Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to the attached financial statements for XYZ Inc. The company is forecasting a 15% increase in sales for year 2. a. If the firm

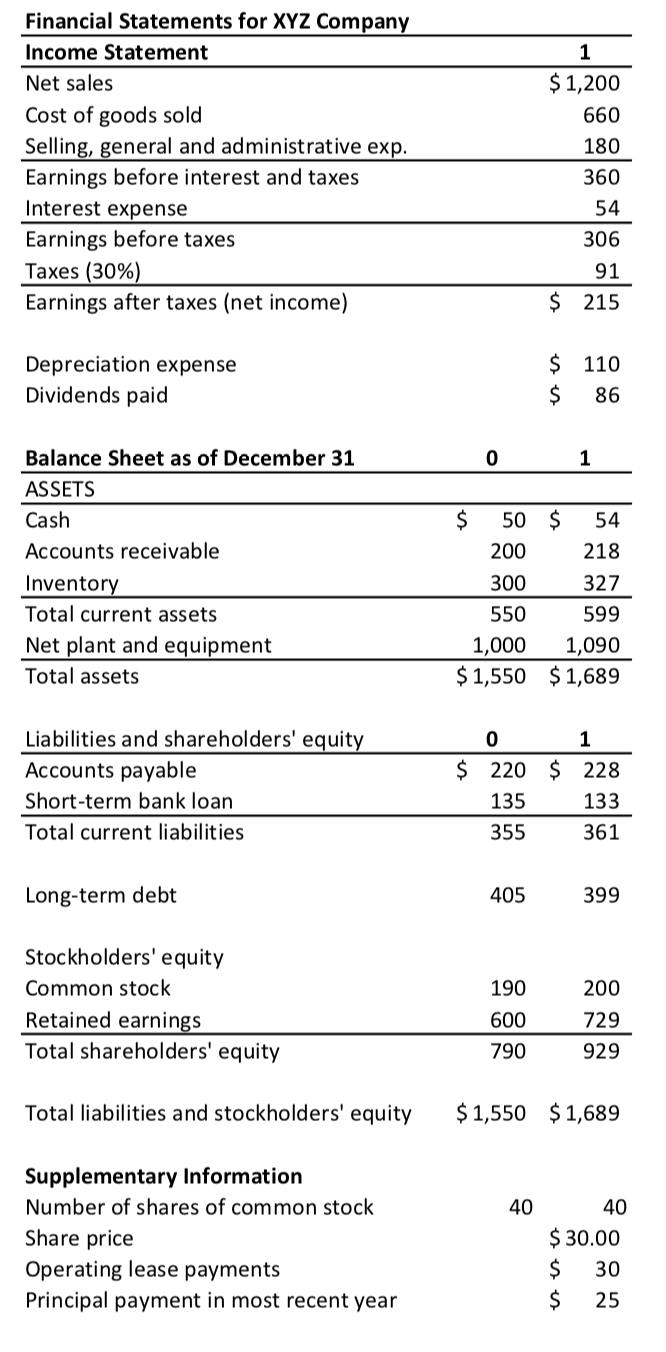

Refer to the attached financial statements for XYZ Inc. The company is forecasting a 15% increase in sales for year 2.

a. If the firm is at 100% capacity, calculate the additional funds (financing) needed (AFN). (8)

b. If the firm's net plant and equipment were at 90% capacity, calculate AFN. Explain. (8)

b. If the firm's net plant and equipment were at 90% capacity, calculate AFN. Explain. (8)

c. Suppose the Company does not want to use any external financing (interest-bearing debt or common stock). Discuss the alternatives available to the Company.

Financial Statements for XYZ Company Income Statement Net sales Cost of goods sold Selling, general and administrative exp. Earnings before interest and taxes Interest expense Earnings before taxes Taxes (30%) Earnings after taxes (net income) $ 1,200 660 180 360 54 306 91 $ 215 Depreciation expense Dividends paid $ $ 110 86 0 1 Balance Sheet as of December 31 ASSETS Cash Accounts receivable Inventory Total current assets Net plant and equipment Total assets $ 50 $ 54 200 218 300 327 550 1,000 1,090 $1,550 $1,689 599 Liabilities and shareholders' equity Accounts payable Short-term bank loan Total current liabilities 0 $ 220 135 355 1 $ 228 133 361 Long-term debt 405 399 190 Stockholders' equity Common stock Retained earnings Total shareholders' equity 600 200 729 929 790 Total liabilities and stockholders' equity $1,550 $ 1,689 40 Supplementary Information Number of shares of common stock Share price Operating lease payments Principal payment in most recent year 40 $ 30.00 $ 30 $ 25 Financial Statements for XYZ Company Income Statement Net sales Cost of goods sold Selling, general and administrative exp. Earnings before interest and taxes Interest expense Earnings before taxes Taxes (30%) Earnings after taxes (net income) $ 1,200 660 180 360 54 306 91 $ 215 Depreciation expense Dividends paid $ $ 110 86 0 1 Balance Sheet as of December 31 ASSETS Cash Accounts receivable Inventory Total current assets Net plant and equipment Total assets $ 50 $ 54 200 218 300 327 550 1,000 1,090 $1,550 $1,689 599 Liabilities and shareholders' equity Accounts payable Short-term bank loan Total current liabilities 0 $ 220 135 355 1 $ 228 133 361 Long-term debt 405 399 190 Stockholders' equity Common stock Retained earnings Total shareholders' equity 600 200 729 929 790 Total liabilities and stockholders' equity $1,550 $ 1,689 40 Supplementary Information Number of shares of common stock Share price Operating lease payments Principal payment in most recent year 40 $ 30.00 $ 30 $ 25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started