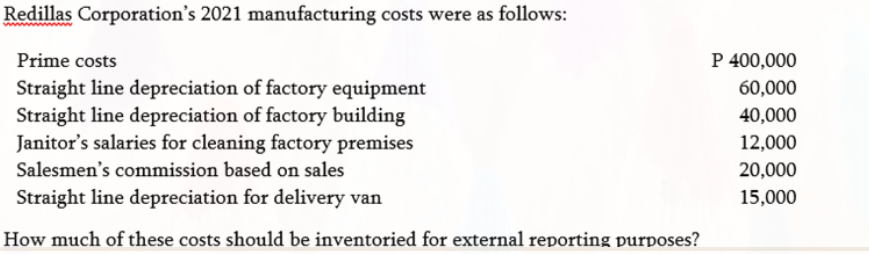

Redillas Corporation's 2021 manufacturing costs were as follows: Prime costs Straight line depreciation of factory equipment Straight line depreciation of factory building Janitor's salaries

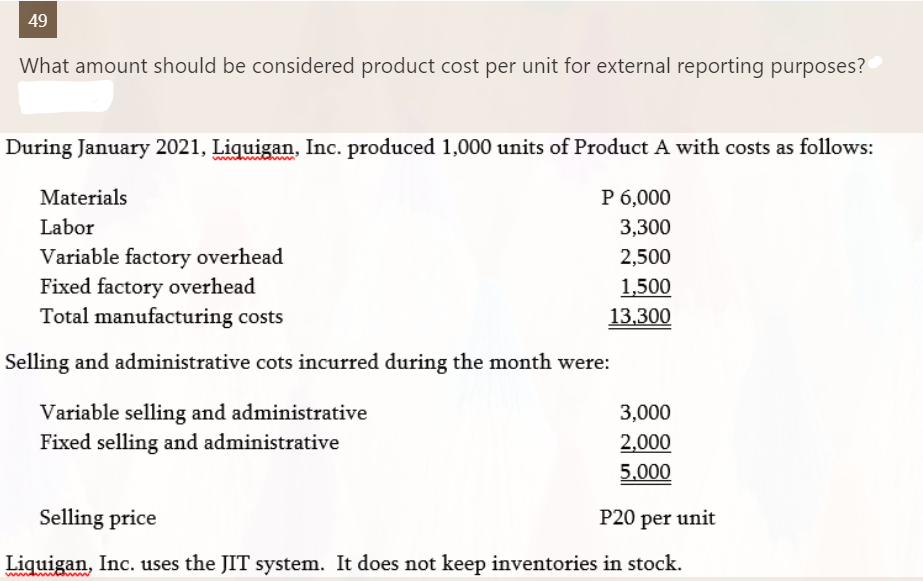

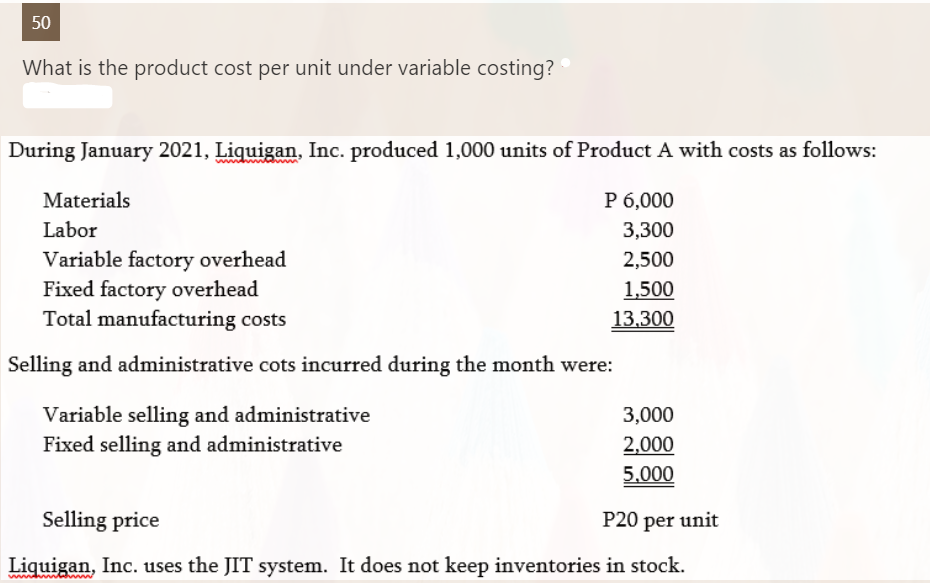

Redillas Corporation's 2021 manufacturing costs were as follows: Prime costs Straight line depreciation of factory equipment Straight line depreciation of factory building Janitor's salaries for cleaning factory premises Salesmen's commission based on sales Straight line depreciation for delivery van How much of these costs should be inventoried for external reporting purposes? P 400,000 60,000 40,000 12,000 20,000 15,000 49 What amount should be considered product cost per unit for external reporting purposes? During January 2021, Liquigan, Inc. produced 1,000 units of Product A with costs as follows: Materials Labor Variable factory overhead Fixed factory overhead Total manufacturing costs P 6,000 3,300 2,500 1,500 13,300 Selling and administrative cots incurred during the month were: Variable selling and administrative Fixed selling and administrative 3,000 2,000 5.000 P20 per unit Selling price Liquigan, Inc. uses the JIT system. It does not keep inventories in stock. 50 What is the product cost per unit under variable costing? During January 2021, Liquigan, Inc. produced 1,000 units of Product A with costs as follows: Materials Labor Variable factory overhead Fixed factory overhead Total manufacturing costs P 6,000 3,300 2,500 1,500 13,300 Selling and administrative cots incurred during the month were: Variable selling and administrative Fixed selling and administrative 3,000 2,000 5,000 P20 per unit Selling price Liquigan, Inc. uses the JIT system. It does not keep inventories in stock.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started