Answered step by step

Verified Expert Solution

Question

1 Approved Answer

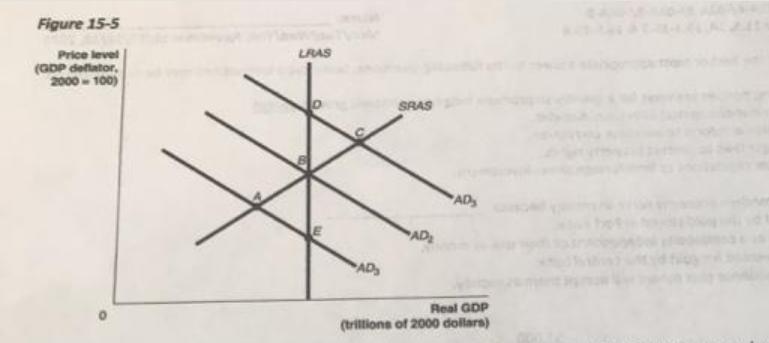

Refer to Figure 15-5. Suppose the economy is in short-run equilibrium above potential GDP, the unemployment rate is very low, and wages and prices

Refer to Figure 15-5. Suppose the economy is in short-run equilibrium above potential GDP, the unemployment rate is very low, and wages and prices are rising. Using the static AD-AS model in the figure above, the correct Fed monetary policy for this (Hint: What would return the economy to long-run equilibrium?) situation would be depicted as a movement from A. C to D. B. A to E. C. B to C D. A to B. E. C to 8. 9.) The Taylor rule helps explain the relationship between the Fed's, A. money supply target; economic conditions B. money supply target; the federal funds target C. federal funds target; the monetary growth rule D. federal funds target; economic conditions and 10.) While many analysts defended the actions taken by the Fed and the Treasury to respond to the financial crisis in 2008, others were critical of these actions. The critics were concerned that by not allowing large firms to fail A. smaller firms will resent not receiving similar assistance. B. stockholders and bondholders of these firms were not allowed to receive the proceeds from the sale of assets that would have occurred if the firms had declared bankruptcy. C. there is an increased likelihood that other firms will engage in risky behavior in the future with the expectation that they will also not be allowed to fail. D. there will be less competition in the U.S. economy, which could led to higher prices for consumers. Figure 15-5 Price level (GDP deflator, 2000-100) LRAS AD SAAS AD AD Real GDP (trillions of 2000 dollars)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the concepts from macroeconomics here are the answers For the first question since the econ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started