Question

Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Standards. AFs financial statements and disclosure notes for the year ended

Air France-KLM (AF), a Franco-Dutch company, prepares its financial statements according to International Financial Standards. AF’s financial statements and disclosure notes for the year ended December 31, 2015 are available in Connect. This material also is available under the Finance link at the company’s website.

Required:

Refer to AF’s disclosure notes, in particular Note 2: Restatement of Accounts 2014. For the three changes in accounting principle reported in the note, does AF account for the changes prospectively or retrospectively? Is this the same approach AF would follow if using US GAAP?

For the change described in 2.1, which if any account balances required adjustment?

Note 2:

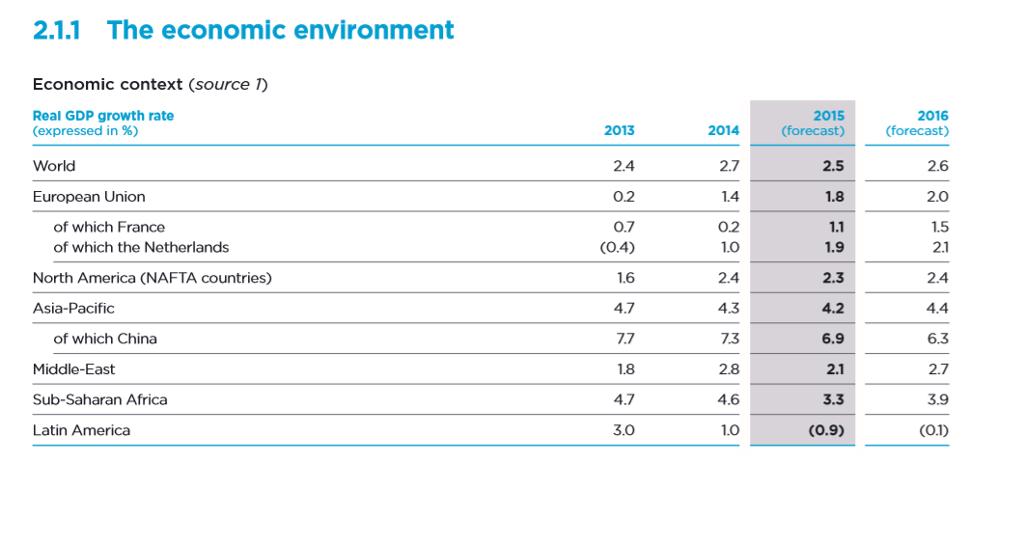

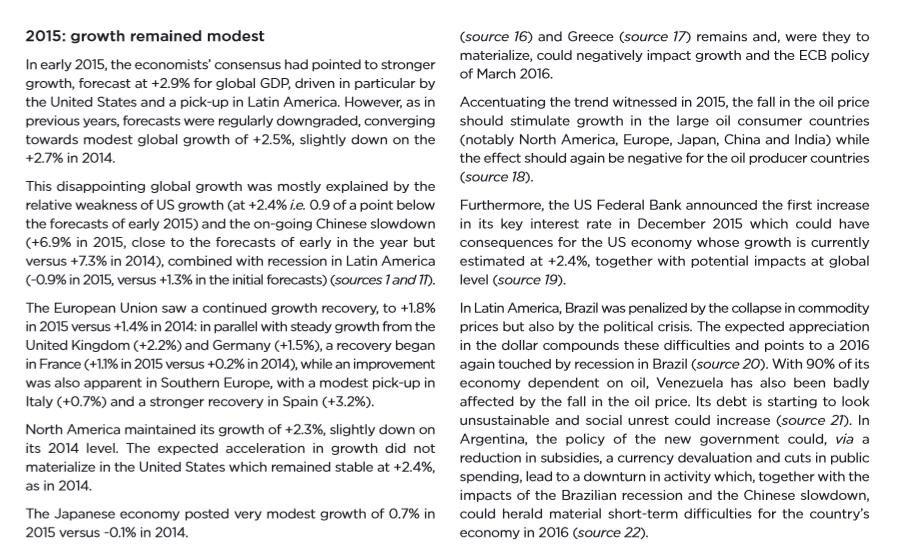

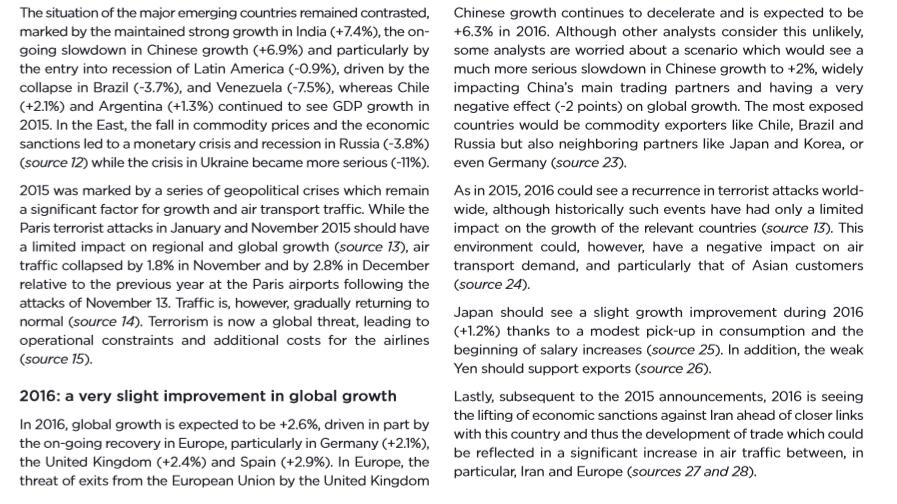

2.1 MARKET AND ENVIRONMENT Air transport industry growth is heavily dependent on the The combination of these factors led to record profits for the economic environment and on global politics since economic industry in 2015, particularly once more in North America. Delta growth and world geopolitical developments have a significant Air Lines more than tripled its operating result, moving from US$22 billion in 2014 to US$7.8 billion in 2015, notably thanks to a US$5 billion saving on the fuel bill (source 6). In total, over just the three first quarters of 2015, the US airlines posted an aggregate influence on passenger and cargo flows. In 2015, global economic growth was slightly lower than in the previous year, at +2.5% (versus +2.7%) However, this average figure covers a number of local disparities. While remaining modest, the recovery accelerated in the European Union. The US$17.9 billion of net income (source 7). The global macro-economic environment will remain broadly beginning of a recovery was witnessed in France, with growth of +1.1%, whereas in the Netherlands growth was stronger at +1.9% (source ). unchanged in 2016, with growth expected to be +2.6%, in line with its level in 2015, although there should continue to be significant disparities: while Europe and North America continue their recovery, the crisis could prove severe in South America and, For the airline industry, 2015 proved to be an exceptional year in several respects. Firstly, the fall in the oil price began in late 2014 more generally, in commodity exporting countries (source ). and accelerated in 2015, the average price halving within the According to IATA forecasts, 2016 should also be an exceptional year, with record profits totaling US$19.2 billion in North America, end of the year, reaching a low of under US$30 in early 2016 ie. a net margin of 9.5%, but also in Europe with US$8.5 billion space of fifteen months (source 2). This decline continued at the (source 3). For the airlines, its effect is partly mitigated by fuel for a net margin of 4.3%, and more variable results in Asia-Pacific hedging strategies (source 4) and, for the European airlines, by the appreciation in the dollar relative to the euro. with US$6.6 billion, representing a net margin of 3.2% on average (source 5). In parallel, restructuring efforts and consolidation in the airline The competitive environment in Europe will continue to be industry made a significant contribution to 2015 results, with an marked by pressure from the Gulf carriers in view of their order on-going productivity improvement measured by IATA and unit books (source 8). In Europe, two other, more-recent competitive labor costs down by 5.5% between 2014 and 2015 (source 5). phenomena became more marked in 2015 and could prove more significant in 2016: the growing interest in long-haul amongst the low-cost carriers, particularly on the North Atlantic (source 9), but also the territorial battle and head-on competition between Lastly, the magnitude of the growth was also remarkable. Based on the IATA data, global airline traffic increased by 6.7% in 2015 compared with 2014, whereas the previous year's growth had been 6% (source 5). the different low-cost airlines in the European air space (source 10).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required solution Ans 1IAS 8 Accounting Policies Changes in Accounting Estimates and Errors requires ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dc5f2ed559_178750.pdf

180 KBs PDF File

635dc5f2ed559_178750.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started