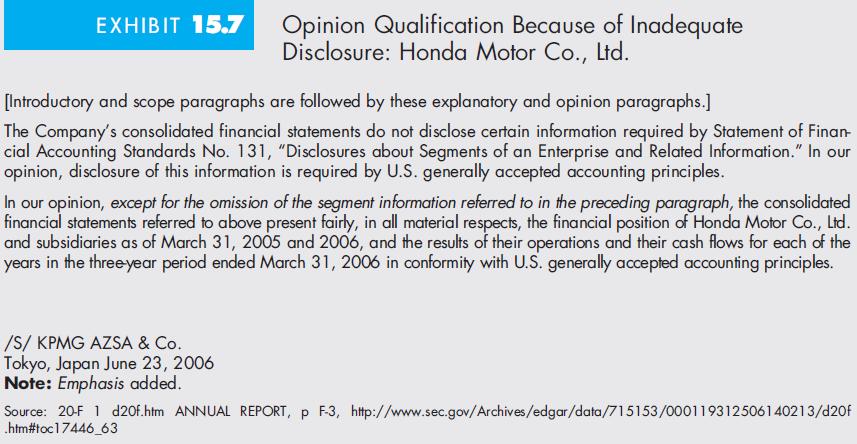

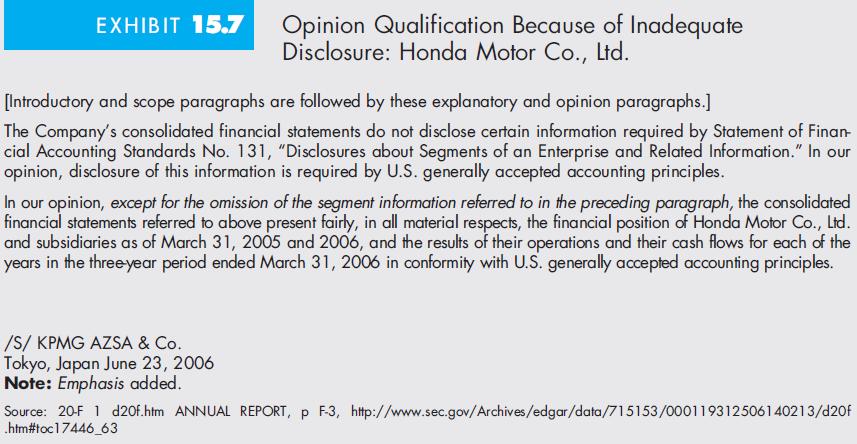

Refer to textbook chapter 15 section titled Qualified Reports, Adverse Reports, and Disclaimers and Exhibit 15.7. You may benefit from referring to AU-C 705. When an auditor issues a qualified opinion, the different bases for the qualification are many. Among auditors there are some who assume that any qualified opinion is qualified because of a material misstatement. This is incorrect. AU-C 450 provides a definition as follows and that is repeated in AU-C 705: a misstatement as a difference between the amount, classification, presentation, or disclosure of a reported financial statement item and the amount, classification, presentation, or disclosure that is required for the item to be presented fairly in accordance with the applicable financial reporting framework.

Exhibit 15.7 illustrates the Honda Motor Company’s qualified audit reports for 2006 and 2006. Select the item or items that most accurately describes the basis for the Honda qualification.

Exhibit 15.7 illustrates the Honda Motor Company’s qualified audit reports for 2006 and 2006. Select the item or items that most accurately describes the basis for the Honda qualification.

| a. Adverse opinion due to a material misstatement of the financial statements | |

|

| b. Qualified opinion due to auditor's inability to obtain sufficient appropriate audit evidence | |

|

| c. Qualified opinion due to a material misstatement of the financial statements | |

|

| d. Unmodified opinion in the current year and a disclaimer of opinion on the prior-year statements of income, changes in stockholders' equity, and cash flows | |

|

| e. Disclaimer of opinion due to the auditor's inability to obtain sufficient appropriate audit evidence about multiple elements of the financial statements | |

|

| f. Qualified opinion due to inadequate disclosure | |

|

| g. Disclaimer of opinion due to the auditor's inability to obtain sufficient appropriate audit evidence about a single element of the financial statements | |

|

| h. Unmodified opinion in the prior year and a qualified opinion in the current year

|

|

Exhibit 15.7 illustrates the Honda Motor Company’s qualified audit reports for 2006 and 2006. Select the item or items that most accurately describes the basis for the Honda qualification.

Exhibit 15.7 illustrates the Honda Motor Company’s qualified audit reports for 2006 and 2006. Select the item or items that most accurately describes the basis for the Honda qualification.