Question

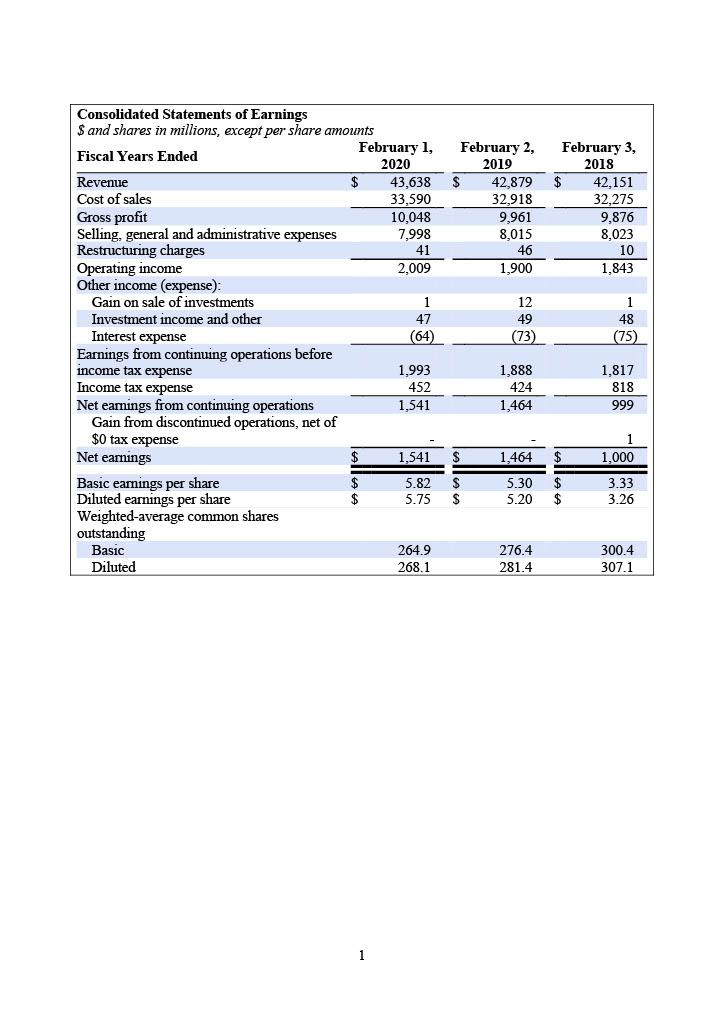

Refer to the 2028 Notes in the long-term debt footnote. 25. Calculate the interest expense on this note for fiscal year 2025 . 26. Calculate

Refer to the 2028 Notes in the long-term debt footnote.

25. Calculate the interest expense on this note for fiscal year 2025.

26. Calculate the total amount of cash payment at maturity date.

27.What is the amount of additions to property and equipment account during fiscal year 2020 (Please note that some PPE is not paid with cash)?

28. Best Buy has disposed of some property and equipment during fiscal year 2020. Assume that there has been no impairment over the year. What is the original acquisition cost of the property and equipment disposed of during the fiscal year 2020?

29 What is the accumulated depreciation of the disposed property, plant and equipment in fiscal year 2020?

30. What is the gain/loss from disposal of property, plant and equipment in fiscal year 2020 if the sale price of the disposed assets is $200 (millions)?

31. If the Company recognized $100 (millions) more depreciation expense than currently recorded, how would the cash flows from operations change?

32 What is the par value of each common share?

33. What is the number of retired common shares during fiscal year 2020?

34. What is the average price per share it costed Best Buy repurchase and retire common shares during fiscal year 2020 (Please note that some stock retirements are not paid with cash)?

35. What is the revenue recognized from gift cards during fiscal year 2020 if Best Buy collected $50 (millions) in fiscal year 2020 from new gift card sales?

Full Chart on link below.

https://www.chegg.com/homework-help/questions-and-answers/please-consider-excerpts-best-buy-annual-report-pdf-fiscal-year-2020-e-fiscal-year-ended-f-q69866108

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started