Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Redo of questions. please answer all 5. Question 1 2 pts Larry purchased General Motors Company's bond for $850. The coupon rate is 5%. The

Redo of questions. please answer all 5.

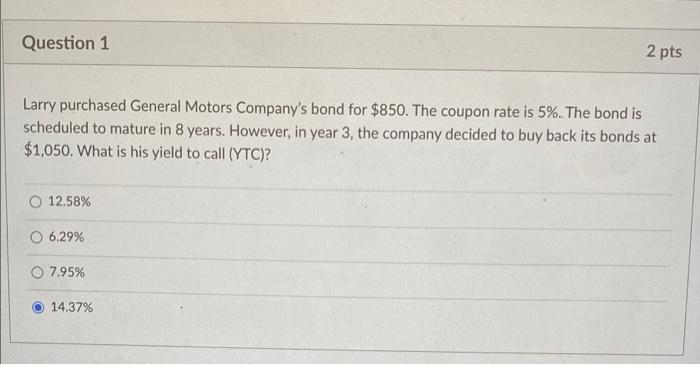

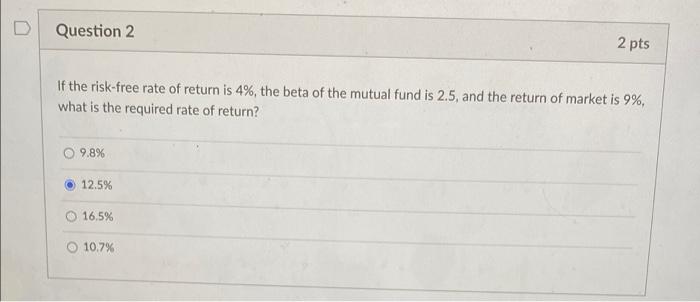

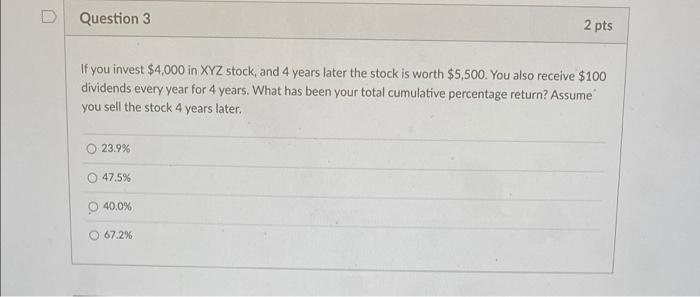

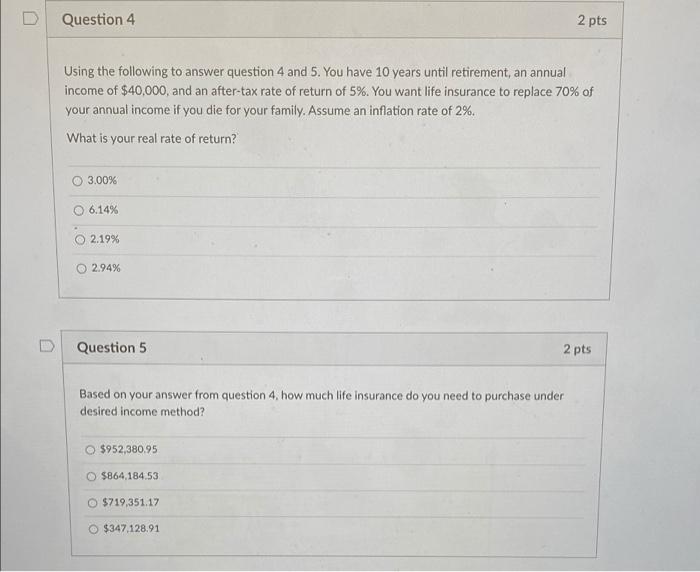

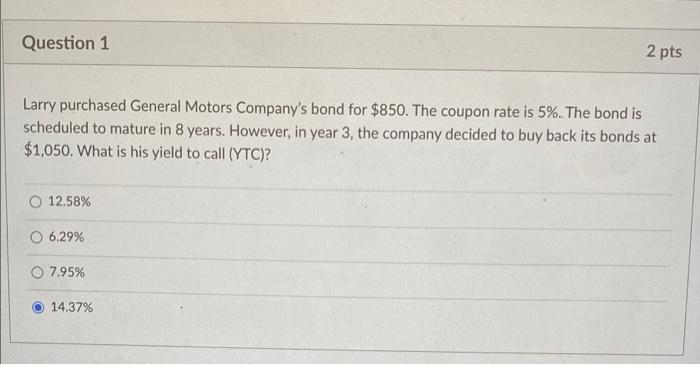

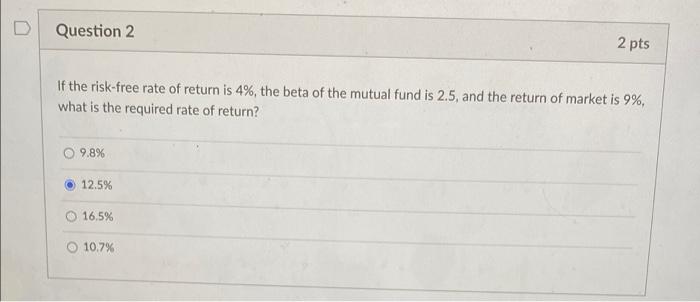

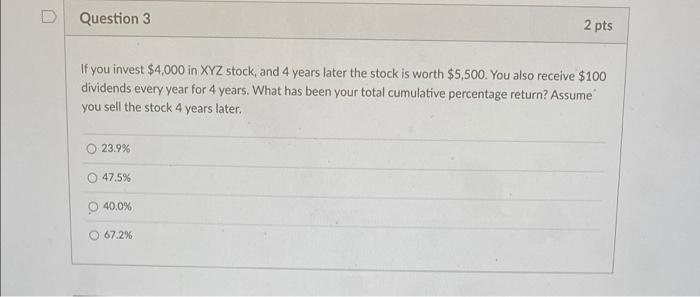

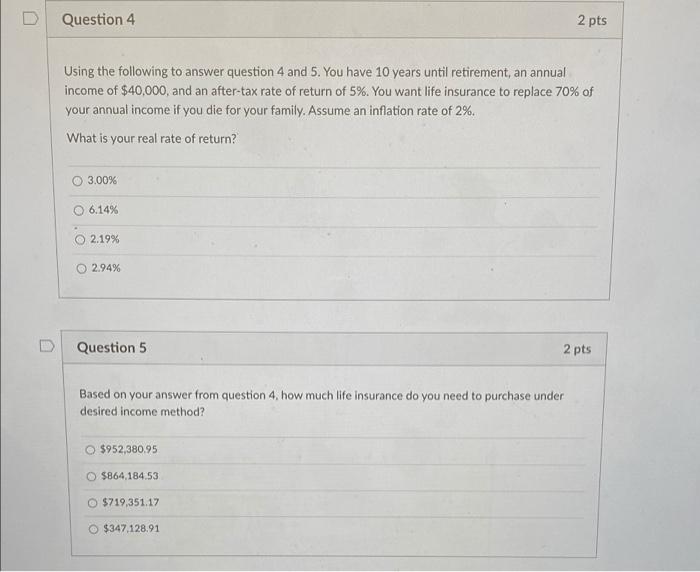

Question 1 2 pts Larry purchased General Motors Company's bond for $850. The coupon rate is 5%. The bond is scheduled to mature in 8 years. However, in year 3, the company decided to buy back its bonds at $1,050. What is his yield to call (YTC)? 12.58% 6.29% O 7.95% 14.37% Question 2 2 pts If the risk-free rate of return is 4%, the beta of the mutual fund is 2.5, and the return of market is 9%, what is the required rate of return? 9.8% 12.5% 16.5% 10.7% Question 3 2 pts If you invest $4,000 in XYZ stock, and 4 years later the stock is worth $5,500. You also receive $100 dividends every year for 4 years. What has been your total cumulative percentage return? Assume you sell the stock 4 years later, O 23.9% 47.5% 40.0% 67.2% Question 4 2 pts Using the following to answer question 4 and 5. You have 10 years until retirement, an annual income of $40,000, and an after-tax rate of return of 5%. You want life insurance to replace 70% of your annual income if you die for your family. Assume an inflation rate of 2%. What is your real rate of return? 3.00% 06.14% 2.19% 2.94% Question 5 2 pts Based on your answer from question 4, how much life insurance do you need to purchase under desired income method? $952,380.95 $864,184.53 O $719,351.17 $347.128.91

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started