Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Refer to the data in P9. In P9. Naib Company engaged in the following transactions in July 2014: July 1 Sold merchandise to Lina

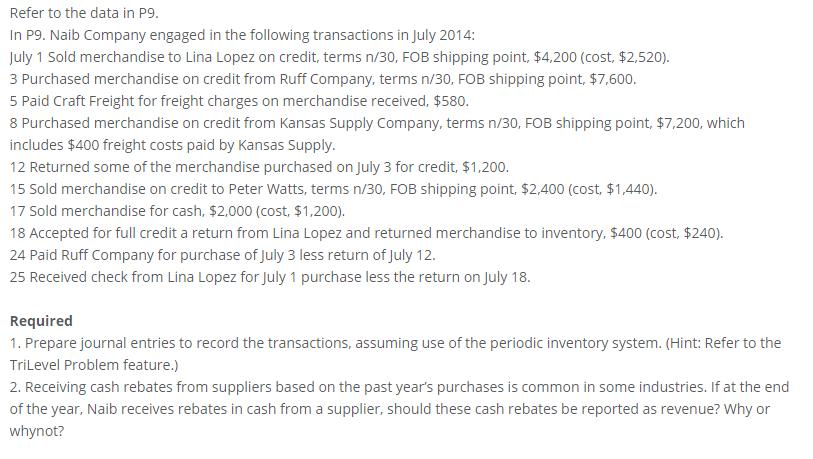

Refer to the data in P9. In P9. Naib Company engaged in the following transactions in July 2014: July 1 Sold merchandise to Lina Lopez on credit, terms n/30, FOB shipping point, $4,200 (cost, $2,520). 3 Purchased merchandise on credit from Ruff Company, terms n/30, FOB shipping point, $7,600. 5 Paid Craft Freight for freight charges on merchandise received, $580. 8 Purchased merchandise on credit from Kansas Supply Company, terms n/30, FOB shipping point, $7,200, which includes $400 freight costs paid by Kansas Supply. 12 Returned some of the merchandise purchased on july 3 for credit, $1,200. 15 Sold merchandise on credit to Peter Watts, terms n/30, FOB shipping point, $2,400 (cost, $1,440). 17 Sold merchandise for cash, $2,000 (cost, $1,200). 18 Accepted for full credit a return from Lina Lopez and returned merchandise to inventory, $400 (cost, $240). 24 Paid Ruff Company for purchase of July 3 less return of July 12. 25 Received check from Lina Lopez for July 1 purchase less the return on July 18. Required 1. Prepare journal entries to record the transactions, assuming use of the periodic inventory system. (Hint: Refer to the TriLevel Problem feature.) 2. Receiving cash rebates from suppliers based on the past year's purchases is common in some industries. If at the end of the year, Naib receives rebates in cash from a supplier, should these cash rebates be reported as revenue? Why or whynot?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Prepare journal entries to record the transactions of CompanyN assuming periodi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started