Question

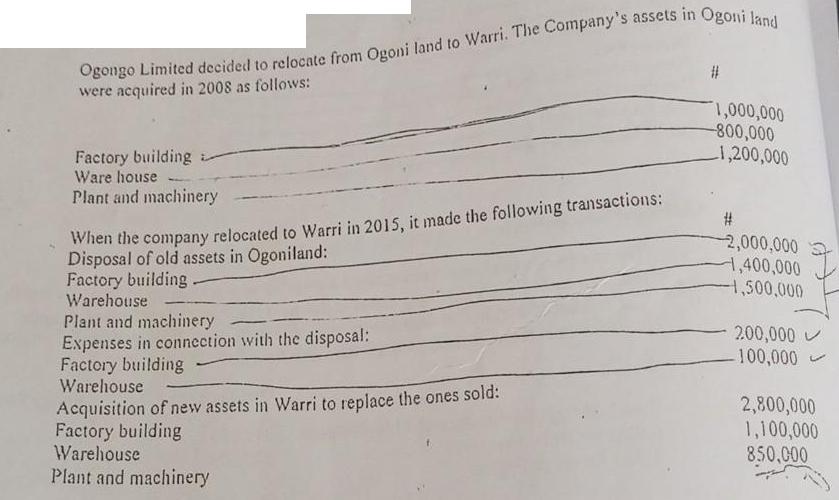

Ogongo Limited decided to relocate from Ogoni land to Warri. The Company's assets in Ogoni land were acquired in 2008 as follows: Factory building

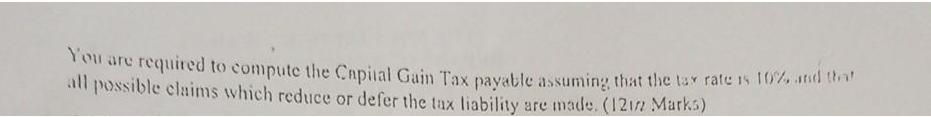

Ogongo Limited decided to relocate from Ogoni land to Warri. The Company's assets in Ogoni land were acquired in 2008 as follows: Factory building Ware house Plant and machinery When the company relocated to Warri in 2015, it made the following transactions: Disposal of old assets in Ogoniland: Factory building - Warehouse Plant and machinery Expenses in connection with the disposal: Factory building Warehouse Acquisition of new assets in Warri to replace the ones sold: Factory building Warehouse Plant and machinery # 1,000,000 -800,000 1,200,000 # -2,000,000 1,400,000 1,500,000 200,000 -100,000 3 2,800,000 1,100,000 850,000 You are required to compute the Capital Gain Tax payable assuming that the tax rate is 10% and that all possible claims which reduce or defer the tax liability are made. (121/72 Marks)

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting with IFRS Fold Out Primer

Authors: John Wild

5th edition

978-0077408770, 77408772, 978-0077413804

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App