Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Computing Installment Payment on Note Payable On January 1, 2020, a borrower signed a long-term note, face amount $30,000 with time to maturity of

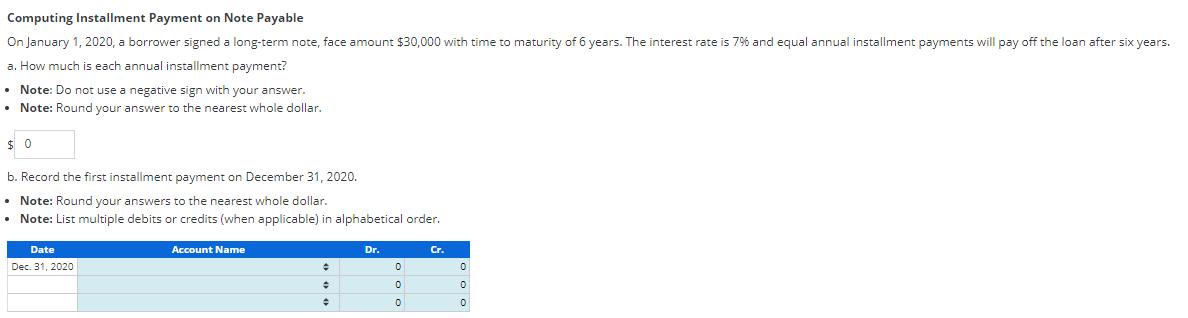

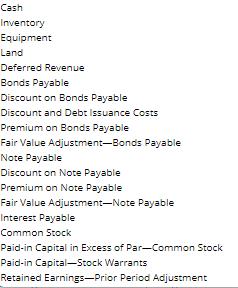

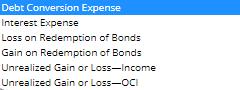

Computing Installment Payment on Note Payable On January 1, 2020, a borrower signed a long-term note, face amount $30,000 with time to maturity of 6 years. The interest rate is 7% and equal annual installment payments will pay off the loan after six years. a. How much is each annual installment payment? Note: Do not use a negative sign with your answer. Note: Round your answer to the nearest whole dollar. $0 b. Record the first installment payment on December 31, 2020. Note: Round your answers to the nearest whole dollar. Note: List multiple debits or credits (when applicable) in alphabetical order. Date Dec. 31, 2020 Account Name + Dr. 0 0 0 Cr. 0 0 0 Cash Inventory Equipment Land Deferred Revenue Bonds Payable Discount on Bonds Payable Discount and Debt Issuance Costs Premium on Bonds Payable Fair Value Adjustment-Bonds Payable Note Payable Discount on Note Payable Premium on Note Payable Fair Value Adjustment-Note Payable Interest Payable Common Stock Paid-in Capital in Excess of Par-Common Stock Paid-in Capital-Stock Warrants Retained Earnings-Prior Period Adjustment Debt Conversion Expense Interest Expense Loss on Redemption of Bonds Gain on Redemption of Bonds Loss-Income Unrealized Gain or Unrealized Gain or Loss-OCI

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a annual installment payment value of note present value annuity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started