Question

Reese, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship. In late December, she received a $20,000 bill from her accountant

Reese, a calendar-year taxpayer, uses the cash method of accounting for her sole proprietorship. In late December, she received a $20,000 bill from her accountant for consulting services related to her small business. Reese can pay the $20,000 bill anytime before January 30 of next year without penalty. Assume Reese's marginal tax rate is 32 percent this year and 35 percent next year, and that she can earn an after-tax rate of return of 12 percent on her investments.

a. What is the after-tax cost if she pays the $20,000 bill in December?

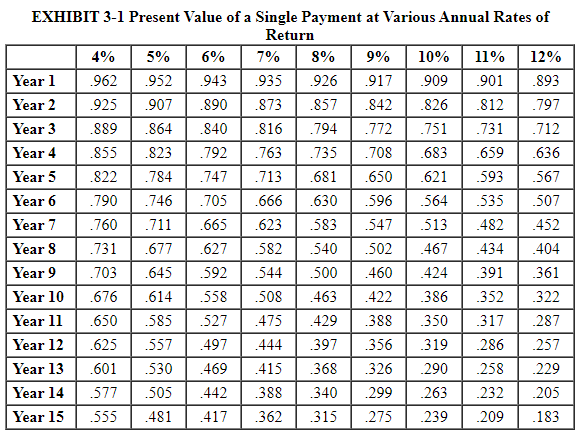

b. What is the after-tax cost if she pays the $20,000 bill in January? Use Exhibit 3.1.

c. Should Reese pay the $20,000 bill in December or January?

multiple choice 1 December January

d. What is the after-tax cost if she expects her marginal tax rate to be 24 percent next year and pays the $20,000 bill in January? Use Exhibit 3.1. (Round your answer to the nearest whole dollar amount.)

e. Should Reese pay the $20,000 bill in December or January if she expects her marginal tax rate to be 32 percent this year and 24 percent next year?

multiple choice 2 December January

EXHIBIT 3-1 Present Value of a Single Payment at Various Annual Rates of Return 4% 5% 6% 7% 8% 9% 10% 11% 12% Year 1 962 952 943 935 .926 917 909 901 .893 Year 2 925 907 .890 .873 .857 .842 .826 .812 .797 Year 3 .889 .864 .840 .816 .794 .772 .751 .731 .712 Year 4 .855 .823 .792 .763 .735 708 .683 .659 .636 Year 5 .822 .784 .747 .713 .681 .650 .621 593 .567 Year 6 .790 .746 .705 .666 .630 596 .564 .535 .507 Year 7 .760 .711 .665 .623 583 .547 513 .482 .452 Year 8 .731 .677 .627 .582 540 502 467 .434 404 Year 9 .703 .645 592 .544 500 460 424 391 361 Year 10 .676 .614 558 .508 463 422 386 352 322 Year 11 .650 .585 527 475 429 388 317 287 Year 12 .625 .557 .497 444 397 356 319 .286 .257 Year 13 .601 530 .469 415 368 326 -290 .258 .229 Year 14 .577 505 442 388 340 .299 .263 .232 .205 Year 15 555 481 417 362 315 -275 .239 .209 .183 350

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started