Answered step by step

Verified Expert Solution

Question

1 Approved Answer

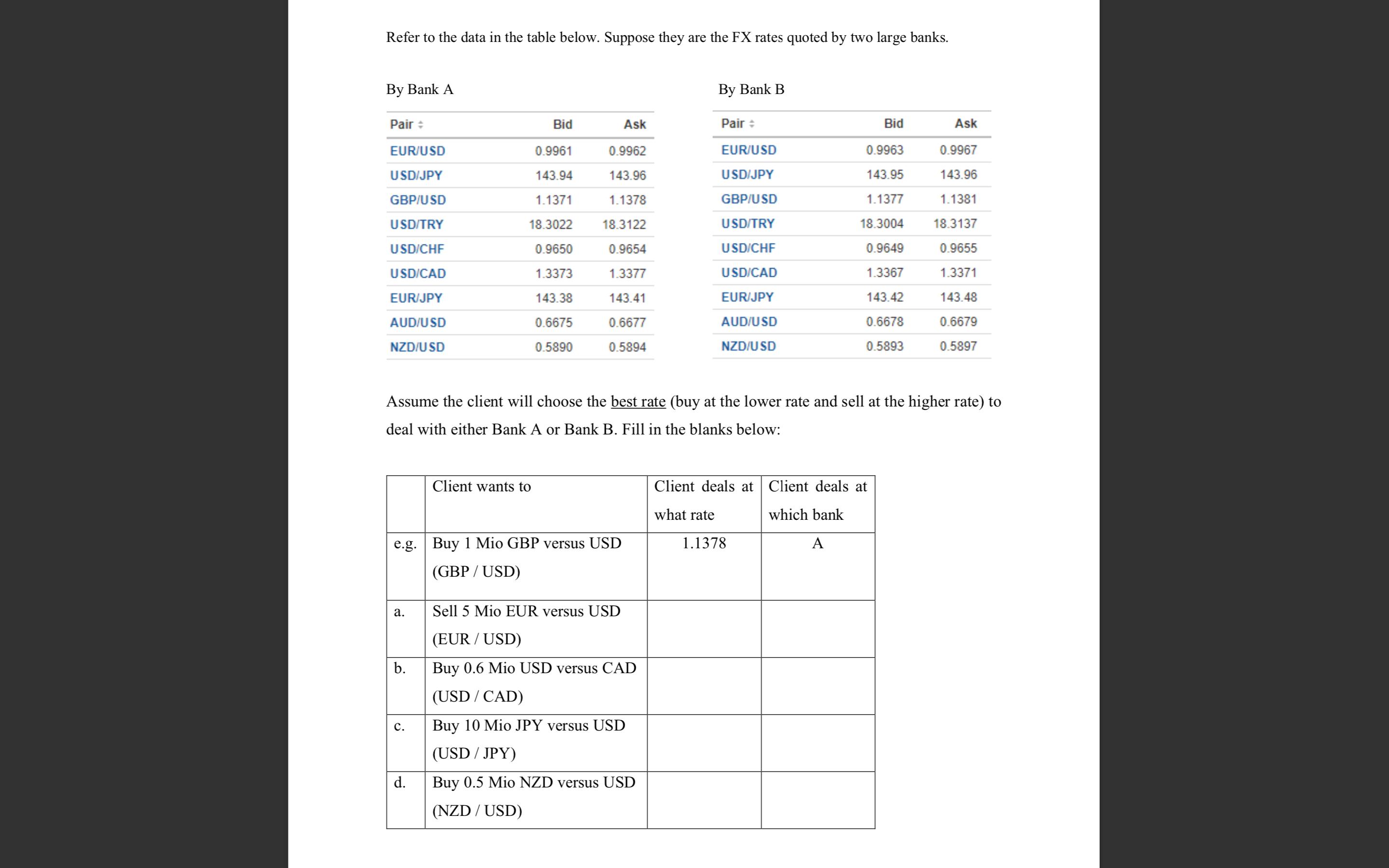

Refer to the data in the table below. Suppose they are the FX rates quoted by two large banks. By Bank A Pair +

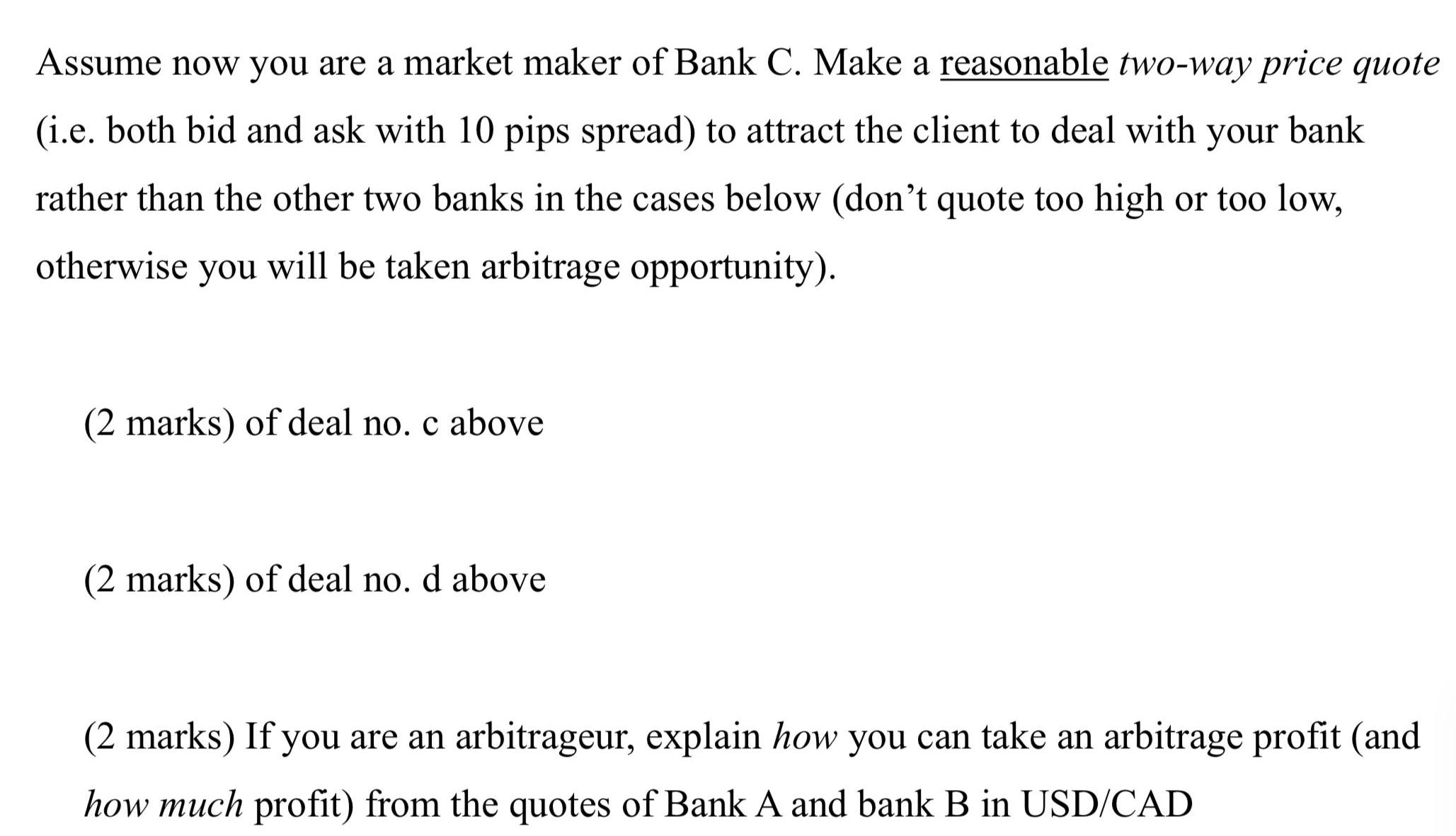

Refer to the data in the table below. Suppose they are the FX rates quoted by two large banks. By Bank A Pair + EUR/USD USD/JPY GBP/USD USD/TRY USD/CHF USD/CAD EUR/JPY AUD/USD NZD/USD a. b. Bid 0.9961 143.94 1.1371 18.3022 0.9650 1.3373 143.38 0.6675 0.5890 e.g. Buy 1 Mio GBP versus USD (GBP/USD) C. d. Client wants to Ask 0.9962 143.96 1.1378 18.3122 0.9654 1.3377 143.41 0.6677 0.5894 Assume the client will choose the best rate (buy at the lower rate and sell at the higher rate) to deal with either Bank A or Bank B. Fill in the blanks below: By Bank B Pair + EUR/USD USD/JPY GBP/USD USD/TRY USD/CHF USD/CAD EUR/JPY AUD/USD NZD/USD Sell 5 Mio EUR versus USD (EUR/USD) Buy 0.6 Mio USD versus CAD (USD/CAD) Buy 10 Mio JPY versus USD (USD/JPY) Buy 0.5 Mio NZD versus USD (NZD / USD) Bid 0.9963 143.95 1.1377 18.3004 0.9649 1.3367 143.42 0.6678 0.5893 Client deals at Client deals at what rate which bank A 1.1378 Ask 0.9967 143.96 1.1381 18.3137 0.9655 1.3371 143.48 0.6679 0.5897 Assume now you are a market maker of Bank C. Make a reasonable two-way price quote (i.e. both bid and ask with 10 pips spread) to attract the client to deal with your bank rather than the other two banks in the cases below (don't quote too high or too low, otherwise you will be taken arbitrage opportunity). (2 marks) of deal no. c above (2 marks) of deal no. d above (2 marks) If you are an arbitrageur, explain how you can take an arbitrage profit (and how much profit) from the quotes of Bank A and bank B in USD/CAD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started