Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to Apple's financial statements in Appendix A to answer the following. Required 1. Assume that the amounts reported for inventories and cost of sales

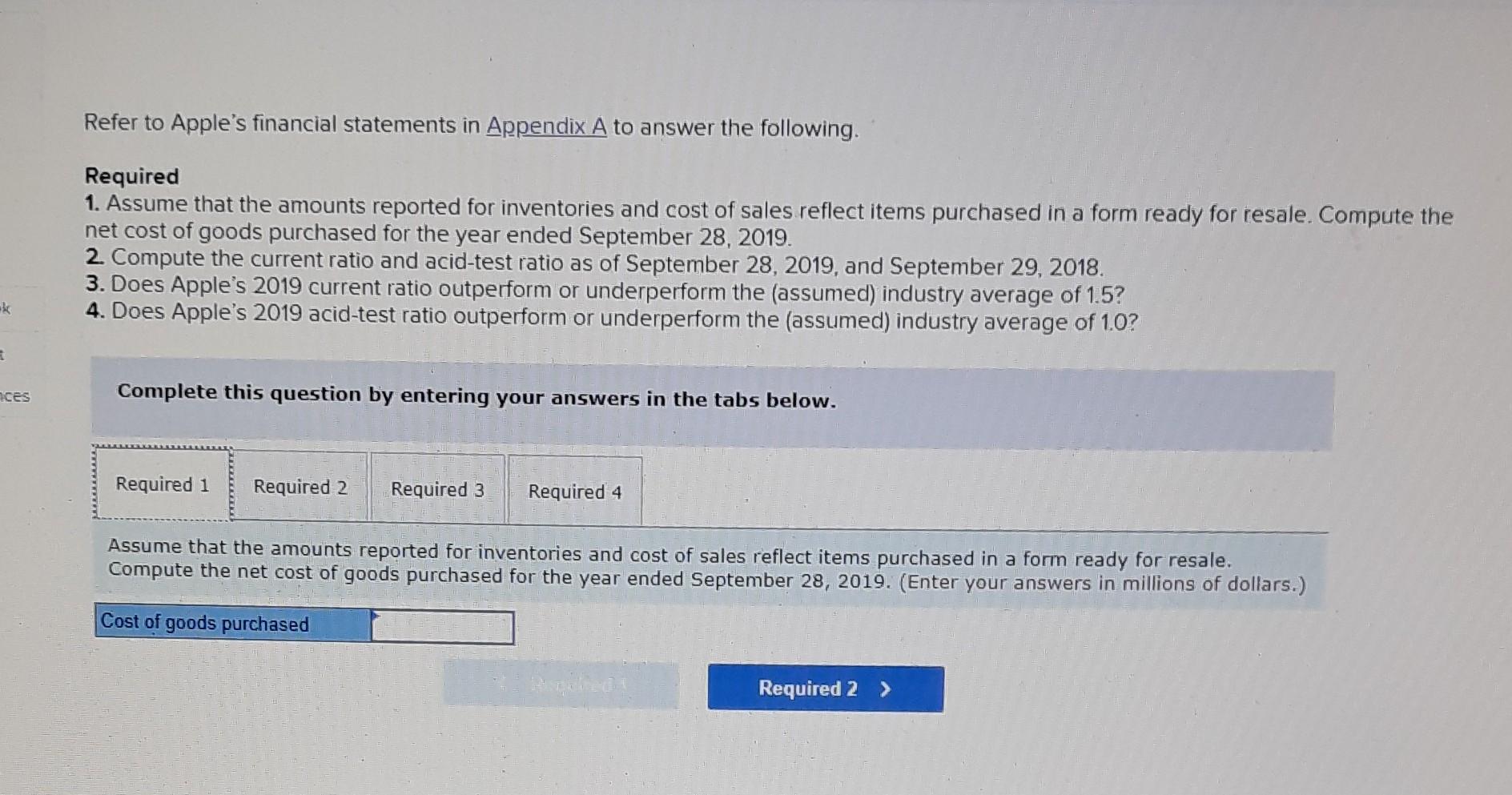

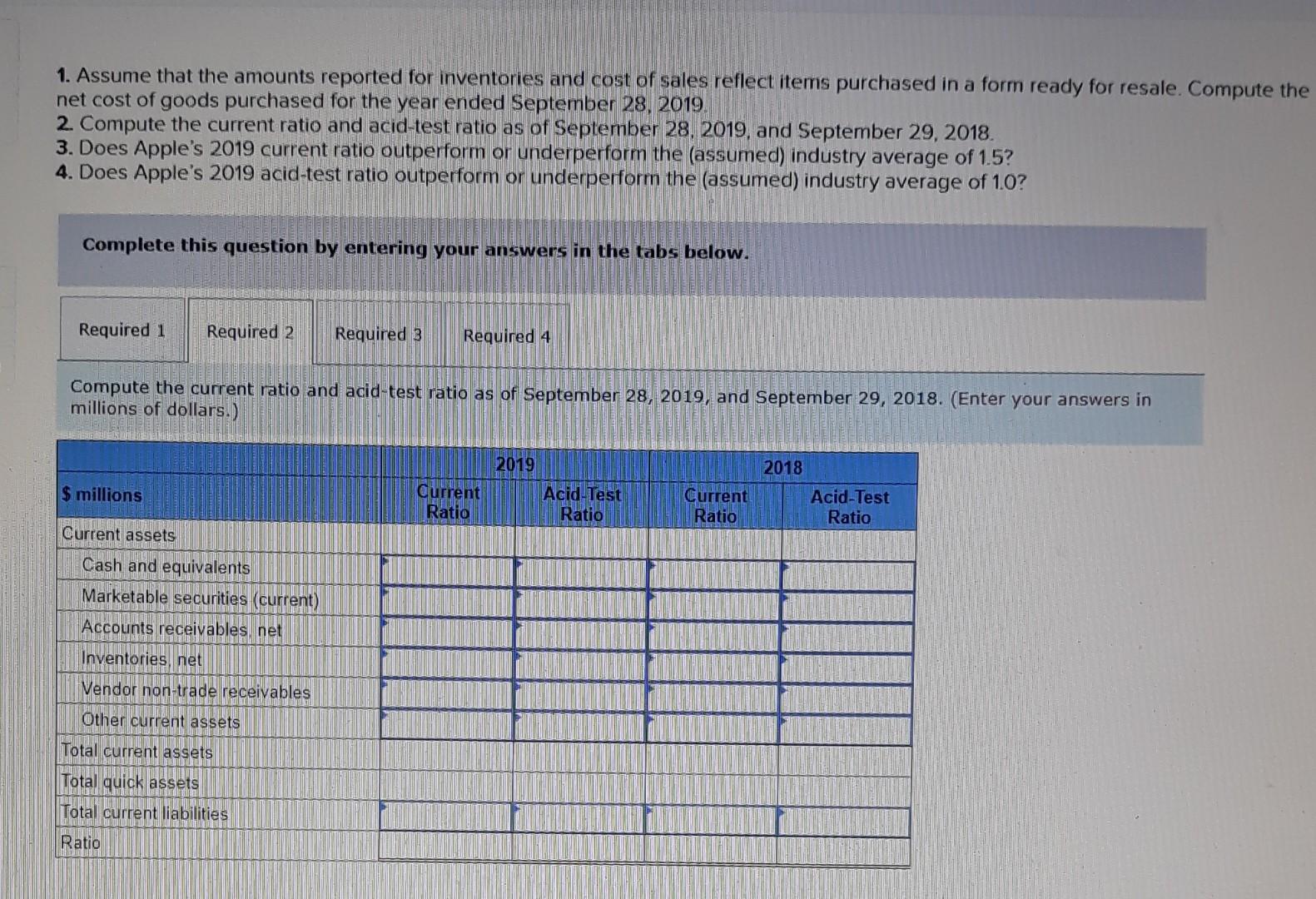

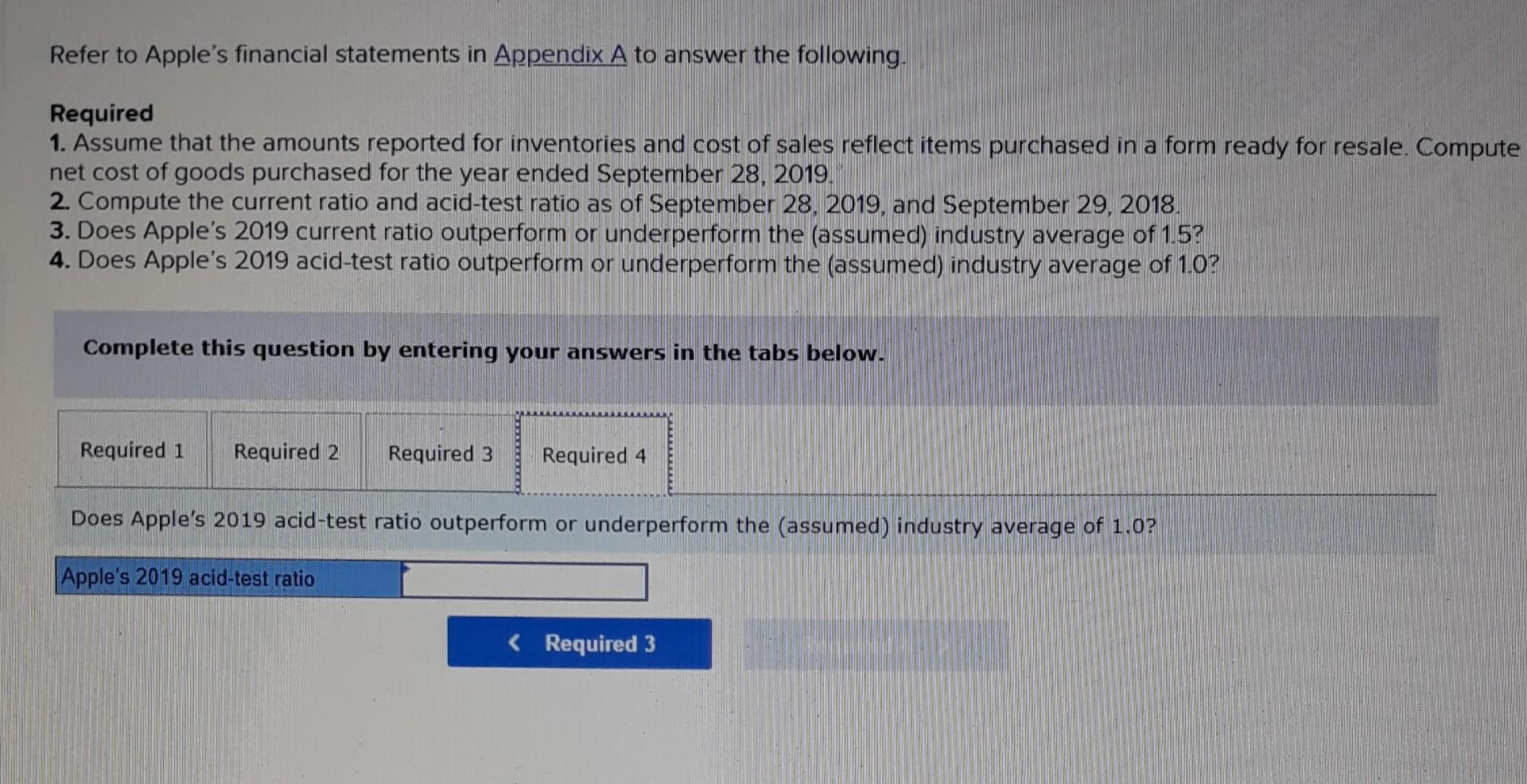

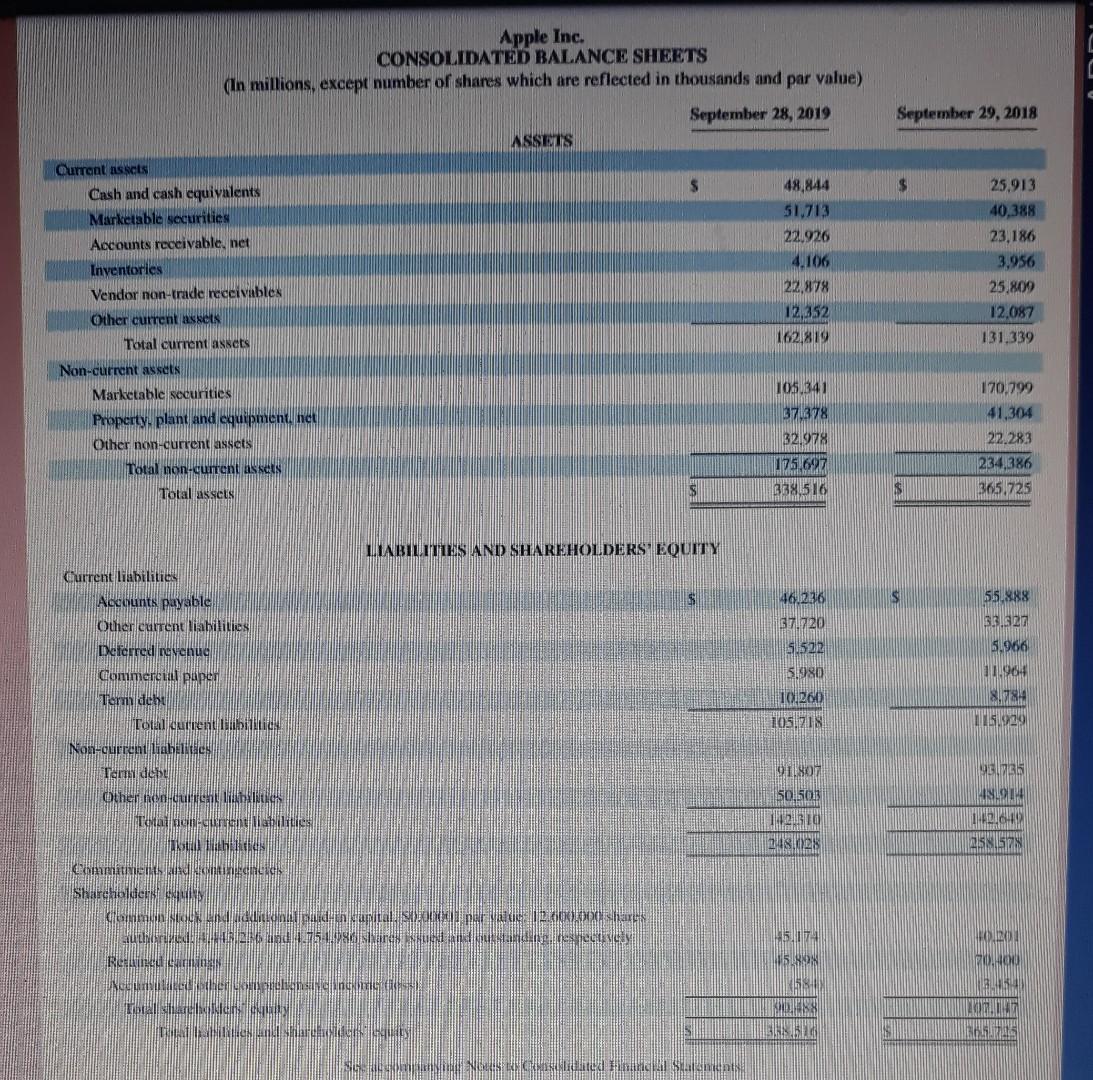

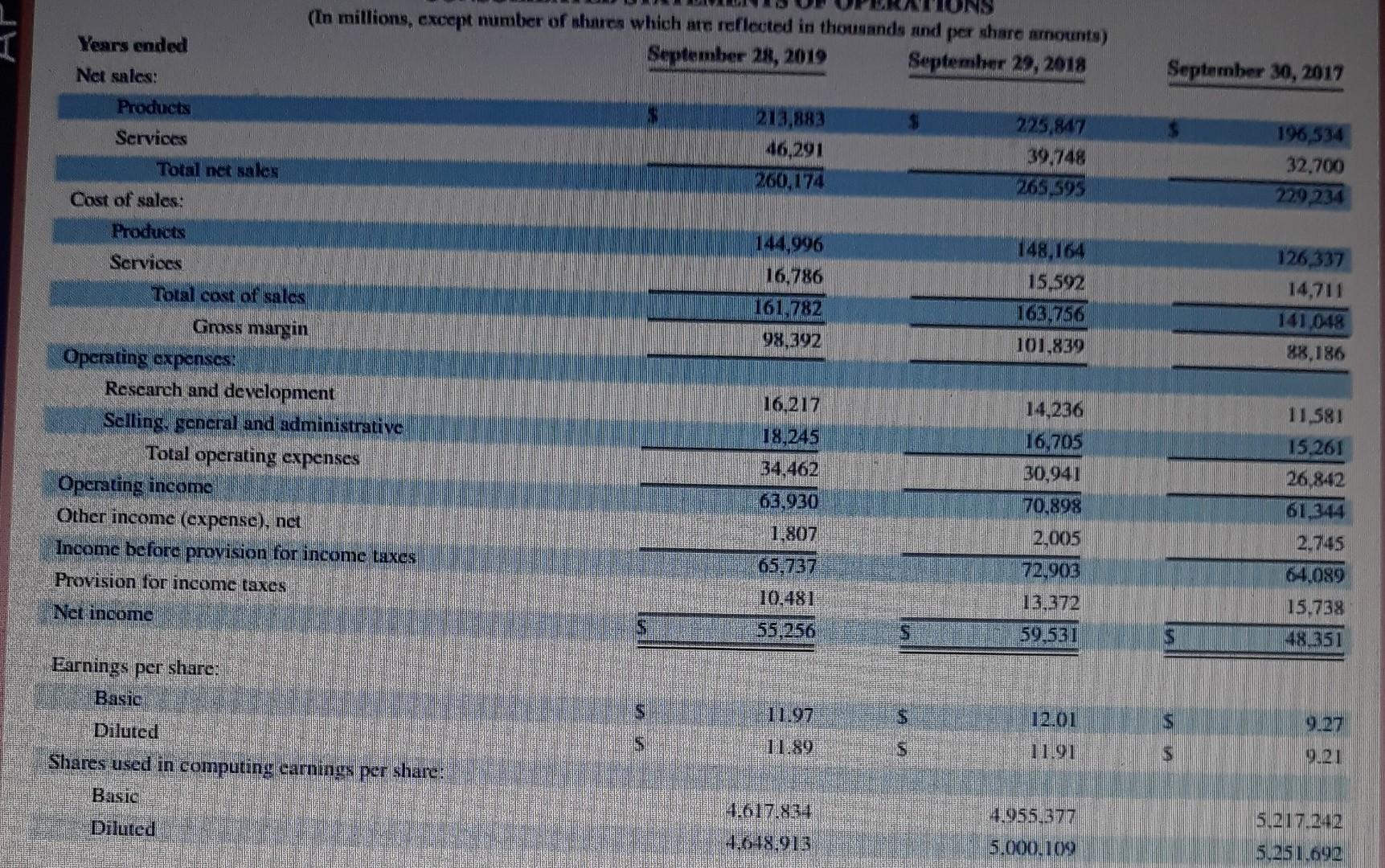

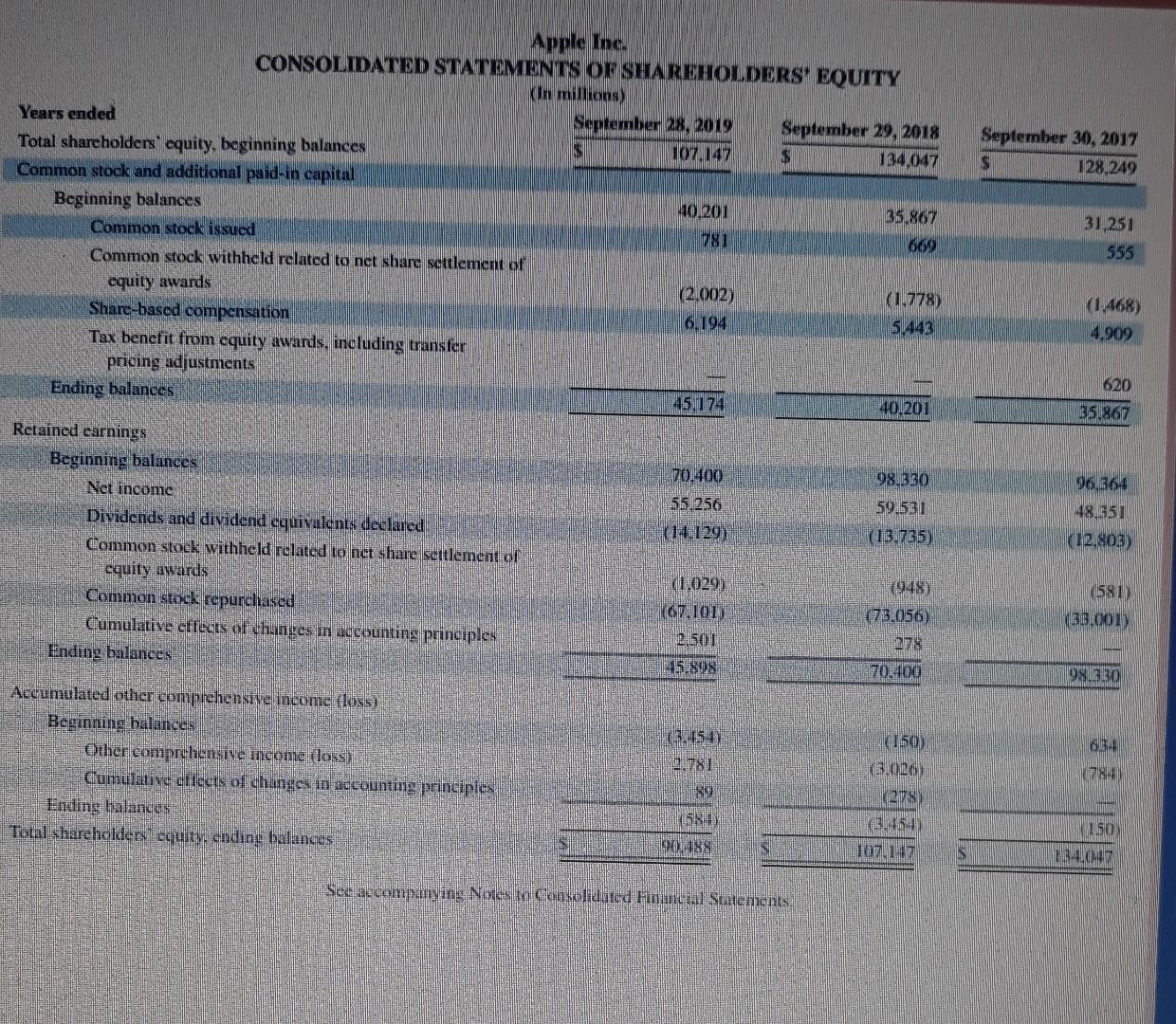

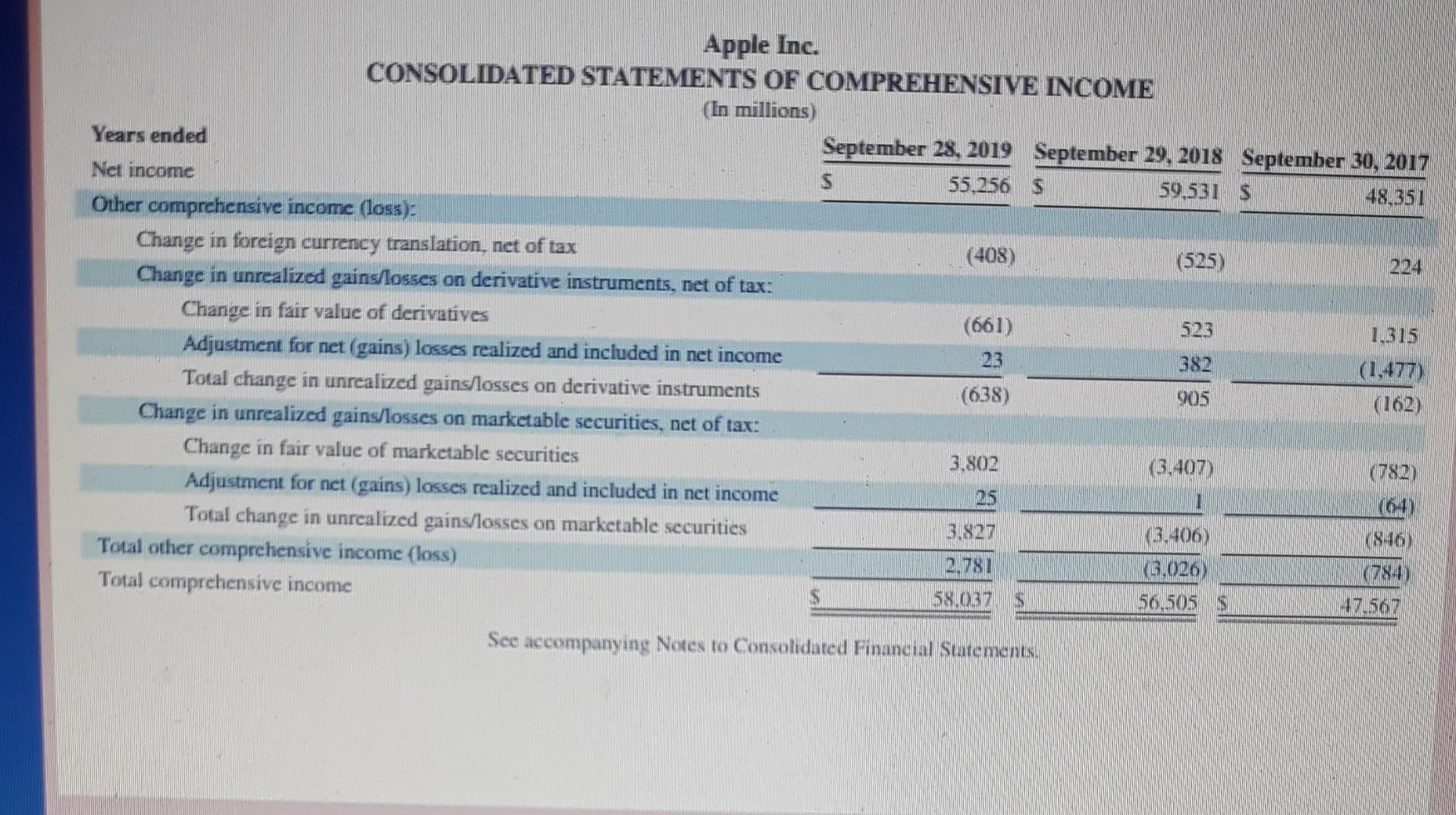

Refer to Apple's financial statements in Appendix A to answer the following. Required 1. Assume that the amounts reported for inventories and cost of sales reflect items purchased in a form ready for resale. Compute the net cost of goods purchased for the year ended September 28, 2019. 2. Compute the current ratio and acid-test ratio as of September 28, 2019, and September 29, 2018. 3. Does Apple's 2019 current ratio outperform or underperform the (assumed) industry average of 1.5 ? 4. Does Apple's 2019 acid-test ratio outperform or underperform the (assumed) industry average of 1.0 ? Complete this question by entering your answers in the tabs below. Assume that the amounts reported for inventories and cost of sales reflect items purchased in a form ready for resale. Compute the net cost of goods purchased for the year ended September 28,2019 . (Enter your answers in millions of dollars.) 1. Assume that the amounts reported for inventories and cost of sales reflect items purchased in a form ready for resale. Compute the net cost of goods purchased for the year ended September 28, 2019 2. Compute the current ratio and acid-test ratio as of September 28, 2019, and September 29, 2018. 3. Does Apple's 2019 current ratio outperform or underperform the (assumed) industry average of 1.5 ? 4. Does Apple's 2019 acid-test ratio outperform or underperform the (assumed) industry average of 1.0? Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio as of September 28, 2019, and September 29, 2018. (Enter your answers in millions of dollars.) Refer to Apple's financial statements in Appendix A to answer the following. Required 1. Assume that the amounts reported for inventories and cost of sales reflect items purchased in a form ready for resale. Compute net cost of goods purchased for the year ended September 28, 2019. 2. Compute the current ratio and acid-test ratio as of September 28, 2019, and September 29, 2018. 3. Does Apple's 2019 current ratio outperform or underperform the (assumed) industry average of 1.5? 4. Does Apple's 2019 acid-test ratio outperform or underperform the (assumed) industry average of 1.0? Complete this question by entering your answers in the tabs below. Does Apple's 2019 current ratio outperform or underperform the (assumed) industry average of 1.5? Refer to Apple's financial statements in Appendix A to answer the following. Required 1. Assume that the amounts reported for inventories and cost of sales reflect items purchased in a form ready for resale. Compute net cost of goods purchased for the year ended September 28, 2019. 2. Compute the current ratio and acid-test ratio as of September 28, 2019, and September 29, 2018. 3. Does Apple's 2019 current ratio outperform or underperform the (assumed) industry average of 1.5? 4. Does Apple's 2019 acid-test ratio outperform or underperform the (assumed) industry average of 1.0? Complete this question by entering your answers in the tabs below. Does Apple's 2019 acid-test ratio outperform or underperform the (assumed) industry average of 1.0 ? Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) I. WBILIMES AND SHAREHOLDERS' BQUMY (In millions, except number of ahures which are reflected in thousands and per share amounts) Apple Inc: CONSOLIDATED STATRMENTS OR SHAREHIOLDERS' BQUITY (in. militions) Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) Sce accompanyine Nores to Consolidated Financial Statcments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started