Answered step by step

Verified Expert Solution

Question

1 Approved Answer

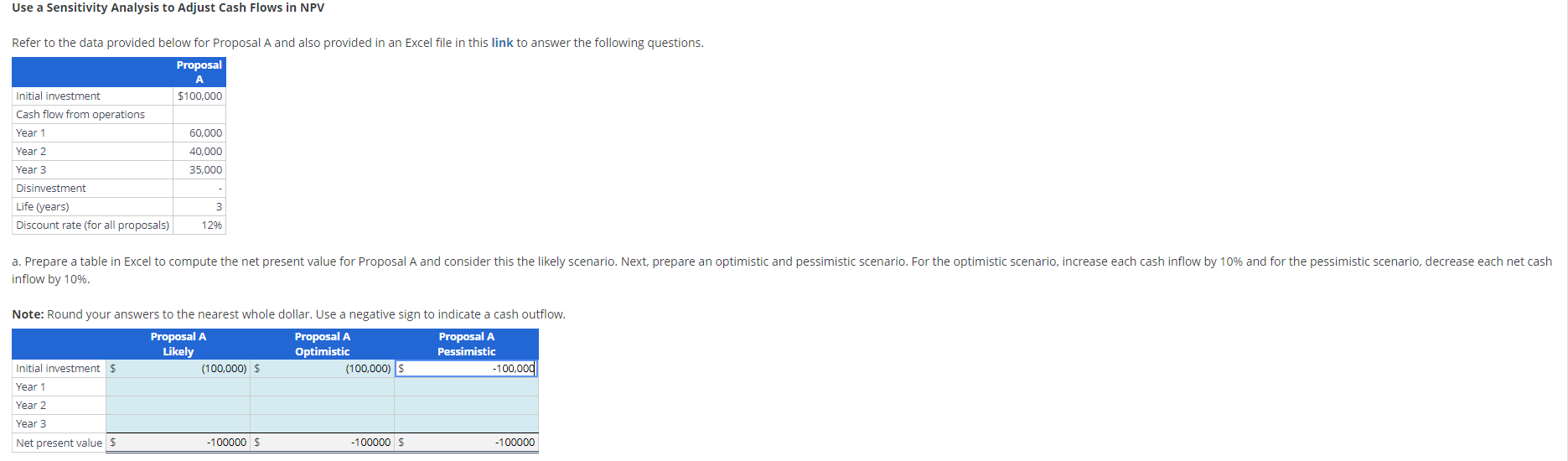

Refer to the data provided below for Proposal A below and answer the following questions. Proposal A Initial investment $ 1 0 0 , 0

Refer to the data provided below for Proposal A below and answer the following questions.

Proposal A

Initial investment $

Cash flow from operations

Year

Year

Year

Disinvestment

Life years

Discount rate for all proposals

Compute the net present value for Proposal A and consider this the likely scenario. Next, prepare an optimistic and pessimistic scenario. For the optimistic scenario, increase each cash inflow by and for the pessimistic scenario, decrease each net cash inflow by

Note: Round your answers to the nearest whole dollar. Use a negative sign to indicate a cash outflow.

Use a Sensitivity Analysis to Adjust Cash Flows in NPV

Refer to the data provided below for Proposal A and also provided in an Excel file in this link to answer the following questions.

tableProposalInitial investment,$Cash flow from operations,Year Year Year DisinvestmentLife yearsDiscount rate for all proposals

inflow by

Note: Round your answers to the nearest whole dollar. Use a negative sign to indicate a cash outflow.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started