Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to The Appraisal Journal (Summer 2019) Recall that the ratio of net study of the valuation of single-tenant properties, operating income to property

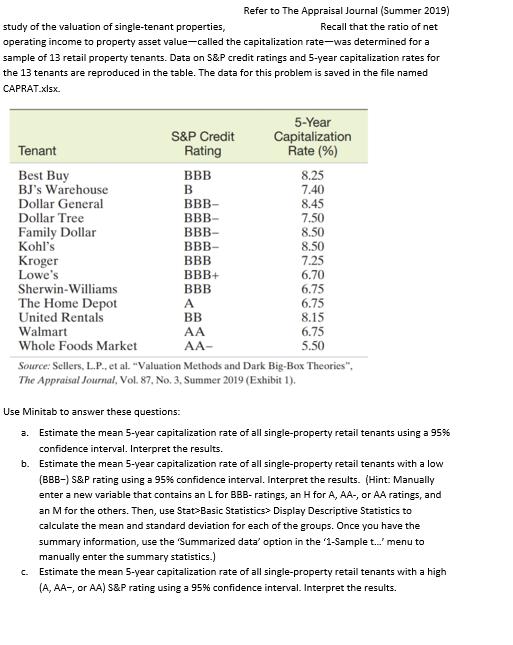

Refer to The Appraisal Journal (Summer 2019) Recall that the ratio of net study of the valuation of single-tenant properties, operating income to property asset value-called the capitalization rate-was determined for a sample of 13 retail property tenants. Data on S&P credit ratings and 5-year capitalization rates for the 13 tenants are reproduced in the table. The data for this problem is saved in the file named CAPRAT.xlsx. Tenant Best Buy BJ's Warehouse Dollar General Dollar Tree Family Dollar Kohl's Kroger Lowe's Sherwin-Williams The Home Depot United Rentals Walmart Whole Foods Market S&P Credit Rating BBB B BBB- BBB- BBB- BBB- BBB BBB+ BBB A BB AA AA- b. 5-Year Capitalization Rate (%) 8.25 7.40 8.45 7.50 8.50 8.50 7.25 6.70 6.75 6.75 8.15 6.75 5.50 Source: Sellers, L.P., et al. "Valuation Methods and Dark Big-Box Theories", The Appraisal Journal, Vol. 87, No. 3, Summer 2019 (Exhibit 1). Use Minitab to answer these questions: a. Estimate the mean 5-year capitalization rate of all single-property retail tenants using a 95% confidence interval. Interpret the results. Estimate the mean 5-year capitalization rate of all single-property retail tenants with a low (BBB-) S&P rating using a 95% confidence interval. Interpret the results. (Hint: Manually enter a new variable that contains an L for BBB- ratings, an H for A, AA-, or AA ratings, and an M for the others. Then, use Stat>Basic Statistics> Display Descriptive Statistics to calculate the mean and standard deviation for each of the groups. Once you have the summary information, use the 'Summarized data' option in the '1-Sample t... menu to manually enter the summary statistics.) c. Estimate the mean 5-year capitalization rate of all single-property retail tenants with a high (A, AA-, or AA) S&P rating using a 95% confidence interval. Interpret the results.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Mean X Xi n Median 8105 11 The Mean is 7...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started