Question

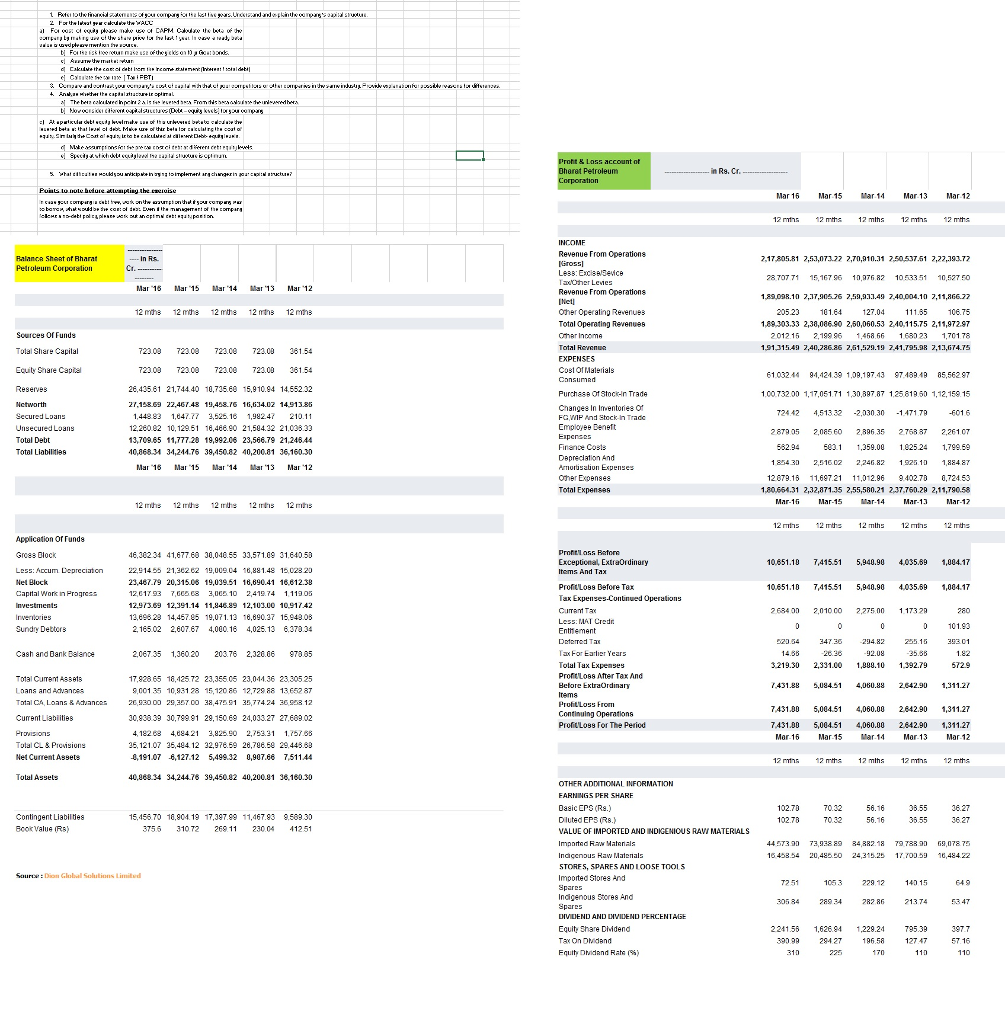

refer enclosed attachment for financial statements Refer to the financial statements of your company for the last five years. Understand and explain the companys capital

refer enclosed attachment for financial statements

Refer to the financial statements of your company for the last five years. Understand and explain the companys capital structure.

For the latest year calculate the WACC

For cost of equity please make use of CAPM. Calculate the beta of the company by making use of the share price for the last 1 year. In case a ready beta value is used please mention the source.

For the risk free return make use of the yields on 10 yr Govt bonds.

Assume the market return

Calculate the cost of debt from the Income statement (Interest / total debt)

Calculate the tax rate ( Tax / PBT)

Compare and contrast your companys cost of capital with that of your competitors or other companies in the same industry. Provide explanation for possible reasons for differences.

Analyse whether the capital structure is optimal.

The beta calculated in point 2 a. is the levered beta. From this beta calculate the unlevered beta.

Now consider different capital structures (Debt equity levels) for your company

At a particular debt equity level make use of this unlevered beta to calculate the levered beta at that level of debt. Make use of this beta for calculating the cost of equity. Similarly the Cost of equity is to be calculated at different Debt- equity levels.

Make assumptions for the pre tax cost of debt at different debt equity levels.

Specify at which debt equity level the capital structure is optimum.

What difficulties would you anticipate in trying to implement any changes in your capital structure?

Points to note before attempting the exercise

In case your company is debt free, work on the assumption that if your company was to borrow, what would be the cost of debt. Even if the management of the company follows a no-debt policy, please work out an optimal debt equity position.Assignment 2 Capital structure and leverage Session 4 (20 marks)

Refer to the financial statements of your company for the last five years. Understand and explain the companys capital structure.

For the latest year calculate the WACC

For cost of equity please make use of CAPM. Calculate the beta of the company by making use of the share price for the last 1 year. In case a ready beta value is used please mention the source.

For the risk free return make use of the yields on 10 yr Govt bonds.

Assume the market return

Calculate the cost of debt from the Income statement (Interest / total debt)

Calculate the tax rate ( Tax / PBT)

Compare and contrast your companys cost of capital with that of your competitors or other companies in the same industry. Provide explanation for possible reasons for differences.

Analyse whether the capital structure is optimal.

The beta calculated in point 2 a. is the levered beta. From this beta calculate the unlevered beta.

Now consider different capital structures (Debt equity levels) for your company

At a particular debt equity level make use of this unlevered beta to calculate the levered beta at that level of debt. Make use of this beta for calculating the cost of equity. Similarly the Cost of equity is to be calculated at different Debt- equity levels.

Make assumptions for the pre tax cost of debt at different debt equity levels.

Specify at which debt equity level the capital structure is optimum.

What difficulties would you anticipate in trying to implement any changes in your capital structure?

Points to note before attempting the exercise

In case your company is debt free, work on the assumption that if your company was to borrow, what would be the cost of debt. Even if the management of the company follows a no-debt policy, please work out an optimal debt equity position.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started