Answered step by step

Verified Expert Solution

Question

1 Approved Answer

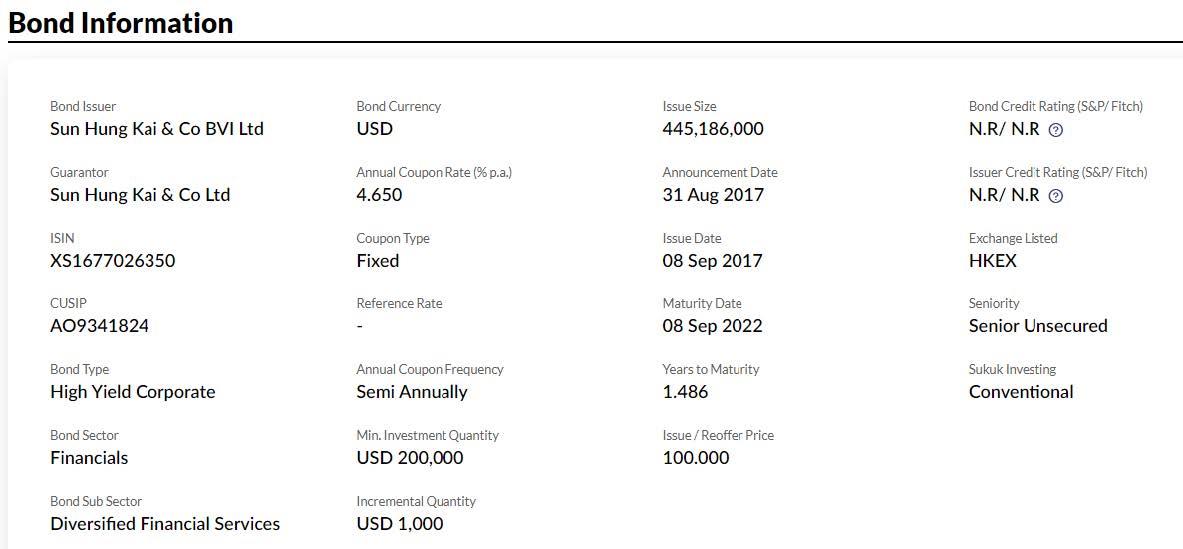

Refer to the bond information below, answer the following questions: i) What is a High Yield Corporate Bond? ii) How does a guarantor differ from

Refer to the bond information below, answer the following questions:

i) What is a High Yield Corporate Bond?

ii) How does a guarantor differ from an issuer?

iii) Assuming today is 08 Sep 2021 and the bond price is 99.000, calculate the bond's yield to maturity. Show the financial calculator input and your calculation steps.

Bond Information Bond Issuer Sun Hung Kai & Co BVI Ltd Guarantor Sun Hung Kai & Co Ltd ISIN XS1677026350 CUSIP AO9341824 Bond Type High Yield Corporate Bond Sector Financials Bond Sub Sector Diversified Financial Services Bond Currency USD Annual Coupon Rate (% p.a.) 4.650 Coupon Type Fixed Reference Rate Annual Coupon Frequency Semi Annually Min. Investment Quantity USD 200,000 Incremental Quantity USD 1,000 Issue Size 445,186,000 Announcement Date 31 Aug 2017 Issue Date 08 Sep 2017 Maturity Date 08 Sep 2022 Years to Maturity 1.486 Issue/Reoffer Price 100.000 Bond Credit Rating (S&P/Fitch) N.R/ N.RO Issuer Credit Rating (S&P/ Fitch) N.R/ N.R Exchange Listed HKEX Seniority Senior Unsecured Sukuk Investing Conventional

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

I A highyield corporate bond is a type of corporate bond that offers a higher ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started