Question

(Redo) The Minoso Corporation anticipates a 20 percent increase in sales for 2017, 2018, and 2019. Minoso is currently operating at full capacity and thus

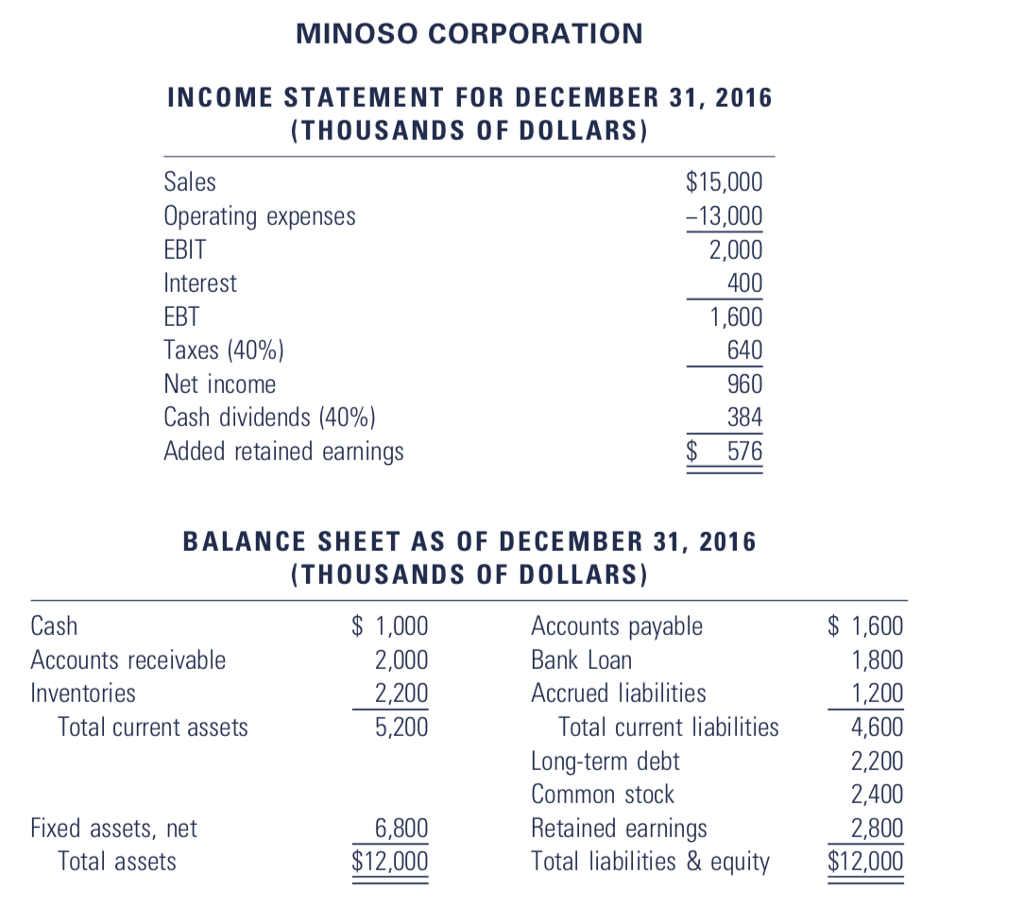

(Redo) The Minoso Corporation anticipates a 20 percent increase in sales for 2017, 2018, and 2019. Minoso is currently operating at full capacity and thus expects to increase its investment in both current and fixed assets in order to support the increase in forecasted sales. The Minoso Corporations 2016 income and balance sheet statements are given in problem 4.(seen below)

A. Prepare an Excel spreadsheet model that projects the income statement, balance sheet, and state- ment of cash flows for 2017 prior to obtaining any additional financing. Use a separate AFN long- term financing (liability/equity) account to show the amount of financing needed to make the bal- ance sheet balance.

B. Extend your 2017 spreadsheet-based financial statement projections for two additional years (2018 and 2019). What is the total amount of AFN needed over the three-year period?

C. Show how your spreadsheet model projections will change if the AFN from Part B is financed by issuing additional long-term debt at a 10 percent interest rate.

There's exsiting question, but I believe its answer is not 100% right about equity and liability on a balance sheet because my AFN of $1148 does not match the balance. Please redo this for me.

MINOSO CORPORATION INCOME STATEMENT FOR DECEMBER 31, 2016 THOUSANDS OF DOLLARS) Sales Operating expenses EBIT Interest EBT Taxes (40%) Net income Cash dividends (40%) Added retained earnings $15,000 -13,000 2,000 400 1,600 640 960 384 $ 576 BALANCE SHEET AS OF DECEMBER 31, 2016 THOUSANDS OF DOLLARS) Cash Accounts receivable Inventories 1,000 2,000 2,200 5,200 $1,600 1,800 1,200 4,600 2,200 2,400 2,800 Total liabilities & equity$12,000 Accounts payable Bank Loan Accrued liabilities Total current assets Total current liabilities Long-term debt Common stock Retained earnings Fixed assets, net Total assets 6,800 $12,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started