Question

Refer to details of rights issue of Arvind Fashions given in the image and answer the following questions : a. After studying the financials of

Refer to details of rights issue of Arvind Fashions given in the image and answer the following questions :

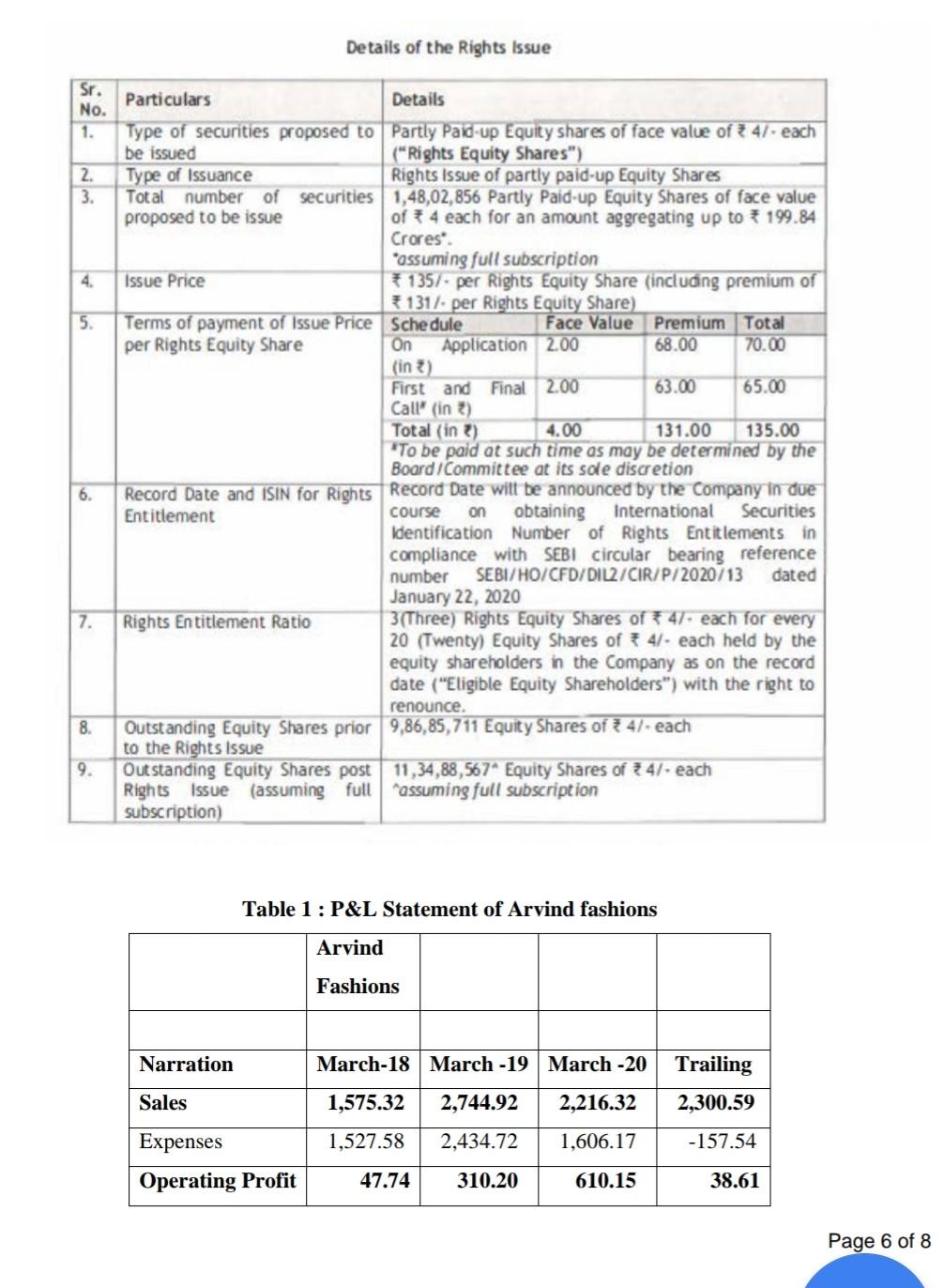

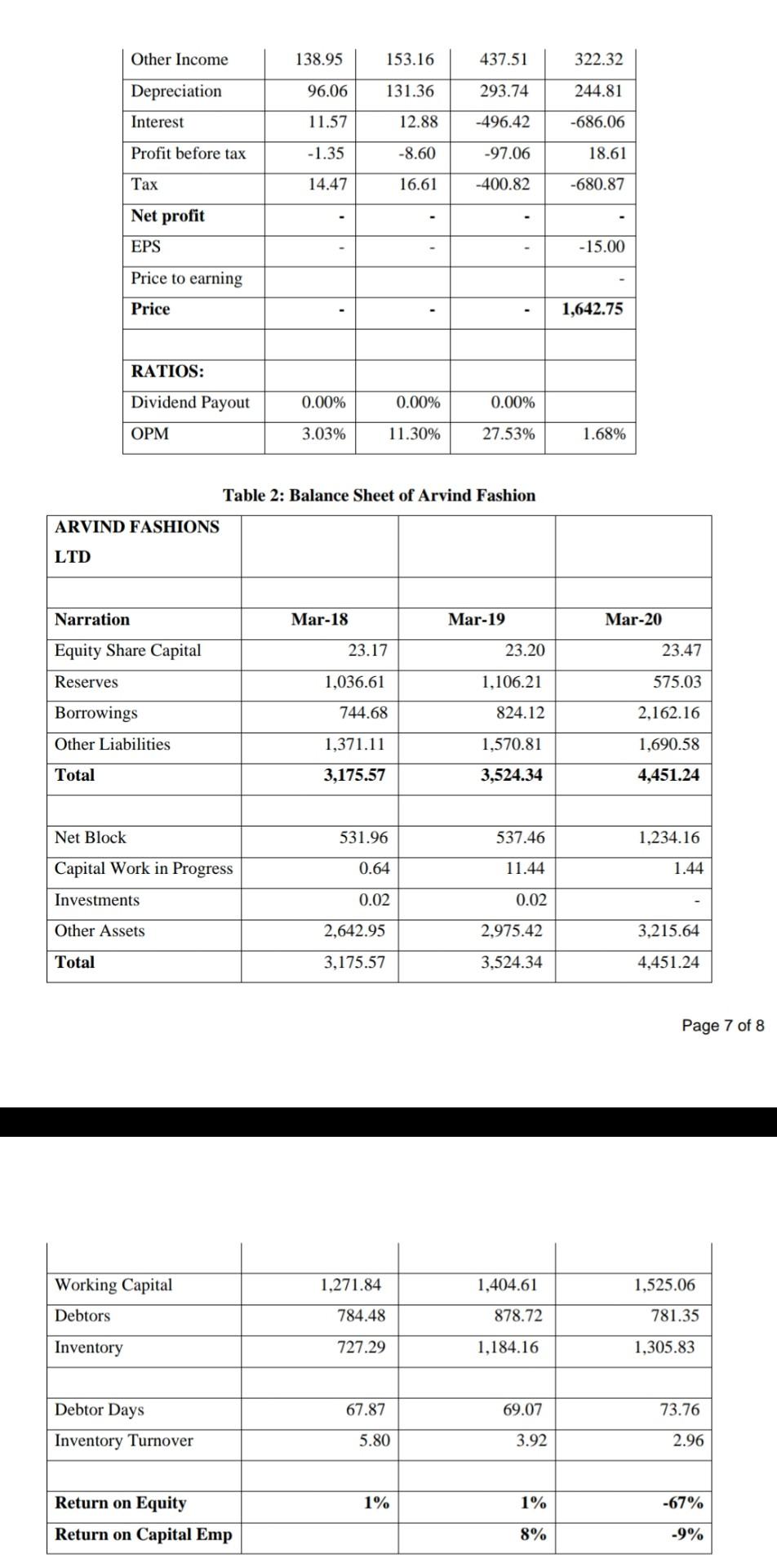

a. After studying the financials of Arvind Fashions, comment as to why the company opted for rights issue against other fund raising options ( borrowing through debt issue , additional bank borrowing , seasoned offering etc. b. As an investor in Arvind Fashions what are the options available to you wrt to the Rights Issue and how would you decide which option is optimal for you ? c. What do you expect the reaction of Arvind Fashions share price on the ex rights day ? Give reasons for your answer .

Details of the Rights Issue Sr. No. 1. 2. 3. 5. Particulars Details Type of securities proposed to Partly Paid-up Equity shares of face value of 4/. each be issued ("Rights Equity Shares") Type of Issuance Rights Issue of partly paid-up Equity Shares Total number of securities 1,48,02,856 Partly Paid-up Equity Shares of face value proposed to be issue of 4 each for an amount aggregating up to 199.84 Crores 'assuming full subscription Issue Price # 1357. per Rights Equity Share (including premium of 131/- per Rights Equity Share) Terms of payment of Issue Price Schedule Face Value Premium Total per Rights Equity Share On Application 2.00 68.00 70.00 (in) First and Final 2.00 63.00 65.00 Call" (in) Total (in) 4.00 131.00 135.00 "To be paid at such time as may be determined by the Board/Committee at its sole discretion Record Date and ISIN for Rights Record Date will be announced by the Company in due Entitlement course on obtaining International Securities Identification Number of Rights Entitlements in compliance with SEBI circular bearing reference number SEBI/HO/CFD/DIL2/CIR/P/2020/13 dated January 22, 2020 Rights Entitlement Ratio 3(Three) Rights Equity Shares of 47. each for every 20 (Twenty) Equity Shares of * 47. each held by the equity shareholders in the Company as on the record date ("Eligible Equity Shareholders") with the right to renounce Outstanding Equity Shares prior 9,86,85,711 Equity Shares of 47. each to the Rights Issue Outstanding Equity Shares post 11,34,88,567" Equity Shares of 41- each Rights Issue (assuming full "assuming full subscription subscription) 6. 7. 8. 9. Table 1 : P&L Statement of Arvind fashions Arvind Fashions Narration March-18 March -19 March -20 Trailing Sales 1,575.32 2,744.92 2,216.32 2,300.59 1,527.58 2,434.72 1,606.17 -157.54 Expenses Operating Profit 47.74 310.20 610.15 38.61 Page 6 of 8 Other Income 138.95 153.16 437.51 322.32 96.06 131.36 293.74 244.81 Depreciation Interest 11.57 12.88 -496.42 -686.06 Profit before tax -1.35 -8.60 -97.06 18.61 14.47 16.61 -400.82 -680.87 Tax Net profit EPS -15.00 Price to earning Price 1,642.75 RATIOS: Dividend Payout 0.00% 0.00% 0.00% OPM 3.03% 11.30% 27.53% 1.68% Table 2: Balance Sheet of Arvind Fashion ARVIND FASHIONS LTD Narration Mar-18 Mar-19 Mar-20 Equity Share Capital 23.17 23.20 23.47 Reserves 1,036.61 1,106.21 575.03 Borrowings 744.68 824.12 2,162.16 Other Liabilities 1,371.11 1,570.81 1,690.58 Total 3,175.57 3,524.34 4,451.24 Net Block 531.96 537.46 1,234.16 Capital Work in Progress 0.64 11.44 1.44 Investments 0.02 0.02 Other Assets 2,642.95 2.975.42 3,215.64 Total 3,175.57 3.524.34 4.451.24 Page 7 of 8 Working Capital 1,271.84 1,404.61 1,525.06 Debtors 784.48 878.72 781.35 Inventory 727.29 1,184.16 1,305.83 Debtor Days 67.87 69.07 73.76 Inventory Turnover 5.80 3.92 2.96 1% 1% -67% Return on Equity Return on Capital Emp 8% -9% Details of the Rights Issue Sr. No. 1. 2. 3. 5. Particulars Details Type of securities proposed to Partly Paid-up Equity shares of face value of 4/. each be issued ("Rights Equity Shares") Type of Issuance Rights Issue of partly paid-up Equity Shares Total number of securities 1,48,02,856 Partly Paid-up Equity Shares of face value proposed to be issue of 4 each for an amount aggregating up to 199.84 Crores 'assuming full subscription Issue Price # 1357. per Rights Equity Share (including premium of 131/- per Rights Equity Share) Terms of payment of Issue Price Schedule Face Value Premium Total per Rights Equity Share On Application 2.00 68.00 70.00 (in) First and Final 2.00 63.00 65.00 Call" (in) Total (in) 4.00 131.00 135.00 "To be paid at such time as may be determined by the Board/Committee at its sole discretion Record Date and ISIN for Rights Record Date will be announced by the Company in due Entitlement course on obtaining International Securities Identification Number of Rights Entitlements in compliance with SEBI circular bearing reference number SEBI/HO/CFD/DIL2/CIR/P/2020/13 dated January 22, 2020 Rights Entitlement Ratio 3(Three) Rights Equity Shares of 47. each for every 20 (Twenty) Equity Shares of * 47. each held by the equity shareholders in the Company as on the record date ("Eligible Equity Shareholders") with the right to renounce Outstanding Equity Shares prior 9,86,85,711 Equity Shares of 47. each to the Rights Issue Outstanding Equity Shares post 11,34,88,567" Equity Shares of 41- each Rights Issue (assuming full "assuming full subscription subscription) 6. 7. 8. 9. Table 1 : P&L Statement of Arvind fashions Arvind Fashions Narration March-18 March -19 March -20 Trailing Sales 1,575.32 2,744.92 2,216.32 2,300.59 1,527.58 2,434.72 1,606.17 -157.54 Expenses Operating Profit 47.74 310.20 610.15 38.61 Page 6 of 8 Other Income 138.95 153.16 437.51 322.32 96.06 131.36 293.74 244.81 Depreciation Interest 11.57 12.88 -496.42 -686.06 Profit before tax -1.35 -8.60 -97.06 18.61 14.47 16.61 -400.82 -680.87 Tax Net profit EPS -15.00 Price to earning Price 1,642.75 RATIOS: Dividend Payout 0.00% 0.00% 0.00% OPM 3.03% 11.30% 27.53% 1.68% Table 2: Balance Sheet of Arvind Fashion ARVIND FASHIONS LTD Narration Mar-18 Mar-19 Mar-20 Equity Share Capital 23.17 23.20 23.47 Reserves 1,036.61 1,106.21 575.03 Borrowings 744.68 824.12 2,162.16 Other Liabilities 1,371.11 1,570.81 1,690.58 Total 3,175.57 3,524.34 4,451.24 Net Block 531.96 537.46 1,234.16 Capital Work in Progress 0.64 11.44 1.44 Investments 0.02 0.02 Other Assets 2,642.95 2.975.42 3,215.64 Total 3,175.57 3.524.34 4.451.24 Page 7 of 8 Working Capital 1,271.84 1,404.61 1,525.06 Debtors 784.48 878.72 781.35 Inventory 727.29 1,184.16 1,305.83 Debtor Days 67.87 69.07 73.76 Inventory Turnover 5.80 3.92 2.96 1% 1% -67% Return on Equity Return on Capital Emp 8% -9%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started