Answered step by step

Verified Expert Solution

Question

1 Approved Answer

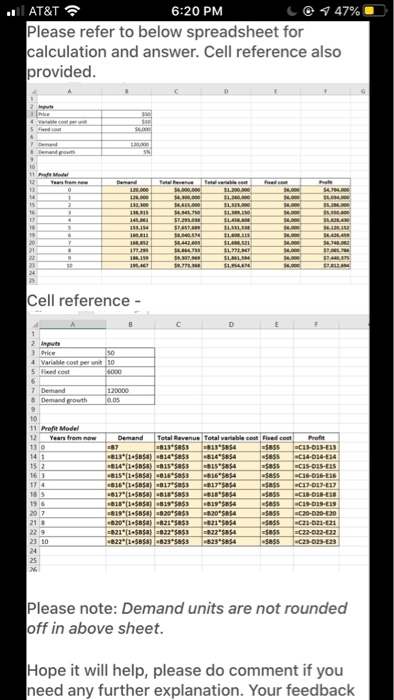

refer to sheet model 2. perform a profit projection for the next 10 years. what is the profit in year 3 and year 10? Format:

refer to sheet "model 2". perform a profit projection for the next 10 years. what is the profit in year 3 and year 10? Format: $1,000

(sheet two is the first picture and sheet one is the second)

the answer is not provided, sheet one is needed to complete sheet two

Numbers File Edit InsertTable Format Arrange Vw Share Window Help 43% Wed 6:20 T Text Chart She et Model 2 Background: Given the information in model 1, now add a new contraint to the model: the company is able to produce up to 160,000 units per year. Perform a profit projection again for the next 10 years Demand growth Demand Units produced Total Revenue Totalwariable cost e d cost Profit .AT&T 6:20 PM C@ 47% Please refer to below spreadsheet for calculation and answer. Cell reference also provided. Cell reference - 8131 814583 145854 1000053 354 BIS 11.osa 03 8 1695854 11.03 81753-185853 (1 ) 6190$ -CIRIHIN 14-01-14 CI-O11-15 -C1-01-036 -C12-01- - - CI-O19- C-00-00 20-02-02 -C22-02-22 201 821833 Please note: Demand units are not rounded off in above sheet. Hope it will help, please do comment if you need any further explanation. Your feedback Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started