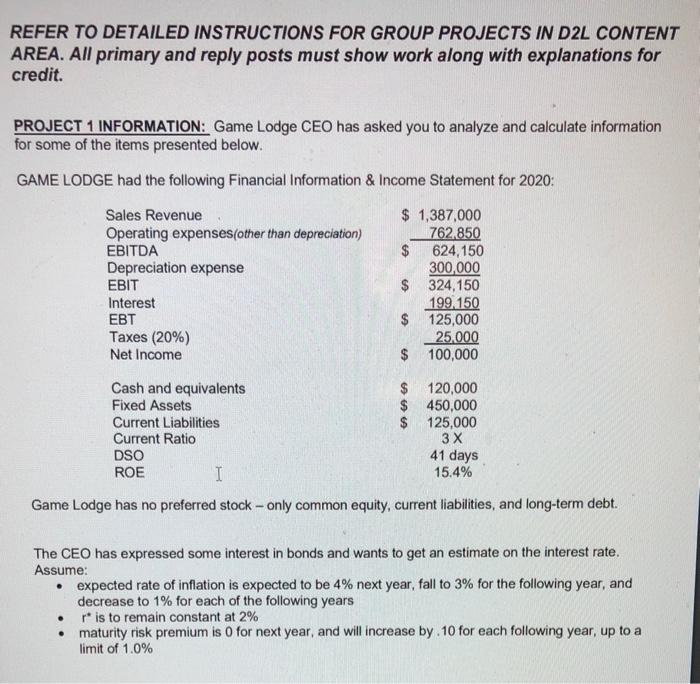

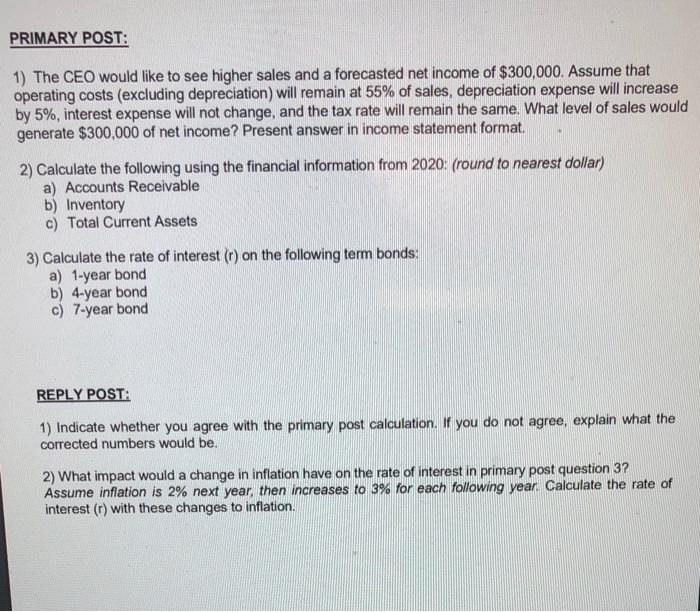

REFER TO DETAILED INSTRUCTIONS FOR GROUP PROJECTS IN D2L CONTENT AREA. All primary and reply posts must show work along with explanations for credit. PROJECT 1 INFORMATION: Game Lodge CEO has asked you to analyze and calculate information for some of the items presented below. GAME LODGE had the following Financial Information & Income Statement for 2020: Sales Revenue Operating expenses(other than depreciation) EBITDA Depreciation expense EBIT Interest EBT Taxes (20%) Net Income $ 1,387,000 762.850 $ 624,150 300,000 $ 324,150 199,150 $ 125,000 25.000 $ 100,000 Cash and equivalents Fixed Assets Current Liabilities Current Ratio DSO ROE I $ 120,000 $ 450,000 $ 125,000 3 X 41 days 15.4% Game Lodge has no preferred stock - only common equity, current liabilities, and long-term debt. The CEO has expressed some interest in bonds and wants to get an estimate on the interest rate. Assume: expected rate of inflation is expected to be 4% next year, fall to 3% for the following year, and decrease to 1% for each of the following years r* is to remain constant at 2% maturity risk premium is 0 for next year, and will increase by 10 for each following year, up to a limit of 1.0% PRIMARY POST: 1) The CEO would like to see higher sales and a forecasted net income of $300,000. Assume that operating costs (excluding depreciation) will remain at 55% of sales, depreciation expense will increase by 5%, interest expense will not change, and the tax rate will remain the same. What level of sales would generate $300,000 of net income? Present answer in income statement format. 2) Calculate the following using the financial information from 2020: (round to nearest dollar) a) Accounts Receivable b) Inventory c) Total Current Assets 3) Calculate the rate of interest (r) on the following term bonds: a) 1-year bond b) 4-year bond c) 7-year bond REPLY POST: 1) Indicate whether you agree with the primary post calculation. If you do not agree, explain what the corrected numbers would be. 2) What impact would a change in inflation have on the rate of interest in primary post question 3? Assume inflation is 2% next year, then increases to 3% for each following year. Calculate the rate of interest (r) with these changes to inflation