Refer to the Connected Home Case(black oak is a VC wanting to invest Connected Home) Based on the simulation results, are Black Oak and the Founders better off implementing the mixed strategy as portrayed in the simulation, or the internet only strategy as assessed by Black Oak on Exhibit 7 of the case? If you were a Founder, how would you use the data to negotiate with Black Oak?

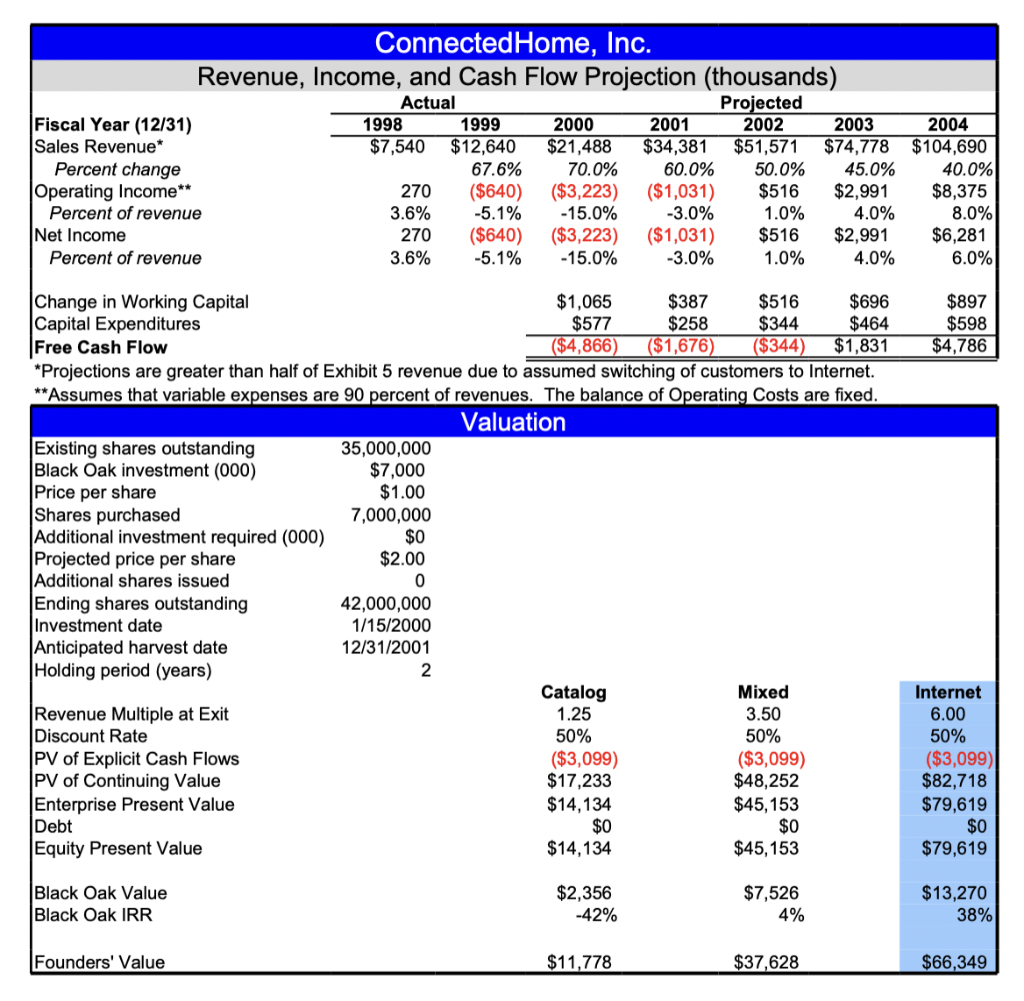

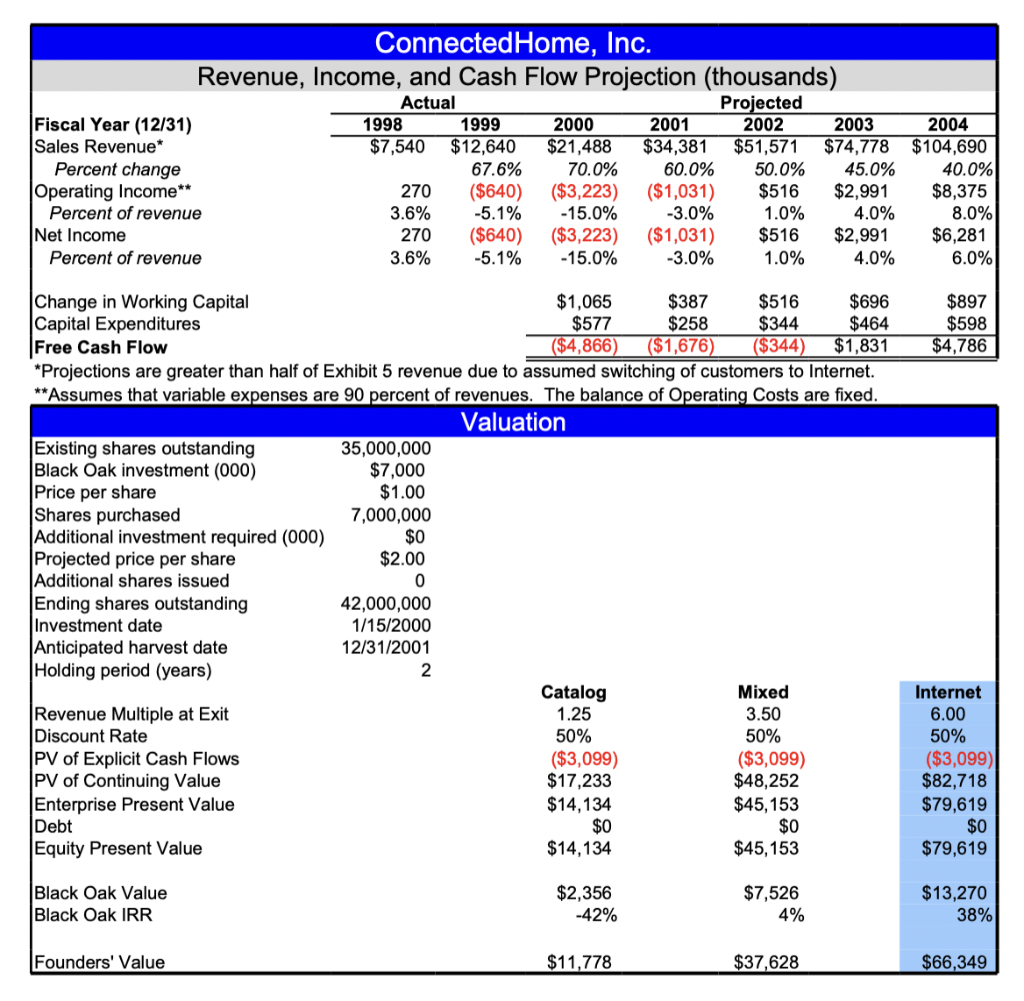

Connected Home, Inc. Revenue, Income, and Cash Flow Projection (thousands) Actual Projected Fiscal Year (12/31) 1998 1999 2000 2001 2002 2003 2004 Sales Revenue* $7,540 $12,640 $21,488 $34,381 $51,571 $74,778 $104,690 Percent change 67.6% 70.0% 60.0% 50.0% 45.0% 40.0% Operating Income** 270 ($640) ($3,223) ($1,031) $516 $2,991 $8,375 Percent of revenue 3.6% -5.1% -15.0% -3.0% 1.0% 4.0% 8.0% Net Income 270 ($640) ($3,223) ($1,031) $516 $2,991 $6,281 Percent of revenue 3.6% -5.1% -15.0% -3.0% 1.0% 4.0% 6.0% $897 $598 $4,786 Change in Working Capital $1,065 $387 $516 $696 Capital Expenditures $577 $258 $344 $464 Free Cash Flow ($4,866) ($1,676) ($344) $1,831 * Projections are greater than half of Exhibit 5 revenue due to assumed switching of customers to Internet. **Assumes that variable expenses are 90 percent of revenues. The balance of Operating costs are fixed. Valuation Existing shares outstanding 35,000,000 Black Oak investment (000) $7,000 Price per share $1.00 Shares purchased 7,000,000 Additional investment required (000) $0 Projected price per share $2.00 Additional shares issued 0 Ending shares outstanding 42,000,000 Investment date 1/15/2000 Anticipated harvest date 12/31/2001 Holding period (years) 2 Catalog Mixed Revenue Multiple at Exit 1.25 3.50 Discount Rate 50% 50% PV of Explicit Cash Flows ($3,099) ($3,099) PV of Continuing Value $17,233 $48,252 Enterprise Present Value $14,134 $45,153 Debt $0 $0 Equity Present Value $14,134 $45,153 Internet 6.00 50% ($3,099) $82,718 $79,619 $0 $79,619 Black Oak Value Black Oak IRR $2,356 -42% $7,526 4% $13,270 38% Founders' Value $11,778 $37,628 $66,349 Connected Home, Inc. Revenue, Income, and Cash Flow Projection (thousands) Actual Projected Fiscal Year (12/31) 1998 1999 2000 2001 2002 2003 2004 Sales Revenue* $7,540 $12,640 $21,488 $34,381 $51,571 $74,778 $104,690 Percent change 67.6% 70.0% 60.0% 50.0% 45.0% 40.0% Operating Income** 270 ($640) ($3,223) ($1,031) $516 $2,991 $8,375 Percent of revenue 3.6% -5.1% -15.0% -3.0% 1.0% 4.0% 8.0% Net Income 270 ($640) ($3,223) ($1,031) $516 $2,991 $6,281 Percent of revenue 3.6% -5.1% -15.0% -3.0% 1.0% 4.0% 6.0% $897 $598 $4,786 Change in Working Capital $1,065 $387 $516 $696 Capital Expenditures $577 $258 $344 $464 Free Cash Flow ($4,866) ($1,676) ($344) $1,831 * Projections are greater than half of Exhibit 5 revenue due to assumed switching of customers to Internet. **Assumes that variable expenses are 90 percent of revenues. The balance of Operating costs are fixed. Valuation Existing shares outstanding 35,000,000 Black Oak investment (000) $7,000 Price per share $1.00 Shares purchased 7,000,000 Additional investment required (000) $0 Projected price per share $2.00 Additional shares issued 0 Ending shares outstanding 42,000,000 Investment date 1/15/2000 Anticipated harvest date 12/31/2001 Holding period (years) 2 Catalog Mixed Revenue Multiple at Exit 1.25 3.50 Discount Rate 50% 50% PV of Explicit Cash Flows ($3,099) ($3,099) PV of Continuing Value $17,233 $48,252 Enterprise Present Value $14,134 $45,153 Debt $0 $0 Equity Present Value $14,134 $45,153 Internet 6.00 50% ($3,099) $82,718 $79,619 $0 $79,619 Black Oak Value Black Oak IRR $2,356 -42% $7,526 4% $13,270 38% Founders' Value $11,778 $37,628 $66,349