Answered step by step

Verified Expert Solution

Question

1 Approved Answer

redo the journal entries for Example 4-2 (day one) and 4-11 (day two) using an incremental borrowing rate of 5%. Do the same for Example

redo the journal entries for Example 4-2 (day one) and 4-11 (day two) using an incremental borrowing rate of 5%. Do the same for Example 4-4 (day one) and 4-13 (day two) also using IBR% of 5%.

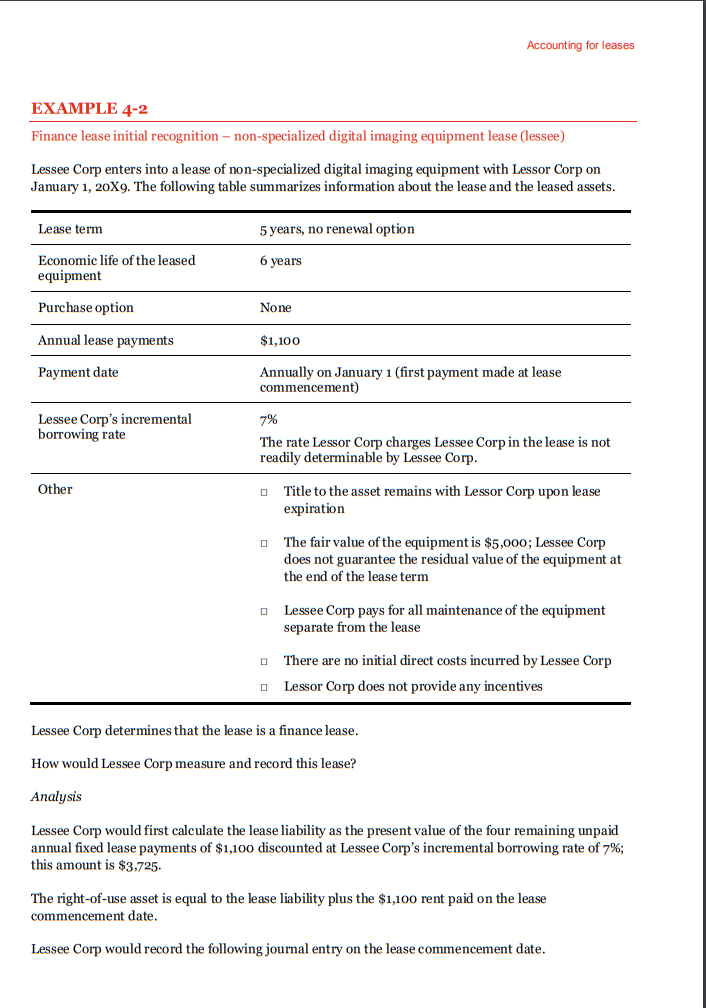

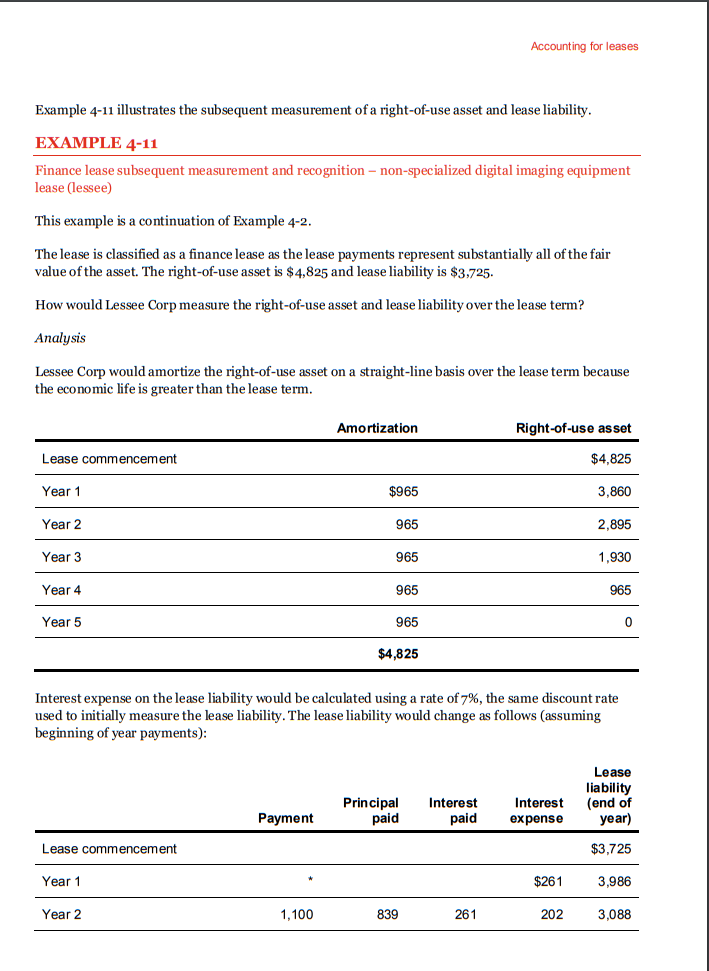

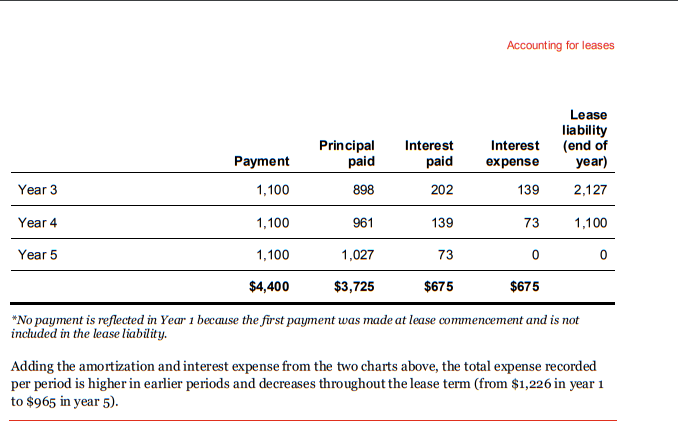

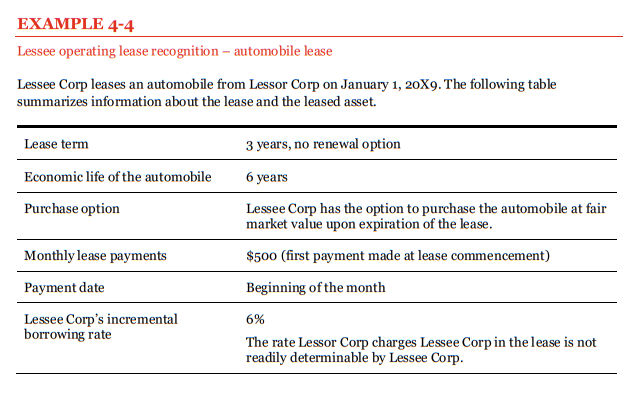

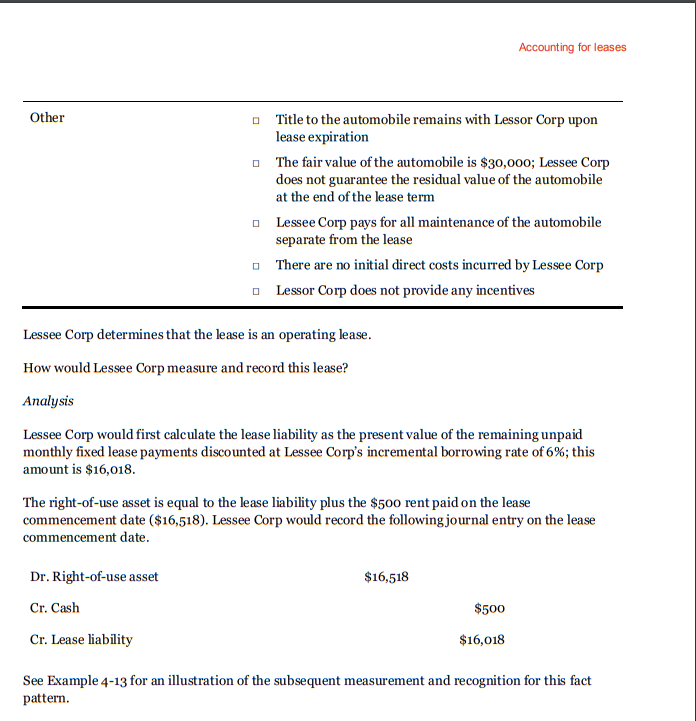

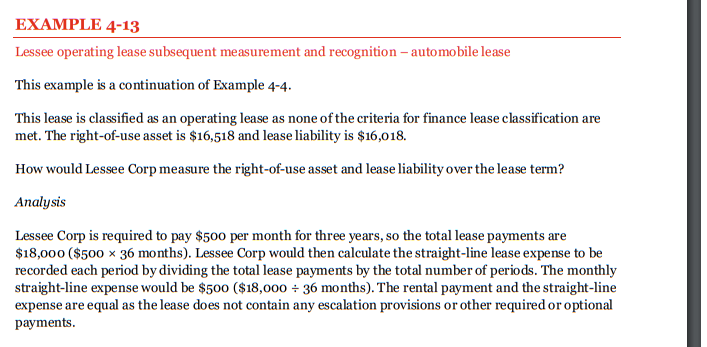

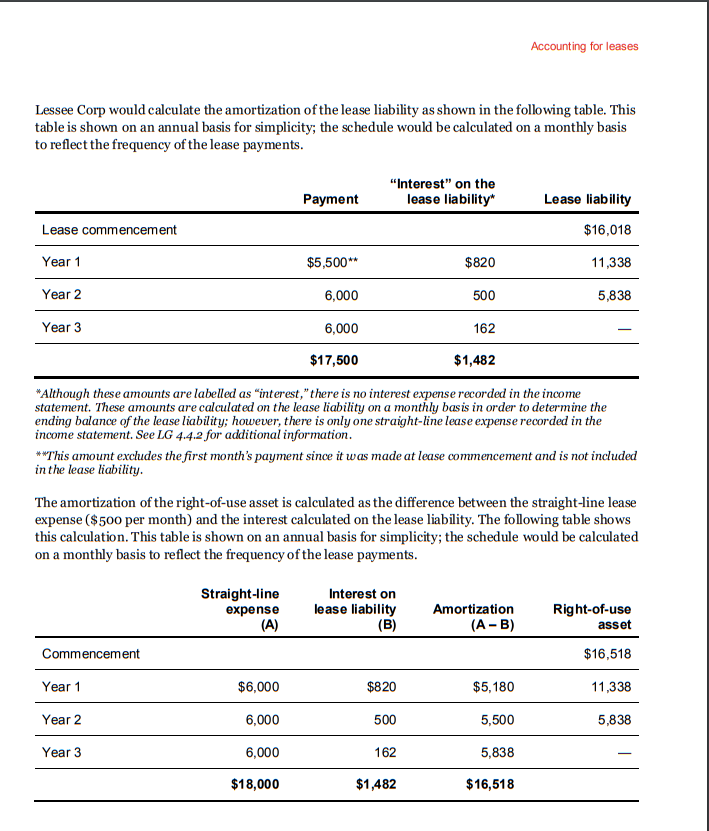

Accounting for leases EXAMPLE 4-2 Finance lease initial recognition - non-specialized digital imaging equipment lease (lessee) Lessee Corp enters into a lease of non-specialized digital imaging equipment with Lessor Corp on January 1, 20X9. The following table summarizes information about the lease and the leased assets Lease term 5 years, no renewal option Economic life of the leased 6 years equipment Purchase option Annual lease payments Payment date Lessee Corp's incremental None $1,100 Annually on January 1 (first payment made at lease commencement) 7% The rate Lessor Corp charges Lessee Corp in the lease is not borrowing rate readily determinable by Lessee Corp Other o Title to the asset remains with Lessor Corp upon lease expiration o The fair value of the equipment is $5,000; Lessee Corp does not guarantee the residual value of the equipment at the end of the lease term o Lessee Corp pays for all maintenance of the equipment mai separate from the lease a There are no initial direct costs incurred by Lessee Corp Lessor Corp does not provide any incentives Lessee Corp determines that the lease is a finance lease How would Lessee Corp measure and record this lease? Analysis Lessee Corp would first calculate the lease liability as the present value of the four remaining unpaid annual fixed lease payments of $1,100 discounted at Lessee Corp's incremental borrowing rate of 7%; this amount is $3,725. The right-of-use asset is equal to the lease liability plus the $1,100 rent paid on the lease commencement date Lessee Corp would record the following journal entry on the lease commencement date Accounting for leases Dr. Right-of-use asset Cr. Lease liability Cr. Cash $4,825 $3,725 $1,100 See Example 4-11 for an illustration of the subsequent measurement and recognition for this fact pattern. Accounting for leases Example 4-11 illustrates the subsequent measurement of a right-of-use asset and lease liability EXAMPLE 4-11 Finance lease subsequent measurement and recognition - non-specialized digital imaging equipment lease (lessee) This example is a continuation of Example 4-2 The lease is classified as a finance lease as the lease payments represent substantially all of the fair value of the asset. The right-of-use asset is $4,825 and lease liability is $3.725. How would Lessee Corp measure the right-of-use asset and lease liability over the lease term? Analysis Lessee Corp would amortize the right-of-use asset on a straight-line basis over the lease term because the economic life is greater than the lease term Right-of-use asset $4,825 3,860 2,895 1,930 965 Amortization Lease commencement Year 1 Year 2 Year 3 Year 4 Year 5 $965 965 965 965 965 $4,825 Interest expense on the lease liability would be calculated using a rate of7%, the same discount rate used to initially measure the lease liability. The lease liability would change as follows (assuming beginning of year payments) Lease liability Interest (end of paid expense year) Principal Interest Payment aid Lease commencement Year 1 Year 2 $3,725 $2613,986 3,088 1,100 839 261 202 Accounting for leases Lease liability Principal Interest Interest (end of paid expense year) Year 3 Year 4 Year 5 Payment 1,100 1,100 1,100 $4,400 paid 898 961 1,027 $3,725 202 139 73 $675 139 2,127 73 1,100 $675 "No payment is reflected in Year 1 because the first payment was made at lease commencement and is not included in the lease liablity. Adding the amortization and interest expense from the two charts above, the total expense recorded per period is higher in earlier periods and decreases throughout the lease term (from $1,226 in year 1 to $965 in year 5) EXAMPLE 4-4 Lessee operating lease recognition- automobile lease Lessee Corp leases an automobile from Lessor Corp on January 1, 20X9. The following table table and the leased aset.h summarizes information about the lease and the leased asset. 3 years, no renewal option Lease term Economic life of the automobile6 years Purchase option Monthly lease payments Payment date Lessee Corp's incremental Lessee Corp has the option to purchase the automobile at fair market value upon expiration of the lease. $500 (first payment made at lease commencement) Beginning of the month 6% The rate Lessor Corp charges Lessee Corp in the lease is not borrowing rate readily determinable by Lessee Corp Accounting for leases Other Title to the automobile remains with Lessor Corp upon lease expiration o The fair value of the automobile is $30,000; Lessee Corp does not guarantee the residual value of the automobile at the end of the lease term Lessee Corp pays for all maintenance of the automobile separate from the lease There are no initial direct costs incurred by Lessee Corp Lessor Corp does not provide any incentives Lessee Corp determines that the lease is an operating lease How would Lessee Corp measure and record this lease? Analysis Lessee Corp would first calculate the lease liability as the present value of the remaining unpaid monthly fixed lease payments discounted at Lessee Corp's incremental borrowing rate of 6%; this amount is $16,018 The right-of-use asset is equal to the lease liability plus the $500 rent paid on the lease commencement date ($16,518). Lessee Corp would record the following journal entry on the lease commencement date Dr. Right-of-use asset Cr. Cash Cr. Lease liability $16,518 $500 $16,018 See Example 4-13 for an illustration of the subsequent measurement and recognition for this fact pattern EXAMPLE 4-13 Lessee operating lease subsequent measurement and recognition -automobile lease This example is a continuation of Example 4-4. This lease is classified as an operating lease as none of the criteria for finance lease classification are met. The right-of-use asset is $16,518 and lease liability is $16,018. How would Lessee Corp measure the right-of-use asset and lease liability over the lease term? Analysis Lessee Corp is required to pay $500 per month for three years, so the total lease payments are $18,000 ($500 x 36 months). Lessee Corp would then calculate the straight-line lease expense to be recorded each period by dividing the total lease payments by the total number of periods. The monthly straight-line expense would be $500 ($18,00036 months). The rental payment and the straight-line expense are equal as the lease does not contain any escalation provisions or other required or optional payments Accounting for leases Lessee Corp would calculate the amortization of the lease liability as shown in the following table. This table is shown on an annual basis for simplicity; the schedule would be calculated on a monthly basis to reflect the frequency of the lease payments "Interest" on the lease liability* Lease liability $16,018 11,338 5,838 Payment Lease commencement Year 1 Year 2 Year 3 $5,500** 6,000 6,000 $17,500 $820 500 $1,482 rest expense recorded in the income Although these amounts are labelled as "interest," there is no inte statement. These amounts are calculated on the lease liability on a monthly basis in order to determine the ending balance of the lease liablity; however, there is only one straight-line lease expense recorded in the income statement. See LG 4.4.2 for additional information *"This amount exchudes the first month's payment since it was made at lease commencement and is not included in the lease liability The amortization of the right-of-use asset is calculated as the difference between the straight-line lease expense ($500 per month) and the interest calculated on the lease liability. The following table shows this calculation. This table is shown on an annual basis for simplicity; the schedule would be calculated on a monthly basis to reflect the frequency of the lease payments. Straight-line Interest on expense lease liability Amortization (A- B) Right-of-use Commencement Year 1 Year 2 Year 3 $6,000 6,000 6,000 $18,000 $820 500 162 $1,482 $5,180 5,500 5,838 $16,518 asset $16,518 11,338 5,838Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started