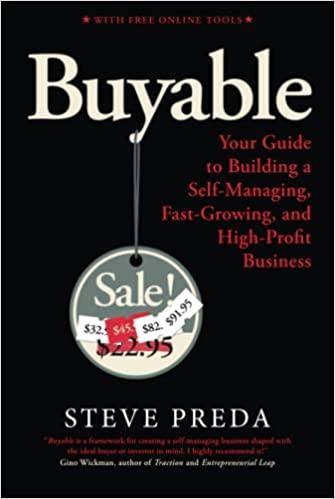

Refer to the Exhibit 21-6 in page 752 which is attached. This example is related to Top-Spin Company. The Excel sheet shows the relevant cash flows which are the differences in expected future cash flows that will result from continuing to use the old technology and updating its technology.

Here is the question: This excel sheet is incomplete to make decision to keep using the current technology or to update it, figure out what is missing then prepare complete excel sheet in order to help the management to make decision.show your calculation.

The doctor want us to define if it is beneficial to updates the technology or not by defining the NPV?

the chart below is what we need to define to extract NPV.

| Nominal discount rate |

| PV Discount rate 8% from the book |

| Annual after-tax cash flow from |

| operations. Exclud depreciation. |

| Income tax cash savings from |

| annual depreciation deduction |

| After-tax cash flow from recovery |

| of working capital |

| Total relevant cash flows |

| Discount rate |

to see if it is beneficial to updates the technology or not by defining the NPV?

it is preferable if you are able to format the excel sheet to do calculation for you.

752 . CHAPTER 21 CAPITAL BUDGETING AND COST ANWLYSIS Categories of Cash Flows A capital investment project typically has three categories of cash flows: (1) net initial investment in the project, which includes the acquisition of assets and any associated addi tions to working capital, minus the after-tax cash flow from the disposal of existing assets; (2) after-tax cash flow from operations (including income tax ensh savings from annual depreciation deductions); and (3) after tax cash flow from tcrminal disposal of an asset and recovery of working capital. We use the Top-Spin example to discuss these three categories As you work through the cash flows in each category, refer to Exhibit 21-6. This exhibit sketches the relevant cash flows for Top-Spin's decision to purchase the new machine as described in items 1 through 3 here. Note that the total relevant cash flows for cach year equal the relevant cash flows used in Exhibits 21-2 and 21-3 to illustrate the NPV and IRR methods. NACIO 1. Net Initial Investment. Three components of net-inicial-investinent cash flows are a) cash outflow to purchase the machine, (b) cash outflow for working capiral, and (c) after-tax cash inflow from current disposal of the old machine. 1a. Initial machine investment. These outflows, made for purchasing plant and equipment, accur at the beginning of the project's life and include cash outflows and installing the equipment. In the Top-Spin example, the machine is an outflow in year. These cash flows are relevant to the capital 29,000 cost including transportation and installation of the carbon-fiber budgeting decision because they will be incurred only if Top-Spin decides tour- chase the new machine. 1b. Initial working-capital imestment. Initial investments in plant and equipment are usually accompanied by addicional investments in working capital. These addi- tional investments take the form of current assets, such as accounts receivable and inventories, minus current liabilities, such as accounts payable. Working-capital investments are similar to plant and equipment investments in that they require cash. The magnitude of the investment generally increases as a function of the level of additional sales generated by the project. However, the exact relationship vanes based on the nature of the project and the operating cycle of the industry. transporting and Exhibit216 Relevant Cash Inflows and Outflows for Top-Spin's Carbon-Fiber Machine H Dit Review View D Sketch of Relevant Cash Flows at End of Year 0 2 3 4 S(390,000) (9.000) 11 19.900 (379,100) Homerisert Page Layou!!! Worms B 1 22 3 1a. Initial machine investment 41b. Initial working capital investment 51c, After-tax cash flow from cutrent disposal 6 of old machine 17 Net initial investment B 2a. Annual after-tax cash flow from operations 19 (excluding the depreciation effect) 10 2b. Income tax cash savings from annual 11 depreciation deductions 12 3a. After-tax cash flow from terminal disposal 13 of machine 14 3b After-lax cash flow from recovery of 15 working capital 16 Total (elevant cash flows 117 as shown in Exhibits 21-2 and 21-3 18 S 72,000 IS 72.000 $ 72,000 $ 72,000 $ 63,000 28,000 28,000 28,000 28,000 28,000 9,000 $(379,100) $ 100,000 $100,000 $100,000 $100.000 $100,000 752 . CHAPTER 21 CAPITAL BUDGETING AND COST ANWLYSIS Categories of Cash Flows A capital investment project typically has three categories of cash flows: (1) net initial investment in the project, which includes the acquisition of assets and any associated addi tions to working capital, minus the after-tax cash flow from the disposal of existing assets; (2) after-tax cash flow from operations (including income tax ensh savings from annual depreciation deductions); and (3) after tax cash flow from tcrminal disposal of an asset and recovery of working capital. We use the Top-Spin example to discuss these three categories As you work through the cash flows in each category, refer to Exhibit 21-6. This exhibit sketches the relevant cash flows for Top-Spin's decision to purchase the new machine as described in items 1 through 3 here. Note that the total relevant cash flows for cach year equal the relevant cash flows used in Exhibits 21-2 and 21-3 to illustrate the NPV and IRR methods. NACIO 1. Net Initial Investment. Three components of net-inicial-investinent cash flows are a) cash outflow to purchase the machine, (b) cash outflow for working capiral, and (c) after-tax cash inflow from current disposal of the old machine. 1a. Initial machine investment. These outflows, made for purchasing plant and equipment, accur at the beginning of the project's life and include cash outflows and installing the equipment. In the Top-Spin example, the machine is an outflow in year. These cash flows are relevant to the capital 29,000 cost including transportation and installation of the carbon-fiber budgeting decision because they will be incurred only if Top-Spin decides tour- chase the new machine. 1b. Initial working-capital imestment. Initial investments in plant and equipment are usually accompanied by addicional investments in working capital. These addi- tional investments take the form of current assets, such as accounts receivable and inventories, minus current liabilities, such as accounts payable. Working-capital investments are similar to plant and equipment investments in that they require cash. The magnitude of the investment generally increases as a function of the level of additional sales generated by the project. However, the exact relationship vanes based on the nature of the project and the operating cycle of the industry. transporting and Exhibit216 Relevant Cash Inflows and Outflows for Top-Spin's Carbon-Fiber Machine H Dit Review View D Sketch of Relevant Cash Flows at End of Year 0 2 3 4 S(390,000) (9.000) 11 19.900 (379,100) Homerisert Page Layou!!! Worms B 1 22 3 1a. Initial machine investment 41b. Initial working capital investment 51c, After-tax cash flow from cutrent disposal 6 of old machine 17 Net initial investment B 2a. Annual after-tax cash flow from operations 19 (excluding the depreciation effect) 10 2b. Income tax cash savings from annual 11 depreciation deductions 12 3a. After-tax cash flow from terminal disposal 13 of machine 14 3b After-lax cash flow from recovery of 15 working capital 16 Total (elevant cash flows 117 as shown in Exhibits 21-2 and 21-3 18 S 72,000 IS 72.000 $ 72,000 $ 72,000 $ 63,000 28,000 28,000 28,000 28,000 28,000 9,000 $(379,100) $ 100,000 $100,000 $100,000 $100.000 $100,000