Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to Example 42 in text Section 18-5f. Albert owns 100% of A Corporation, Betty is the sole proprietor of B Company, and Cai

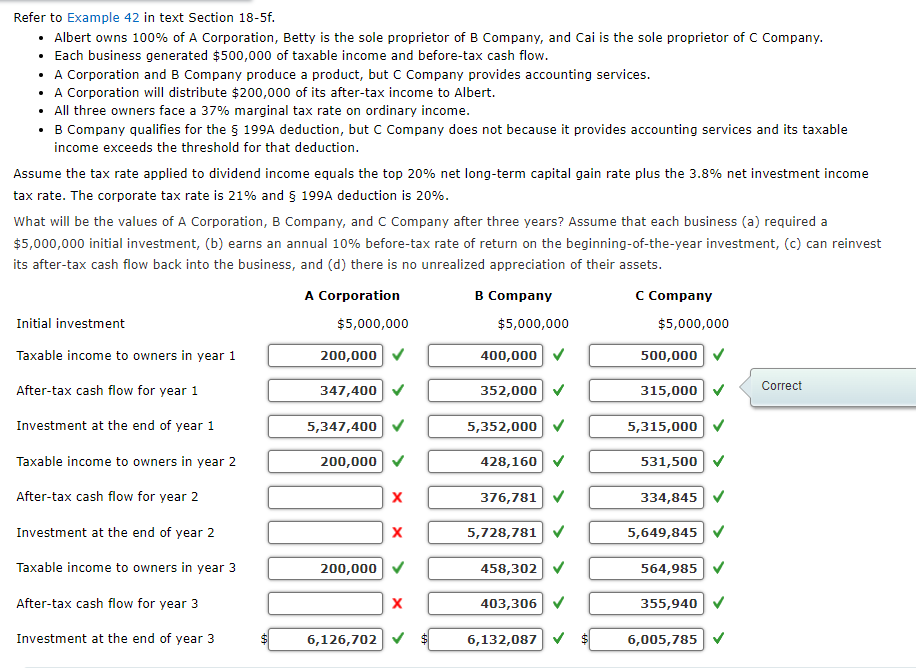

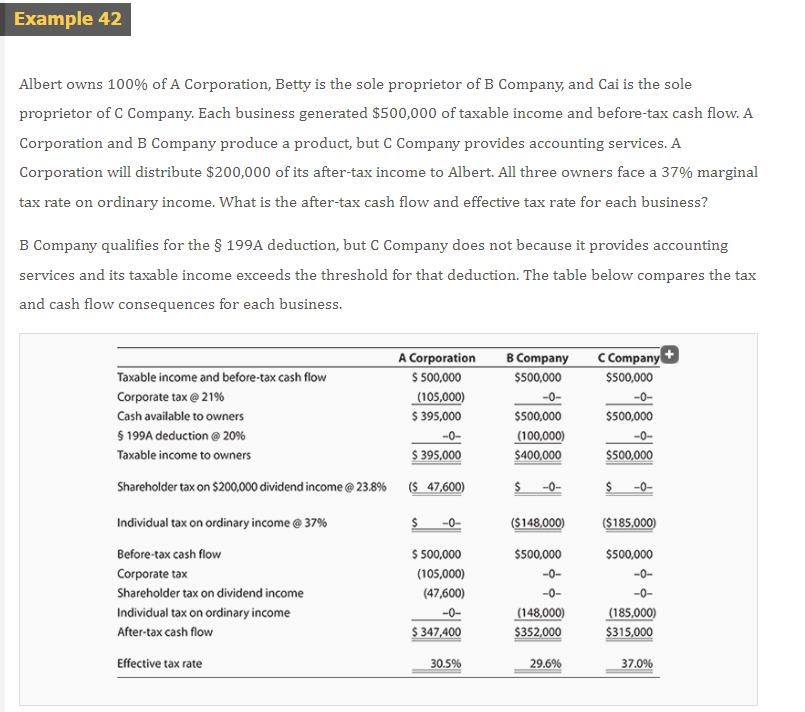

Refer to Example 42 in text Section 18-5f. Albert owns 100% of A Corporation, Betty is the sole proprietor of B Company, and Cai is the sole proprietor of C Company. Each business generated $500,000 of taxable income and before-tax cash flow. A Corporation and B Company produce a product, but C Company provides accounting services. A Corporation will distribute $200,000 of its after-tax income to Albert. All three owners face a 37% marginal tax rate on ordinary income. B Company qualifies for the 199A deduction, but C Company does not because it provides accounting services and its taxable income exceeds the threshold for that deduction. Assume the tax rate applied to dividend income equals the top 20% net long-term capital gain rate plus the 3.8% net investment income tax rate. The corporate tax rate is 21% and 199A deduction is 20%. What will be the values of A Corporation, B Company, and C Company after three years? Assume that each business (a) required a $5,000,000 initial investment, (b) earns an annual 10% before-tax rate of return on the beginning-of-the-year investment, (c) can reinvest its after-tax cash flow back into the business, and (d) there is no unrealized appreciation of their assets. A Corporation B Company C Company Initial investment $5,000,000 $5,000,000 $5,000,000 Taxable income to owners in year 1 After-tax cash flow for year 1 200,000 400,000 500,000 347,400 352,000 315,000 Correct Investment at the end of year 1 5,347,400 5,352,000 5,315,000 Taxable income to owners in year 2 200,000 428,160 531,500 After-tax cash flow for year 2 x 376,781 334,845 Investment at the end of year 2 x 5,728,781 5,649,845 Taxable income to owners in year 3 200,000 458,302 564,985 After-tax cash flow for year 3 403,306 355,940 Investment at the end of year 3 6,126,702 6,132,087 6,005,785 Example 42 Albert owns 100% of A Corporation, Betty is the sole proprietor of B Company, and Cai is the sole proprietor of C Company. Each business generated $500,000 of taxable income and before-tax cash flow. A Corporation and B Company produce a product, but C Company provides accounting services. A Corporation will distribute $200,000 of its after-tax income to Albert. All three owners face a 37% marginal tax rate on ordinary income. What is the after-tax cash flow and effective tax rate for each business? B Company qualifies for the 199A deduction, but C Company does not because it provides accounting services and its taxable income exceeds the threshold for that deduction. The table below compares the tax and cash flow consequences for each business. Taxable income and before-tax cash flow A Corporation $500,000 B Company $500,000 C Company+ $500,000 Corporate tax @ 21% (105,000) -0- Cash available to owners $395,000 $500,000 -0- $500,000 $ 199A deduction @ 20% -0- (100,000) -0- Taxable income to owners $395,000 $400,000 $500,000 Shareholder tax on $200,000 dividend income @ 23.8% ($ 47,600) $ -0- $ -0- Individual tax on ordinary income @ 37% -0- ($148,000) ($185,000) Before-tax cash flow Corporate tax $ 500,000 (105,000) $500,000 -0- $500,000 -0- (47,600) Shareholder tax on dividend income Individual tax on ordinary income After-tax cash flow Effective tax rate -0- $ 347,400 (148,000) $352,000 (185,000) $315,000 30.5% 29.6% 37.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started